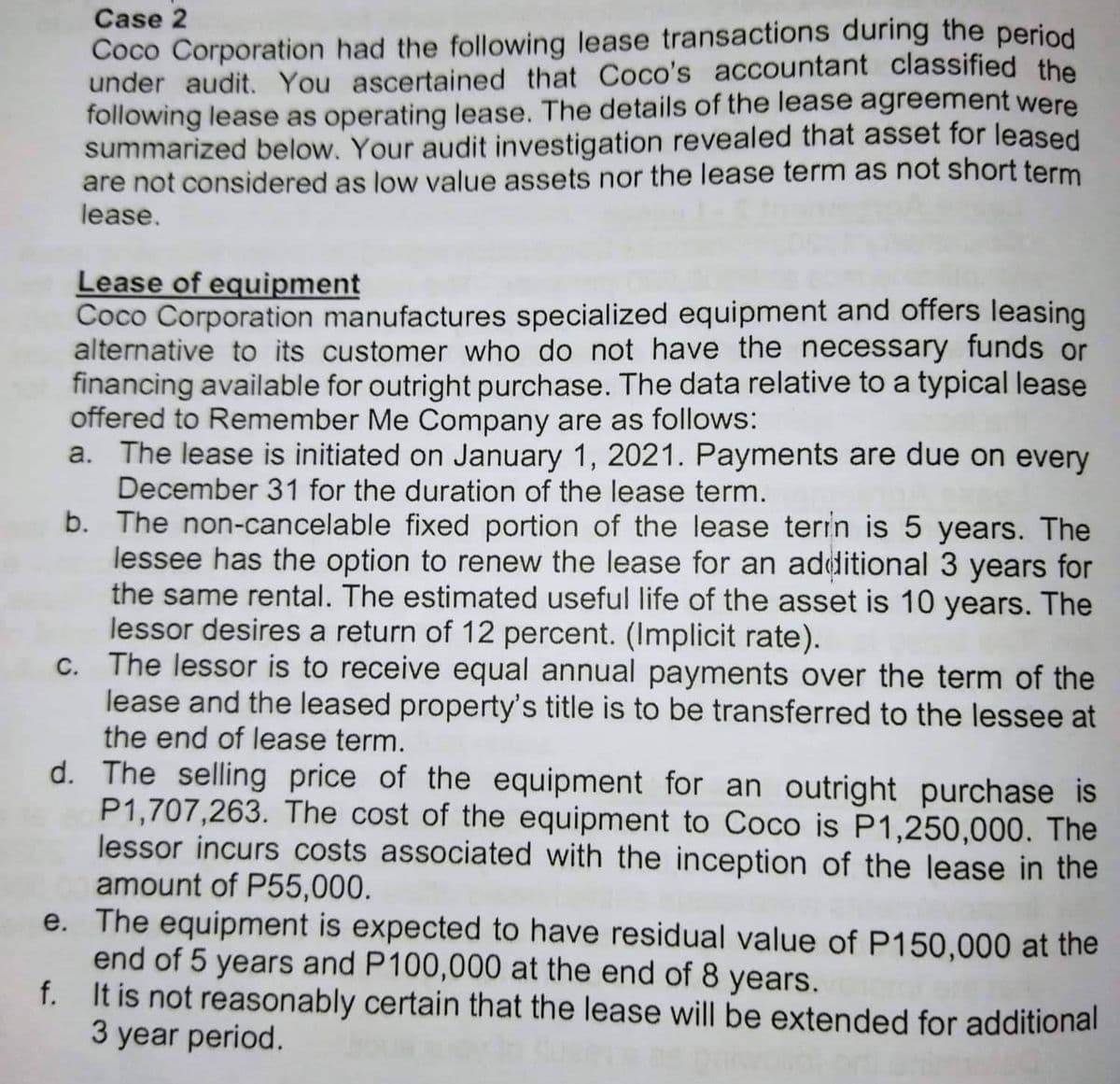

Case 2 Coco Corporation had the following lease transactions during the period under audit. You ascertained that Coco's accountant classified the following lease as operating lease. The details of the lease agreement were summarized below. Your audit investigation revealed that asset for leased are not considered as low value assets nor the lease term as not short term lease. Lease of equipment Coco Corporation manufactures specialized equipment and offers leasing alternative to its customer who do not have the necessary funds or financing available for outright purchase. The data relative to a typical lease offered to Remember Me Company are as follows: a. The lease is initiated on January 1, 2021. Payments are due on every December 31 for the duration of the lease term. b. The non-cancelable fixed portion of the lease terin is 5 years. The lessee has the option to renew the lease for an additional 3 years for the same rental. The estimated useful life of the asset is 10 years. The lessor desires a return of 12 percent. (Implicit rate). c. The lessor is to receive equal annual payments over the term of the lease and the leased property's title is to be transferred to the lessee at the end of lease term. d. The selling price of the equipment for an outright purchase is P1,707,263. The cost of the equipment to Coco is P1,250,000. The lessor incurs costs associated with the inception of the lease in the amount of P55,000. e. The equipment is expected to have residual value of P150,000 at the end of 5 years and P100,000 at the end of 8 years. f. It is not reasonably certain that the lease will be extended for additional 3 year period.

Case 2 Coco Corporation had the following lease transactions during the period under audit. You ascertained that Coco's accountant classified the following lease as operating lease. The details of the lease agreement were summarized below. Your audit investigation revealed that asset for leased are not considered as low value assets nor the lease term as not short term lease. Lease of equipment Coco Corporation manufactures specialized equipment and offers leasing alternative to its customer who do not have the necessary funds or financing available for outright purchase. The data relative to a typical lease offered to Remember Me Company are as follows: a. The lease is initiated on January 1, 2021. Payments are due on every December 31 for the duration of the lease term. b. The non-cancelable fixed portion of the lease terin is 5 years. The lessee has the option to renew the lease for an additional 3 years for the same rental. The estimated useful life of the asset is 10 years. The lessor desires a return of 12 percent. (Implicit rate). c. The lessor is to receive equal annual payments over the term of the lease and the leased property's title is to be transferred to the lessee at the end of lease term. d. The selling price of the equipment for an outright purchase is P1,707,263. The cost of the equipment to Coco is P1,250,000. The lessor incurs costs associated with the inception of the lease in the amount of P55,000. e. The equipment is expected to have residual value of P150,000 at the end of 5 years and P100,000 at the end of 8 years. f. It is not reasonably certain that the lease will be extended for additional 3 year period.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

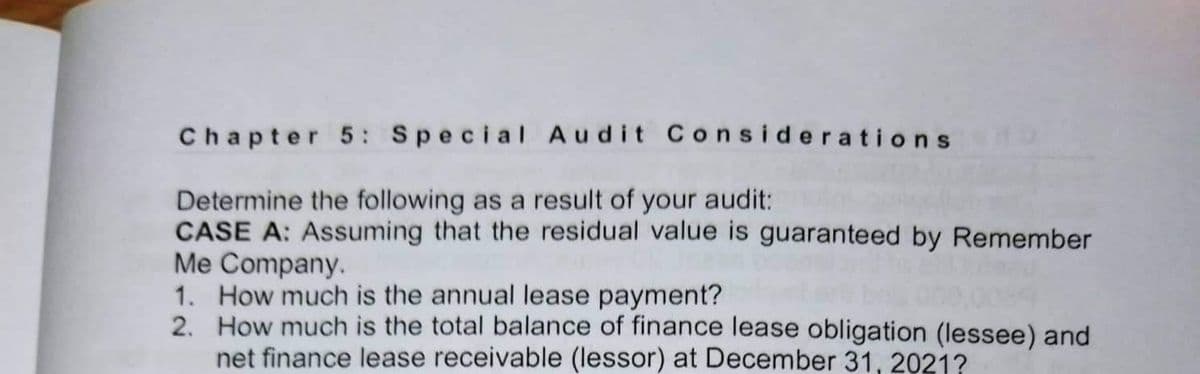

Transcribed Image Text:Chapter 5: Special Audit Considerations

Determine the following as a result of your audit:

CASE A: Assuming that the residual value is guaranteed by Remember

Me Company.

1. How much is the annual lease payment?

2.

How much is the total balance of finance lease obligation (lessee) and

net finance lease receivable (lessor) at December 31, 2021?

Transcribed Image Text:Case 2

Coco Corporation had the following lease transactions during the period

under audit. You ascertained that Coco's accountant classified the

following lease as operating lease. The details of the lease agreement were

summarized below. Your audit investigation revealed that asset for leased

are not considered as low value assets nor the lease term as not short term

lease.

Lease of equipment

Coco Corporation manufactures specialized equipment and offers leasing

alternative to its customer who do not have the necessary funds or

financing available for outright purchase. The data relative to a typical lease

offered to Remember Me Company are as follows:

a. The lease is initiated on January 1, 2021. Payments are due on every

December 31 for the duration of the lease term.

b. The non-cancelable fixed portion of the lease terin is 5 years. The

lessee has the option to renew the lease for an additional 3 years for

the same rental. The estimated useful life of the asset is 10 years. The

lessor desires a return of 12 percent. (Implicit rate).

c. The lessor is to receive equal annual payments over the term of the

lease and the leased property's title is to be transferred to the lessee at

the end of lease term.

d. The selling price of the equipment for an outright purchase is

P1,707,263. The cost of the equipment to Coco is P1,250,000. The

lessor incurs costs associated with the inception of the lease in the

amount of P55,000.

e.

The equipment is expected to have residual value of P150,000 at the

end of 5 years and P100,000 at the end of 8 years.

f.

It is not reasonably certain that the lease will be extended for additional

3 year period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education