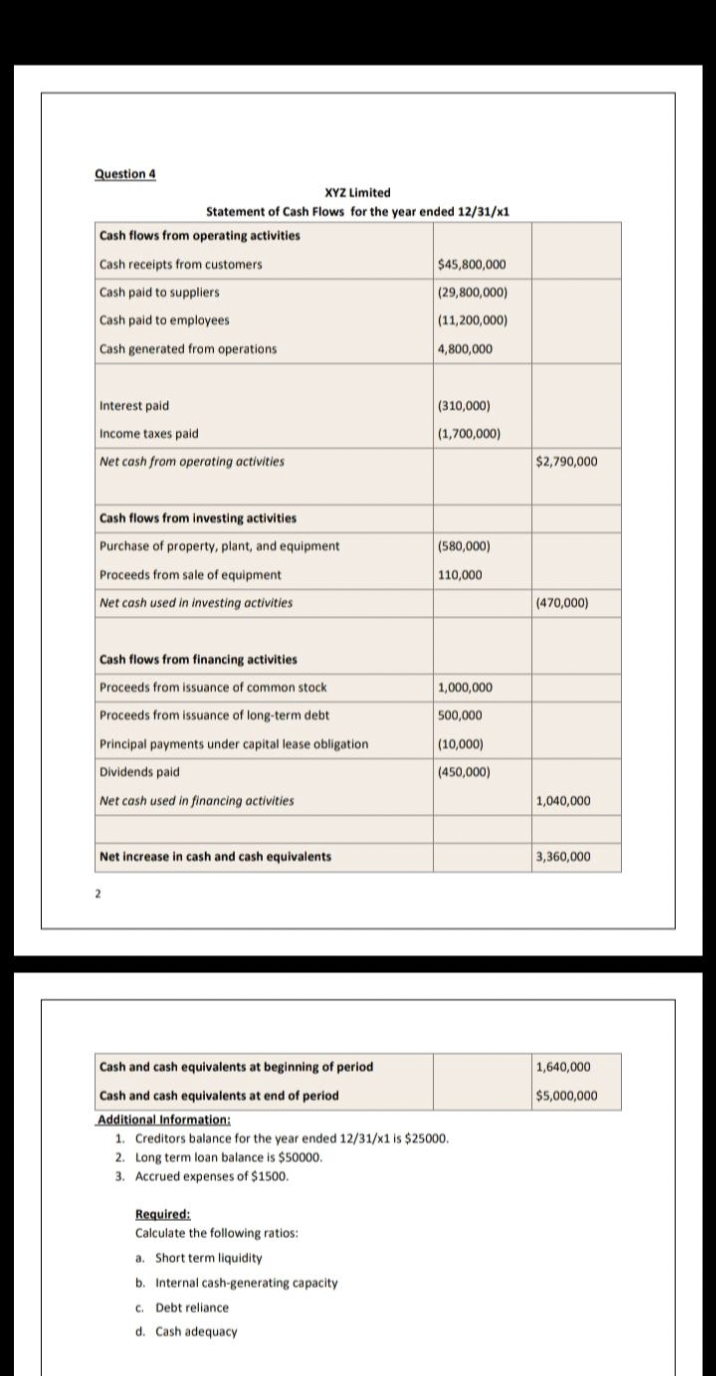

Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Additional Information: 1. Creditors balance for the year ended 12/31/x1 is $25000. 2. Long term loan balance is $50000. 3. Accrued expenses of $1500. Required: Calculate the following ratios: a. Short term liquidity b. Internal cash-generating capacity c. Debt reliance d. Cash adequacy 1,640,000 $5,000,000

Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Additional Information: 1. Creditors balance for the year ended 12/31/x1 is $25000. 2. Long term loan balance is $50000. 3. Accrued expenses of $1500. Required: Calculate the following ratios: a. Short term liquidity b. Internal cash-generating capacity c. Debt reliance d. Cash adequacy 1,640,000 $5,000,000

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 16.18EX: Statement of cash flowsindirect method The following statement of cash flows for Shasta Inc. was not...

Related questions

Question

Please help me to solve all ratios

Transcribed Image Text:Question 4

XYZ Limited

Statement of Cash Flows for the year ended 12/31/x1

Cash flows from operating activities

Cash receipts from customers

Cash paid to suppliers

Cash paid to employees

Cash generated from operations.

Interest paid

Income taxes paid

Net cash from operating activities

Cash flows from investing activities

Purchase of property, plant, and equipment

Proceeds from sale of equipment

Net cash used in investing activities

Cash flows from financing activities

Proceeds from issuance of common stock.

Proceeds from issuance of long-term debt

Principal payments under capital lease obligation

Dividends paid

Net cash used in financing activities

Net increase in cash and cash equivalents

2

$45,800,000

(29,800,000)

(11,200,000)

4,800,000

Required:

Calculate the following ratios:

a. Short term liquidity

b. Internal cash-generating capacity

c. Debt reliance

d. Cash adequacy

(310,000)

(1,700,000)

(580,000)

110,000

1,000,000

500,000

(10,000)

(450,000)

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

Additional Information:

1. Creditors balance for the year ended 12/31/x1 is $25000.

2. Long term loan balance is $50000.

3. Accrued expenses of $1500.

$2,790,000

(470,000)

1,040,000

3,360,000

1,640,000

$5,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning