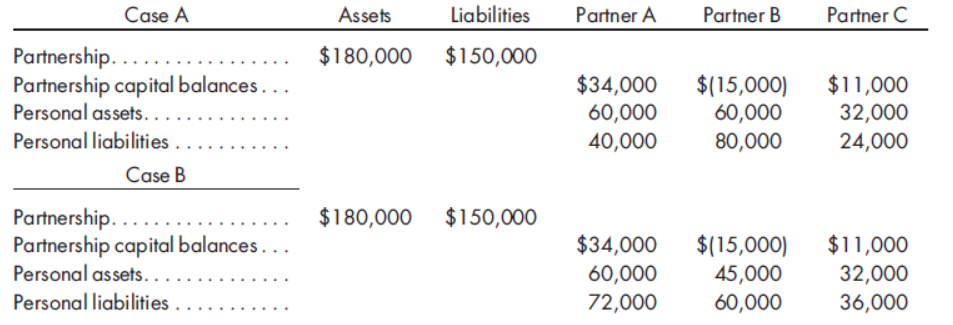

Case A Assets Liabilities Partner A Partner B Partner C $180,000 $150,000 Partnership.... Partnership capital balances... Personal assets... $34,000 60,000 $(15,000) 60,000 80,000 $11,000 32,000 Personal liabilities 40,000 24,000 Case B Partnership...... Partnership capital balances... Personal assets..... $180,000 $150,000 $34,000 $(15,000) 45,000 $11,000 60,000 72,000 32,000 Personal liabilities 60,000 36,000

The following two independent cases deal with a

Assuming that the partners share

1. Given Case A, if all of the assets were sold for $165,000, how much of personal assets could Partner B contribute toward their capital balance?

2. Given Case A, if all of the assets were sold for $126,000, how much could Partner C contribute toward the remaining partnership liabilities, assuming the unsatisfied partnership creditors first seek recovery against Partner A?

3. Given Case B, if all of the assets were sold for $135,000 and all partners with deficit capital balances contributed personal assets toward those deficits, how much, if anything, would Partner A have to contribute toward unsatisfied partnership creditors?

4. Given the same facts as item (3) above, what amount could Partner A’s unsatisfied personal creditors receive from A’s interest in the partnership?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 18 images