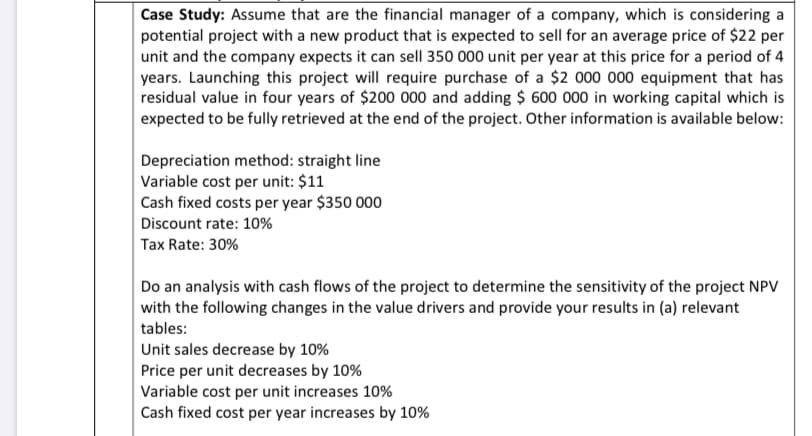

Case Study: Assume that are the financial manager of a company, which is considering a potential project with a new product that is expected to sell for an average price of $22 per unit and the company expects it can sell 350 000 unit per year at this price for a period of 4 years. Launching this project will require purchase of a $2 000 000 equipment that has residual value in four years of $200 000 and adding $ 600 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $11 Cash fixed costs per year $350 000 Discount rate: 10% Tax Rate: 30% Do an analysis with cash flows of the project to determine the sensitivity of the project NPV with the following changes in the value drivers and provide your results in (a) relevant tables: Unit sales decrease by 10% Price per unit decreases by 10% Variable cost per unit increases 10% Cash fixed cost per year increases by 10%

Case Study: Assume that are the financial manager of a company, which is considering a potential project with a new product that is expected to sell for an average price of $22 per unit and the company expects it can sell 350 000 unit per year at this price for a period of 4 years. Launching this project will require purchase of a $2 000 000 equipment that has residual value in four years of $200 000 and adding $ 600 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $11 Cash fixed costs per year $350 000 Discount rate: 10% Tax Rate: 30% Do an analysis with cash flows of the project to determine the sensitivity of the project NPV with the following changes in the value drivers and provide your results in (a) relevant tables: Unit sales decrease by 10% Price per unit decreases by 10% Variable cost per unit increases 10% Cash fixed cost per year increases by 10%

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

Question is attached herewith

Transcribed Image Text:Case Study: Assume that are the financial manager of a company, which is considering a

potential project with a new product that is expected to sell for an average price of $22 per

unit and the company expects it can sell 350 000 unit per year at this price for a period of 4

years. Launching this project will require purchase of a $2 000 000 equipment that has

residual value in four years of $200 000 and adding $ 600 000 in working capital which is

expected to be fully retrieved at the end of the project. Other information is available below:

Depreciation method: straight line

Variable cost per unit: $11

Cash fixed costs per year $350 000

Discount rate: 10%

Tax Rate: 30%

Do an analysis with cash flows of the project to determine the sensitivity of the project NPV

with the following changes in the value drivers and provide your results in (a) relevant

tables:

Unit sales decrease by 10%

Price per unit decreases by 10%

Variable cost per unit increases 10%

Cash fixed cost per year increases by 10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College