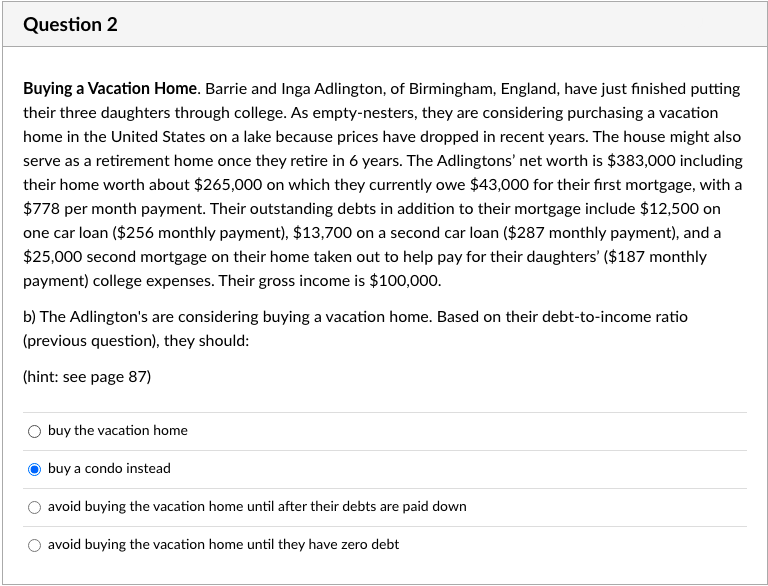

Question 2 Buying a Vacation Home. Barrie and Inga Adlington, of Birmingham, England, have just finished putting their three daughters through college. As empty-nesters, they are considering purchasing a vacation home in the United States on a lake because prices have dropped in recent years. The house might also serve as a retirement home once they retire in 6 years. The Adlingtons' net worth is $383,000 including their home worth about $265,000 on which they currently owe $43,000 for their first mortgage, with a $778 per month payment. Their outstanding debts in addition to their mortgage include $12,500 on one car loan ($256 monthly payment), $13,700 on a second car loan ($287 monthly payment), and a $25,000 second mortgage on their home taken out to help pay for their daughters' ($187 monthly payment) college expenses. Their gross income is $100,000. b) The Adlington's are considering buying a vacation home. Based on their debt-to-income ratio (previous question), they should: (hint: see page 87) buy the vacation home buy a condo instead avoid buying the vacation home until after their debts are paid down avoid buying the vacation home until they have zero debt

Question 2 Buying a Vacation Home. Barrie and Inga Adlington, of Birmingham, England, have just finished putting their three daughters through college. As empty-nesters, they are considering purchasing a vacation home in the United States on a lake because prices have dropped in recent years. The house might also serve as a retirement home once they retire in 6 years. The Adlingtons' net worth is $383,000 including their home worth about $265,000 on which they currently owe $43,000 for their first mortgage, with a $778 per month payment. Their outstanding debts in addition to their mortgage include $12,500 on one car loan ($256 monthly payment), $13,700 on a second car loan ($287 monthly payment), and a $25,000 second mortgage on their home taken out to help pay for their daughters' ($187 monthly payment) college expenses. Their gross income is $100,000. b) The Adlington's are considering buying a vacation home. Based on their debt-to-income ratio (previous question), they should: (hint: see page 87) buy the vacation home buy a condo instead avoid buying the vacation home until after their debts are paid down avoid buying the vacation home until they have zero debt

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 2DTM

Related questions

Question

3

Transcribed Image Text:Question 2

Buying a Vacation Home. Barrie and Inga Adlington, of Birmingham, England, have just finished putting

their three daughters through college. As empty-nesters, they are considering purchasing a vacation

home in the United States on a lake because prices have dropped in recent years. The house might also

serve as a retirement home once they retire in 6 years. The Adlingtons' net worth is $383,000 including

their home worth about $265,000 on which they currently owe $43,000 for their first mortgage, with a

$778 per month payment. Their outstanding debts in addition to their mortgage include $12,500 on

one car loan ($256 monthly payment), $13,700 on a second car loan ($287 monthly payment), and a

$25,000 second mortgage on their home taken out to help pay for their daughters' ($187 monthly

payment) college expenses. Their gross income is $100,000.

b) The Adlington's are considering buying a vacation home. Based on their debt-to-income ratio

(previous question), they should:

(hint: see page 87)

buy the vacation home

buy a condo instead

avoid buying the vacation home until after their debts are paid down

avoid buying the vacation home until they have zero debt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT