Case Study # 4 Excel Submission – Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%, 32%, 19%, 12%, 12% & 5%). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the to complete nearly all of its construction projects without the need for costly rental company lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. New Equipment Old Equipment $40,000 38,000 35,000 30,000 25,000 22,500 $25,000 16,000 9,000 8,000 6,000 5,000 2. 4. 5. 6.. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. 123 456

Case Study # 4 Excel Submission – Capital Budgeting Comprehensive Problem Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for $50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%, 32%, 19%, 12%, 12% & 5%). The old equipment can be sold for $33,000. Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow the to complete nearly all of its construction projects without the need for costly rental company lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS depreciation schedule. Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. New Equipment Old Equipment $40,000 38,000 35,000 30,000 25,000 22,500 $25,000 16,000 9,000 8,000 6,000 5,000 2. 4. 5. 6.. The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment be purchased to replace the old equipment? Briefly justify your answer. 123 456

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 104.4C

Related questions

Question

Transcribed Image Text:Study Excel Instructio x

EXAM 3-BUSI 320 class notes x

b Login (bartieby

es/155996/assignments/1958552

E Individual Differen...

M Corporate Finance

U SPAN101: Element...

L Canvas Dashboard

U Course Registration

out

# 4 Comp Prob - Ch 12 (D).docx

I Downle

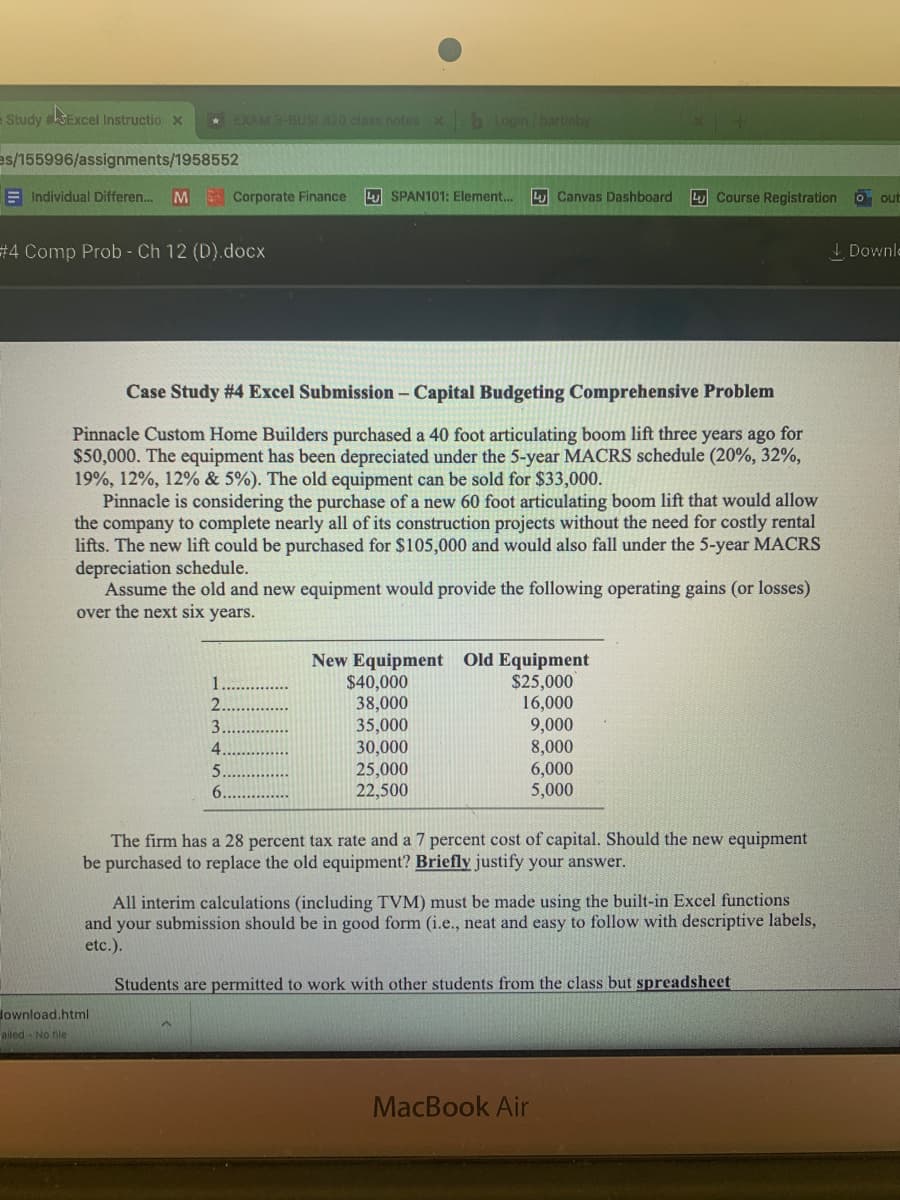

Case Study # 4 Excel Submission – Capital Budgeting Comprehensive Problem

Pinnacle Custom Home Builders purchased a 40 foot articulating boom lift three years ago for

$50,000. The equipment has been depreciated under the 5-year MACRS schedule (20%, 32%,

19%, 12%, 12% & 5%). The old equipment can be sold for $33,000.

Pinnacle is considering the purchase of a new 60 foot articulating boom lift that would allow

the company to complete nearly all of its construction projects without the need for costly rental

lifts. The new lift could be purchased for $105,000 and would also fall under the 5-year MACRS

depreciation schedule.

Assume the old and new equipment would provide the following operating gains (or losses)

over the next six years.

New Equipment Old Equipment

$40,000

38,000

35,000

30,000

25,000

22,500

$25,000

16,000

1

2.

9,000

8,000

3.

4.

6,000

5,000

5.

6.

The firm has a 28 percent tax rate and a 7 percent cost of capital. Should the new equipment

be purchased to replace the old equipment? Briefly justify your answer.

All interim calculations (including TVM) must be made using the built-in Excel functions

and your submission should be in good form (i.e., neat and easy to follow with descriptive labels,

etc.).

Students are permitted to work with other students from the class but spreadsheet

download.html

ailed No file

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning