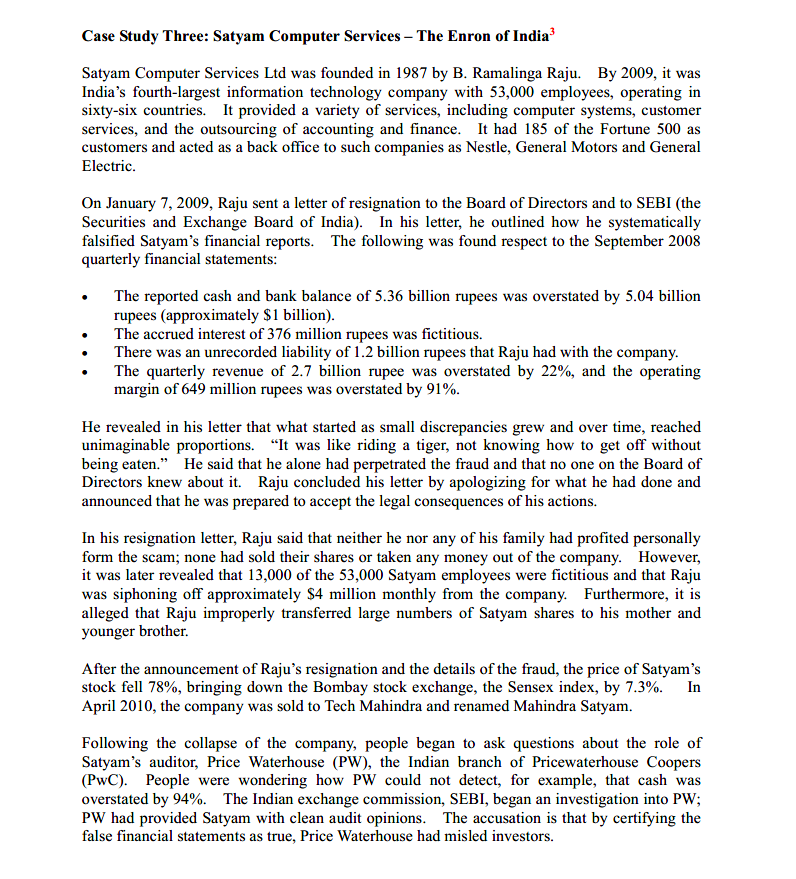

Case Study Three: Satyam Computer Services – The Enron of India³ Satyam Computer Services Ltd was founded in 1987 by B. Ramalinga Raju. By 2009, it was India's fourth-largest information technology company with 53,000 employees, operating in sixty-six countries. It provided a variety of services, including computer systems, customer services, and the outsourcing of accounting and finance. It had 185 of the Fortune 500 as customers and acted as a back office to such companies as Nestle, General Motors and General Electric. On January 7, 2009, Raju sent a letter of resignation to the Board of Directors and to SEBI (the Securities and Exchange Board of India). In his letter, he outlined how he systematically falsified Satyam's financial reports. The following was found respect to the September 2008 quarterly financial statements: The reported cash and bank balance of 5.36 billion rupees was overstated by 5.04 billion rupees (approximately $1 billion). The accrued interest of 376 million rupees was fictitious. There was an unrecorded liability of 1.2 billion rupees that Raju had with the company. The quarterly revenue of 2.7 billion rupee was overstated by 22%, and the operating margin of 649 million rupees was overstated by 91%. He revealed in his letter that what started as small discrepancies grew and over time, reached unimaginable proportions. "It was like riding a tiger, not knowing how to get off without being eaten." He said that he alone had perpetrated the fraud and that no one on the Board of Directors knew about it. Raju concluded his letter by apologizing for what he had done and announced that he was prepared to accept the legal consequences of his actions. In his resignation letter, Raju said that neither he nor any of his family had profited personally form the scam; none had sold their shares or taken any money out of the company. However, it was later revealed that 13,000 of the 53,000 Satyam employees were fictitious and that Raju was siphoning off approximately $4 million monthly from the company. Furthermore, it is alleged that Raju improperly transferred large numbers of Satyam shares to his mother and younger brother. After the announcement of Raju's resignation and the details of the fraud, the price of Satyam's stock fell 78%, bringing down the Bombay stock exchange, the Sensex index, by 7.3%. In April 2010, the company was sold to Tech Mahindra and renamed Mahindra Satyam. Following the collapse of the company, people began to ask questions about the role of Satyam's auditor, Price Waterhouse (PW), the Indian branch of Pricewaterhouse Coopers (PwC). People were wondering how PW could not detect, for example, that cash was overstated by 94%. The Indian exchange commission, SEBI, began an investigation into PW; PW had provided Satyam with clean audit opinions. The accusation is that by certifying the false financial statements as true, Price Waterhouse had misled investors.

Case Study Three: Satyam Computer Services – The Enron of India³ Satyam Computer Services Ltd was founded in 1987 by B. Ramalinga Raju. By 2009, it was India's fourth-largest information technology company with 53,000 employees, operating in sixty-six countries. It provided a variety of services, including computer systems, customer services, and the outsourcing of accounting and finance. It had 185 of the Fortune 500 as customers and acted as a back office to such companies as Nestle, General Motors and General Electric. On January 7, 2009, Raju sent a letter of resignation to the Board of Directors and to SEBI (the Securities and Exchange Board of India). In his letter, he outlined how he systematically falsified Satyam's financial reports. The following was found respect to the September 2008 quarterly financial statements: The reported cash and bank balance of 5.36 billion rupees was overstated by 5.04 billion rupees (approximately $1 billion). The accrued interest of 376 million rupees was fictitious. There was an unrecorded liability of 1.2 billion rupees that Raju had with the company. The quarterly revenue of 2.7 billion rupee was overstated by 22%, and the operating margin of 649 million rupees was overstated by 91%. He revealed in his letter that what started as small discrepancies grew and over time, reached unimaginable proportions. "It was like riding a tiger, not knowing how to get off without being eaten." He said that he alone had perpetrated the fraud and that no one on the Board of Directors knew about it. Raju concluded his letter by apologizing for what he had done and announced that he was prepared to accept the legal consequences of his actions. In his resignation letter, Raju said that neither he nor any of his family had profited personally form the scam; none had sold their shares or taken any money out of the company. However, it was later revealed that 13,000 of the 53,000 Satyam employees were fictitious and that Raju was siphoning off approximately $4 million monthly from the company. Furthermore, it is alleged that Raju improperly transferred large numbers of Satyam shares to his mother and younger brother. After the announcement of Raju's resignation and the details of the fraud, the price of Satyam's stock fell 78%, bringing down the Bombay stock exchange, the Sensex index, by 7.3%. In April 2010, the company was sold to Tech Mahindra and renamed Mahindra Satyam. Following the collapse of the company, people began to ask questions about the role of Satyam's auditor, Price Waterhouse (PW), the Indian branch of Pricewaterhouse Coopers (PwC). People were wondering how PW could not detect, for example, that cash was overstated by 94%. The Indian exchange commission, SEBI, began an investigation into PW; PW had provided Satyam with clean audit opinions. The accusation is that by certifying the false financial statements as true, Price Waterhouse had misled investors.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

(a) What, in your view, are India’s most significant corporate governance failures as shown

in the Satyam Computer scandal?

Transcribed Image Text:Case Study Three: Satyam Computer Services – The Enron of India³

Satyam Computer Services Ltd was founded in 1987 by B. Ramalinga Raju. By 2009, it was

India's fourth-largest information technology company with 53,000 employees, operating in

sixty-six countries. It provided a variety of services, including computer systems, customer

services, and the outsourcing of accounting and finance. It had 185 of the Fortune 500 as

customers and acted as a back office to such companies as Nestle, General Motors and General

Electric.

On January 7, 2009, Raju sent a letter of resignation to the Board of Directors and to SEBI (the

Securities and Exchange Board of India). In his letter, he outlined how he systematically

falsified Satyam's financial reports. The following was found respect to the September 2008

quarterly financial statements:

The reported cash and bank balance of 5.36 billion rupees was overstated by 5.04 billion

rupees (approximately $1 billion).

The accrued interest of 376 million rupees was fictitious.

There was an unrecorded liability of 1.2 billion rupees that Raju had with the company.

The quarterly revenue of 2.7 billion rupee was overstated by 22%, and the operating

margin of 649 million rupees was overstated by 91%.

He revealed in his letter that what started as small discrepancies grew and over time, reached

unimaginable proportions. "It was like riding a tiger, not knowing how to get off without

being eaten." He said that he alone had perpetrated the fraud and that no one on the Board of

Directors knew about it. Raju concluded his letter by apologizing for what he had done and

announced that he was prepared to accept the legal consequences of his actions.

In his resignation letter, Raju said that neither he nor any of his family had profited personally

form the scam; none had sold their shares or taken any money out of the company. However,

it was later revealed that 13,000 of the 53,000 Satyam employees were fictitious and that Raju

was siphoning off approximately $4 million monthly from the company. Furthermore, it is

alleged that Raju improperly transferred large numbers of Satyam shares to his mother and

younger brother.

After the announcement of Raju's resignation and the details of the fraud, the price of Satyam's

stock fell 78%, bringing down the Bombay stock exchange, the Sensex index, by 7.3%.

April 2010, the company was sold to Tech Mahindra and renamed Mahindra Satyam.

In

Following the collapse of the company, people began to ask questions about the role of

Satyam's auditor, Price Waterhouse (PW), the Indian branch of Pricewaterhouse Coopers

(PwC). People were wondering how PW could not detect, for example, that cash was

overstated by 94%. The Indian exchange commission, SEBI, began an investigation into Pw;

PW had provided Satyam with clean audit opinions. The accusation is that by certifying the

false financial statements as true, Price Waterhouse had misled investors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.