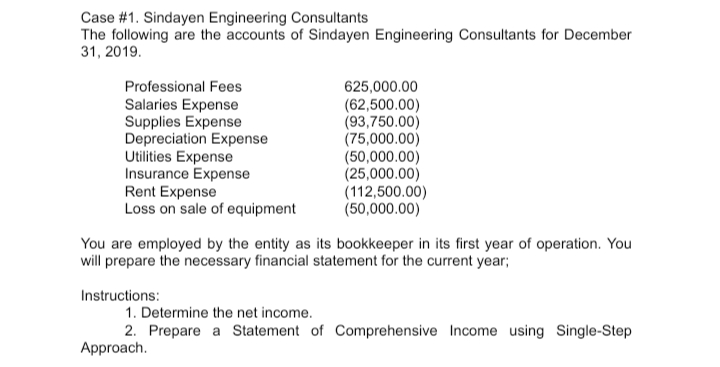

Case #1. Sindayen Engineering Consultants The following are the accounts of Sindayen Engineering Consultants for December 31, 2019. Professional Fees 625,000.00 Salaries Expense Supplies Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Loss on sale of equipment (62,500.00) (93,750.00) (75,000.00) (50,000.00) (25,000.00) (112,500.00) (50,000.00) You are employed by the entity as its bookkeeper in its first year of operation. You will prepare the necessary financial statement for the current year; Instructions: 1. Determine the net income. 2. Prepare a Statement of Comprehensive Income using Single-Step Approach.

Case #1. Sindayen Engineering Consultants The following are the accounts of Sindayen Engineering Consultants for December 31, 2019. Professional Fees 625,000.00 Salaries Expense Supplies Expense Depreciation Expense Utilities Expense Insurance Expense Rent Expense Loss on sale of equipment (62,500.00) (93,750.00) (75,000.00) (50,000.00) (25,000.00) (112,500.00) (50,000.00) You are employed by the entity as its bookkeeper in its first year of operation. You will prepare the necessary financial statement for the current year; Instructions: 1. Determine the net income. 2. Prepare a Statement of Comprehensive Income using Single-Step Approach.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8RE: At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a...

Related questions

Question

Prepare the Statement of Comprehensive Income

Transcribed Image Text:Case #1. Sindayen Engineering Consultants

The following are the accounts of Sindayen Engineering Consultants for December

31, 2019.

Professional Fees

Salaries Expense

Supplies Expense

Depreciation Expense

Utilities Expense

Insurance Expense

Rent Expense

Loss on sale of equipment

625,000.00

(62,500.00)

(93,750.00)

(75,000.00)

(50,000.00)

(25,000.00)

(112,500.00)

(50,000.00)

You are employed by the entity as its bookkeeper in its first year of operation. You

will prepare the necessary financial statement for the current year;

Instructions:

1. Determine the net income.

2. Prepare a Statement of Comprehensive Income using Single-Step

Approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning