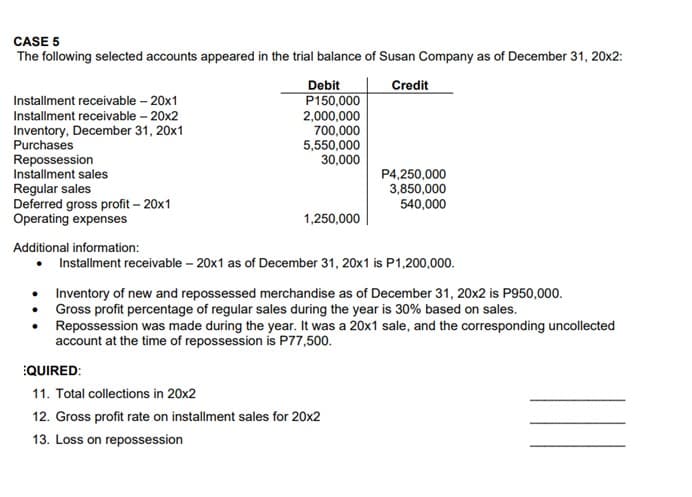

CASE 5 The following selected accounts appeared in the trial balance of Susan Company as of December 31 Debit Credit P150,000 2,000,000 Installment receivable - 20x1 Installment receivable - 20x2 Inventory, December 31, 20x1 Purchases 700,000 5,550,000 Repossession 30,000 Installment sales P4,250,000 Regular sales 3,850,000 540,000 Deferred gross profit - 20x1 Operating expenses 1,250,000

Q: The following information relates to production activities of Mercer Manufacturing for the year.…

A: Direct Material Price Variance (SP − AP) × AQ Direct materials quantity variance =…

Q: According to AASB 10/IFRS 10 Consolidated Financial Statements, a non-controlling interest is…

A: Non-controlling interest:- It is the minority interest where a shareholder owns less than 50% of the…

Q: Adjustment for accrued revenue requires a/an choose correct answer a. decrease liabilities…

A: Lets understand the basics. Adjustment entry is required to make to record correct amount of revenue…

Q: What is Richard's net pay for the week if he earns $1,200? (Use Table 9.1 and Table 9.2). (Round…

A: Introduction: Net pay is the amount they receive after all payroll taxes have been reduced from…

Q: 2.3 Bookkeeping systems - How do you record your cash sales and other money received in your…

A: As per rule we provide solution to the first three-subparts or one question only and you have asked…

Q: A company has two service departments (S1 and S2) and two production departments (P1 and P2).…

A: Here discuss about the details of the allocation of cost to the different service department and its…

Q: a. How much is the depletion charge in 2022? b. Assuming that of the 300,000 ounces of gold…

A: Depletion refers to the reducing in the value of natural resources of the earth from extraction of…

Q: Insurance of last year in adjustment where to adjust that insurance?

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: 17. Bahati Zuri obtained an installment loan for $25,000 so he could be a partner in a new…

A: Interest = net loan * 9%* 36/12

Q: Information related to Burns Iron Works appears below. What is the ending balance in the finished…

A: Cost of goods sold is calculated by following formula: Cost of goods sold = Beginning finished goods…

Q: 3

A: The debt-to-income ratio (DTI) compares your monthly debt payments to your monthly income. It's the…

Q: Following emoluments are received by Ms Sangeeta during the previous year ended on 31.3.2021 Basic…

A: Direct taxation seems to be a sort of direct tax placed on an individual's earnings. In India,…

Q: Business tran saction Jan 1 started business with RM 20000 cash. 2 Purchased furniture worth RM 5000…

A: A profit and loss statement is a summary of a company's revenue and expenses for a given period of…

Q: Cost of Goods Sold is increasing at rate that does not match sales or gross profit. While sales and…

A: The gross profit is calculated by deducting the cost f goods sold from the sales revenues of the…

Q: ind time to replace the machine.

A:

Q: 1. is the basic pay in an employee's compensation package wherein the amount of money the employee…

A: As per our guidelines we are supposed to answer only 4 parts maximum. kindly ask remaining parts as…

Q: The net realizable value of account receivable at year end shall be

A: Net realizable value of accounts receivables are the net amount which has computed by the company…

Q: One, Two and Three were partners with capital balances on January 2, 20x10 of P100,000; P150,000 and…

A: Under bonus method ,excess payment to retiring partner bear by existing partner. In this case…

Q: Information related to Scullio Manufacturing appears below. What is the ending balance in the…

A: A cost sheet is a method of allocating total costs into different categories. It helps to identify…

Q: 2. ABC Company placed an order on December 1. It normally receives the order after 9 days. If the…

A: Re-order Point: - It is the point when a company has to place an order re-stock. Given: - Lead time=…

Q: The spreadsheet is O a. used to aid in preparing financial statements. O b. used to determine net…

A: Spreadsheet is generally used to prepare the financial statements. it is done after recording…

Q: Assume that in September, Joplin Designs customers actually return $150,000 of inventory. Using the…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: The predetermined factory overhead rate is: Multiple Choice 212% of direct labor costs.…

A: Introduction: Direct labor cost is one of the most important components of major organizational…

Q: Which of the following is generally true about the differences between U.S. GAAP and IFRS? a. More…

A: US GAAP and IFRS are the two different financial reporting standards which have different standards…

Q: 1.Materials are issued from the storeroom to production based on a form called the ________.…

A: 1. Materials are issued from the storeroom to production based on a form called the ________. Ans.…

Q: The market flex provision in an underwriting/syndication agreement means that the underwriter/lead…

A: The provisions which give the underwriter or the syndicate or the arrangers some amount of the…

Q: Stan and Sylvia are each 22 years old, and not married. Sylvia is 8+ months pregnant with their…

A: Taxes in the US differ if a couple is married and files the tax return jointly and if an individual,…

Q: ABC Company has a policy of maintaining an inventory of finished goods equal to 25% of the following…

A: Units available for sale = Units sold during period + ending inventory

Q: raham Corporation used the following data to evaluate its current operating system. The company…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Cash Accounts Receivable Prepaid Insurance Equipment Accounts Payable Unearned Rent Carmen Meeks,…

A: The trial balance is prepared to record the final balance of each account and further it is used to…

Q: 3. Compute the direct labor variance, including its rate and efficiency variances. (Indicate the…

A: The variance arises when the actual performance is not as per the targeted performance. The same…

Q: how the requisite journal entries to correct the balance.

A: Here to made the correction entry to clear the suspense account which was incurred shortage due to…

Q: paration time, rest

A: The labors whose are slow, lazy , does not do work with full efficiency or the fresh labors will be…

Q: How much is the total capital gains tax due?

A: Introduction: Any profit or money gained by the character from the sale of a capital asset is…

Q: Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual…

A: Formulas: Interest amount = Notes amount x Interest rate x Time period

Q: Credit sales P6,000,000 Cash sales 1,000,000 Collection from customers 5,600,000 Cash purchases…

A: Purchases under the cash basis is purchases that have been paid for during the year It includes cash…

Q: bills. In which of the following scenarios is the money withdrawn from the Roth IRA considered a…

A: The answer for the multiple choice question and relevant explanation are presented hereunder : What…

Q: Learning CurveBordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems…

A: Introduction; Direct labor, the wages and expenses provided to employees who can be directly…

Q: The Johnson's Company had net income(after tax) = 500,000 USD, Johnson's Company's income statement…

A: Formula: Times interest earned = EBIT / Interest expense

Q: The materials account in the general ledger is a control account; a separate account for each type…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC…

A: Given, Beginning inventory = $50,000 Total material {Direct + Indirect} purchased = $90,000 Total…

Q: Happy Selling's had the following accounts atyear end: Cash-250,000, Accounts Payable-70,000,…

A: The current assets are the assets which can be converted into cash within one year. For example,…

Q: You are considering a luxury apartment building project that requires an investment of $15,000,000.…

A: Answer:- Return on investment meaning:- The ratio of net income to investment is generally known as…

Q: The management of Sheridan Company is trying to decide whether it can increase its dividend. During…

A: Formula used: Company's free cash flow = Net cash provided by operating activities - Dividends paid…

Q: Industrious Inc. disclosed the following information: Accounts payable, after deducting debit…

A: The accounts payable includes the balance due to suppliers or creditors of the business.

Q: How can a bank mitigate LIQUIDITY RISK? Hold a large percentage of its liabilities in Core Deposits…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: On December 27, 20x1, XYZ received a sales order for a credit sale of goods with selling price of…

A: given that, Selling price of goods = P45,000 Shippment cost = P4,500 Goods received by buyer = 2…

Q: List the three key benefits companies get from preparing a budget. The budget allows managers to be…

A: An estimate of income and expenditure for a set period of time is called budget.

Q: Antuan Company set the following standard costs per unit for its product. $ 12.00 Direct materials…

A: Detailed overhead variance report :-

Q: Show in tabular form (depreciation schedule) the computation for the depreciation expenses,…

A: Business organizations are required to charge the depreciation expense so as to show the fair value…

Step by step

Solved in 2 steps

- Allowance method Using transactions listed in £6-S. indicate the effects of each transaction on the liquidity metric days’ sales in receivables and profiability metric return on sales.Presented below is the December 31 trial balance of Metlock Boutique. METLOCK BOUTIQUETRIAL BALANCEDECEMBER 31DebitCreditCash $25,800 Accounts Receivable 32,700 Allowance for Doubtful Accounts $747Inventory, December 31 83,530 Prepaid Insurance 6,660 Equipment 98,000 Accumulated Depreciation—Equipment 38,000Notes Payable 28,790Common Stock 76,402Retained Earnings 9,760Sales Revenue 730,451Cost of Goods Sold 492,200 Salaries and Wages Expense (sales) 62,400 Advertising Expense 7,670 Salaries and Wages Expense (administrative) 69,810 Supplies Expense 5,380 $884,150$884,150 Prepare adjusting journal entries for the following. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) 1. Bad debt expense is estimated to be $1,306. 2. Equipment is depreciated based on a 7-year life (no salvage value). 3. Insurance expired during the year…3. The following is the trial balance of Aroro Enterprise as at 31 August 2019Particulars Debit (RM) Credit (RM)Capital 48,400Drawings 3,500Trade receivables 9,000Trade payables 12,500Sales 40,400Purchases 31,000Sales returns 300Purchases returns 250Wages and salaries 5,600Discounts allowed 120Discounts received 200Provision for doubtful debts 300Insurance 700Inventory as at 1 September 2018 2,400Utilities 950Rates 350Premises 10,000Fixtures and fittings 3,000Motor van 20,000Cash in hand 330Cash at bank 14,800TOTAL 102,050 102,050Additional information as at 31 August 2019:i. Inventory as at 31 August 2019 amounted RM3,300ii. An entity from whom there is accounts receivables of RM200 was unable tosettle his debt and this amount is to be written off as bad debts.iii. The provision for doubtful debts is 1% of the outstanding trade receivables.iv. The owner took RM100 worth of goods from the business for his own useRequired:a) Statement of Profit or Loss and Others Comprehensive Income…

- The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows:Dec. 31, 20Y2 Dec. 31, 20Y1AssetsCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 918,000 $ 964,800Accounts receivable (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 828,900 761,940Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,268,460 1,162,980Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,340 35,100Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315,900 479,700Buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,462,500 900,900Accumulated depreciation—buildings . . . . . . . . . . . . . . . . . . . . . . . . . . .…42.The following data were available for ABC Company, which uses perpetual system, at Dec 31, 20X2:Accounts Payable, beg P15,000Accounts Payable, end P10,000Inventory, beg P17,000Inventory, end P9,000Cash payment to creditors(net of 2% discount) 294,000Purchase returns, P5,000How much were the credit purchases during the period? 285,000 294,000 300,000 315,0001. Below is a trial balance of Ali Mamat Enterprise, extracted after one year’s trading.Ali Mamat EnterpriseTrial Balance as at 31 December 2019Particulars Debit (RM) Credit (RM)Sales 190,576Purchases 119,832Salaries 56,527Motor expenses 2,416Rent 1,894Insurance 372General expenses 85Premises 95,420Motor vehicles 16,594Account receivables 26,740Account payable 16,524Cash at bank 16,519Cash in hand 342Drawings 8,425Capital 138,066TOTAL 345,166 345,166Required: i. Statement of Profit or Loss and Others Comprehensive Income for the year ended 31 December 2019.ii. Statement of Financial Position as at 31 December 2019.

- The trial balance of Fuzzy Security Services Ltd. as of January 1, Year 9, had the following normal balances:Cash$93,380Petty Cash100Accounts receivable21,390Allowance for doubtful accounts2,485Supplies180Prepaid rent3,000Merchandise inventory (23 @ $280)6,440Equipment9,000Van27,000Accumulated depreciation14,900Salaries payable1,500Common stock50,000Retained earnings91,605During Year 9, Fuzzy Security Services experienced the following transactions:1. Paid the salaries payable from Year 8.2. Paid $9,000 on May 2, Year 9, for one year’s office rent in advance.3. Purchased $425 of supplies on account.4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase.5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable.6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.)7. Billed $107,000 of monitoring…The following items were excerpted from Poeltl, Inc.'s balance sheets: December 31, 2023December 31, 2022Cash$86,300$59,000Accounts receivable65,60070,600Inventory157,000150.300Property and equipment794,500745,400Accumulated depreciation(184,000)(168,200)Accounts payable61,00050,600Wages payable20,40023,000 Poeltl's 2023 income statement showed net income of $463,000, depreciation expense of $57,000, and a gain on disposal of equipment of $16,000. On Poeltl's 2023 statement of cash flows, how much is Net Cash Provided by Operating Activities?3. The following balances have been taken from the unadjusted trial balance of a tradingorganization for the year ended Dec. 31, 2020:Sales (All on credit) Rs. 650,000Sales Return and Allowance (All from credit sales) 20,000Sales Discount 10,000Accounts Receivable 430,000Allowance for bad debt (Cr.) 2000Required:Record and close bad debt expense for the year ended Dec. 31, 2020 under each of the followingassumptions separately:a. Allowance for bad debt was estimated @ 10% of accounts receivable.b. Bad debt expense was estimated @ 1.5% of net credit sales.

- Use the following adjusted trial balance to answer questions 22-25.Cash $ 6,530Accounts Receivable 2,450Prepaid Expenses 880Equipment 18,490Accounts Payable 1,800Loan Payable 10,600Owner’s Equity 12,940Fees Earned 9,750Marketing Expense 1,685Rent Expense 1,960Utilities Expense 345Wages Expense 2,750Totals $35,090 $35,09022. Net income for the period is:A. $9,750B. $6,530C. $3,010D. None of these23. Total assets on the balance sheet will be:A. $35,090B. $28,350C. $9,860D. None of these24. Total liabilities on the balance sheet will be:A. $1,800B. $10,600C. $25,340D. None of these25. Owner’s Equity on the balance sheet will be $12,940.A. TrueB. False24.The following data were available for ABC Trading, which uses perpetual system, at Dec 31, 20X2:Accounts Payable, beg P10,000Accounts Payable, end P8,000Inventory, beg P17,000Inventory, end P9,000Payment to creditors 287,000Purchase returns, P15,000How much were the credit purchases during the period? 285,000 293,000 300,000 315,000DATA PROVIDEDThe pre-adjustment trial balance of Wing-It (Pty) Ltd as at 31 August 2022 is presented:AccountDebitCreditProfessional fees765 000Goods sold435 000Cost of sales215 000Interest received19 500Interest on loan6 300Bank charges3 200Cleaning1 500Staff welfare650Salaries and wages35 850Municipal services6 850Printing and stationery16 715Telephone18 600Fuel and oil56 000Repairs and maintenance: Building5 200Repairs and maintenance: Vehicles6 850Capital: Blue520 000Capital: Green630 000Drawings: Blue35 000Drawings: Green27 000Current account: Blue2 500Current account: Green6 400Retained income265 000Land500 000Buildings1 500 000Accumulated depreciation on buildings21 000Vehicles380 000Accumulated depreciation on vehicles65 000Equipment and electronics79 500Accumulated depreciation on equipment and electronics1 5008% Long-term loan325 000Bank: FNB168 000Bank: ABSA32 000Debtors control account85 000Allowance for credit losses6 400Creditors control account78 600Petty cash2…