Cash and cash equivalents, Jan. 1. $ 35,800 Cash and cash equivalents, Dec. 31 74,800 Cash paid to acquire plant assets Proceeds from short-term borrowing 21,000 10,000 Loans made to borrowers 5,000 Collections on loans (excluding interest) 4,000 Interest and dividends received . 27,000 Cash received from customers 795,000 Proceeds from sales of plant assets 9,000 Dividends paid . 55,000 Cash paid to suppliers and employees 635,000 Interest paid. Income taxes paid 19,000 71,000

Cash and cash equivalents, Jan. 1. $ 35,800 Cash and cash equivalents, Dec. 31 74,800 Cash paid to acquire plant assets Proceeds from short-term borrowing 21,000 10,000 Loans made to borrowers 5,000 Collections on loans (excluding interest) 4,000 Interest and dividends received . 27,000 Cash received from customers 795,000 Proceeds from sales of plant assets 9,000 Dividends paid . 55,000 Cash paid to suppliers and employees 635,000 Interest paid. Income taxes paid 19,000 71,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.2E

Related questions

Question

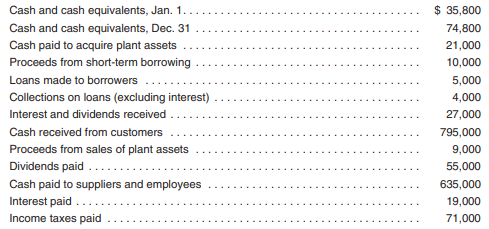

The accounting staff of Wyoming Outfitters, Inc., has assembled the following information for the year ended December 31, 2011:

Using this information, prepare a statement of cash flows. Include a proper heading for the financial statement, and classify the given information into the categories of operating activities, investing activities, and financing activities. Determine net cash flows from operating activities by the direct method. Place brackets around the dollar amounts of all cash disbursements.

Transcribed Image Text:Cash and cash equivalents, Jan. 1.

$ 35,800

Cash and cash equivalents, Dec. 31

74,800

Cash paid to acquire plant assets

Proceeds from short-term borrowing

21,000

10,000

Loans made to borrowers

5,000

Collections on loans (excluding interest)

4,000

Interest and dividends received .

27,000

Cash received from customers

795,000

Proceeds from sales of plant assets

9,000

Dividends paid .

55,000

Cash paid to suppliers and employees

635,000

Interest paid.

Income taxes paid

19,000

71,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning