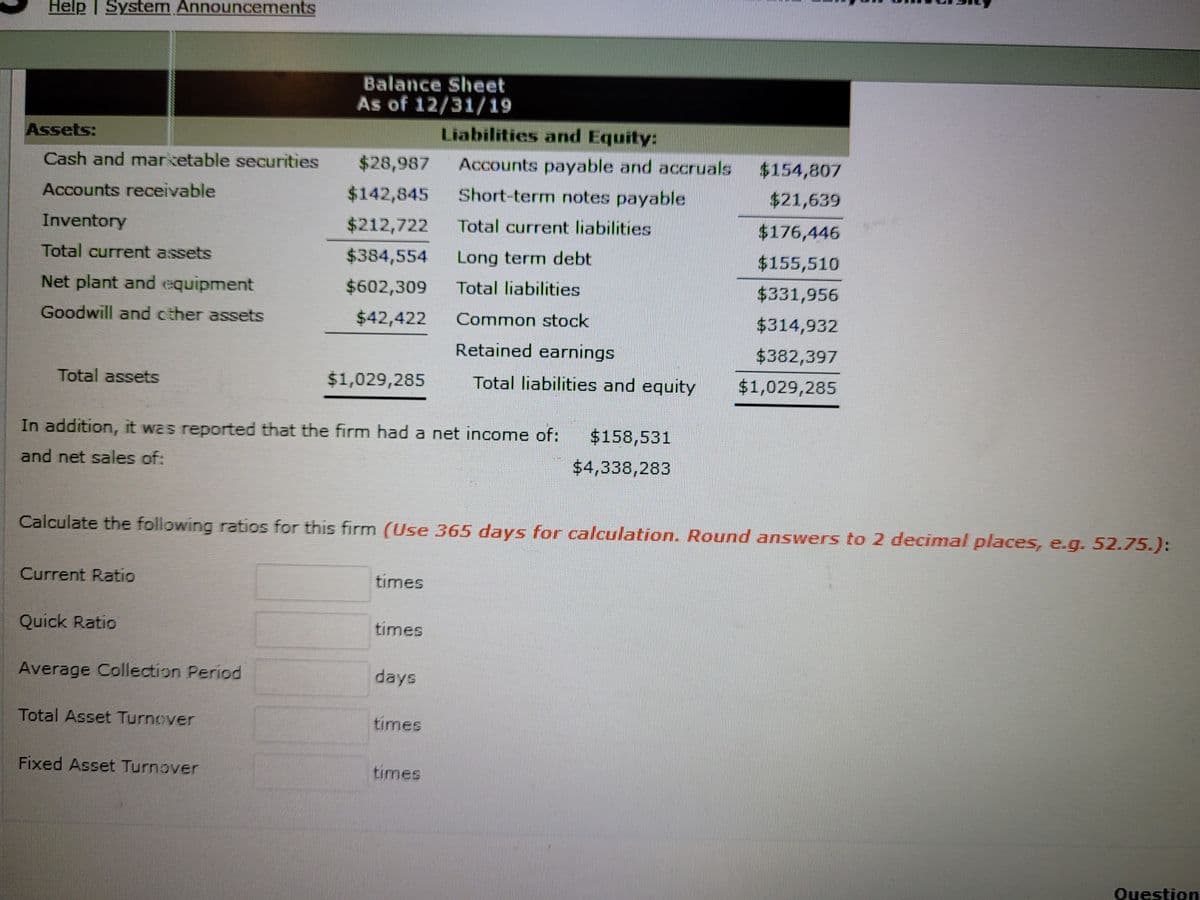

Cash and marketable securities $28,987 Accounts payable and accruals $154,807 Accounts receivable $142,845 Short-term notes payable $21,639 Inventory $212,722 Total current liabilities $176,446 Total current assets $384,554 Long term debt $155,510 Net plant and equipment $602,309 Total liabilities $331,956 Goodwill and cther assets $42,422 Common stock $314,932 Retained earnings $382,397 Total assets $1,029,285 Total liabilities and equity $1,029,285 In addition, it was reported that the firm had a net income of: $158,531 and net sales of: $4,338,283

Cash and marketable securities $28,987 Accounts payable and accruals $154,807 Accounts receivable $142,845 Short-term notes payable $21,639 Inventory $212,722 Total current liabilities $176,446 Total current assets $384,554 Long term debt $155,510 Net plant and equipment $602,309 Total liabilities $331,956 Goodwill and cther assets $42,422 Common stock $314,932 Retained earnings $382,397 Total assets $1,029,285 Total liabilities and equity $1,029,285 In addition, it was reported that the firm had a net income of: $158,531 and net sales of: $4,338,283

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPA: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

Transcribed Image Text:Help | System Announcements

Balance Sheet

As of 12/31/19

Assets:

Liabilities and Equity:

Cash and marketable securities

$28,987

Accounts payable and accruals

$154,807

Accounts receivable

$142,845

Short-term notes payable

$21,639

Inventory

$212,722

Total current liabilities

$176,446

Total current assets

$384,554

Long term debt

$155,510

Net plant and equipment

$602,309

Total liabilities

$331,956

Goodwill and cther assets

$42,422

Common stock

$314,932

Retained earnings

$382,397

Total assets

$1,029,285

Total liabilities and equity

$1,029,285

In addition, it was reported that the firm had a net income of:

$158,531

and net sales of:

$4,338,283

Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g. 52.75.):

Current Ratio

times

Quick Ratio

times

Average Collection Period

days

Total Asset Turnever

times

Fixed Asset Turnover

times

Question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning