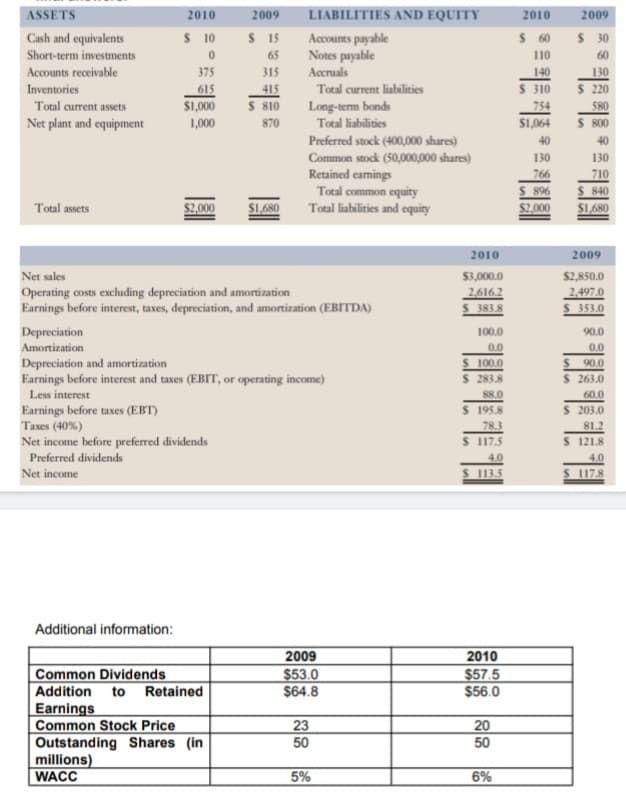

ASSETS 2010 2009 LIABILITIES AND EQUITY 2010 2009 S 10 S 15 Accounts payable Notes payable $ 60 Cash and equivalents Short-term imvestments 65 10 Accounts receivable 375 315 Accruals 140 130 Inventories 615 415 Total current liabilities S 310 $ 220 S1,000 Long-tem bonds Total liabilities Total current assets S 810 870 754 Net plant and equipment 1,000 S1,064 Preferred stock (400,000 shares) 40 40 Common stock (50,000,000 shares) Retained camings Total common equity Total liabilities and equity 130 130 766 710 S 840 S2000 S1.680 S 896 S200 Total assets $1,680 2010 2009 Net sales $3,000.0 $2,850.0 Operating costs excluding depreciation and amortization Earnings before interest, taxes, depreciation, and amortization (EBITDA) 26162 S 383.8 2,497.0 S 353.0 Depreciation 100.0 90.0 0.0 0.0 S 100.0 $ 283.8 Amortization Depreciation and amortization Earnings before interest and taxes (EBIT, or operating income) 90.0 S 263.0 60.0 $4203.0 Less interest 88.0 Earnings before taxes (EBT) Taxes (40%) Net income before preferred dividends Preferred dividends S 195.8 78.3 S 17.5 81.2 S 121.8 4.0 4.0 S 1 17.8 Net income 113.5 Additional information: 2009 $53.0 $64.8 2010 Common Dividends $57.5 $56.0 Addition to Retained Earnings Common Stock Price Outstanding Shares (in millions) WACC 20 23 50 50 5% 6% コ

ASSETS 2010 2009 LIABILITIES AND EQUITY 2010 2009 S 10 S 15 Accounts payable Notes payable $ 60 Cash and equivalents Short-term imvestments 65 10 Accounts receivable 375 315 Accruals 140 130 Inventories 615 415 Total current liabilities S 310 $ 220 S1,000 Long-tem bonds Total liabilities Total current assets S 810 870 754 Net plant and equipment 1,000 S1,064 Preferred stock (400,000 shares) 40 40 Common stock (50,000,000 shares) Retained camings Total common equity Total liabilities and equity 130 130 766 710 S 840 S2000 S1.680 S 896 S200 Total assets $1,680 2010 2009 Net sales $3,000.0 $2,850.0 Operating costs excluding depreciation and amortization Earnings before interest, taxes, depreciation, and amortization (EBITDA) 26162 S 383.8 2,497.0 S 353.0 Depreciation 100.0 90.0 0.0 0.0 S 100.0 $ 283.8 Amortization Depreciation and amortization Earnings before interest and taxes (EBIT, or operating income) 90.0 S 263.0 60.0 $4203.0 Less interest 88.0 Earnings before taxes (EBT) Taxes (40%) Net income before preferred dividends Preferred dividends S 195.8 78.3 S 17.5 81.2 S 121.8 4.0 4.0 S 1 17.8 Net income 113.5 Additional information: 2009 $53.0 $64.8 2010 Common Dividends $57.5 $56.0 Addition to Retained Earnings Common Stock Price Outstanding Shares (in millions) WACC 20 23 50 50 5% 6% コ

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

compute for NOPAT or

Formula EBIT x (1-Tax Rate)

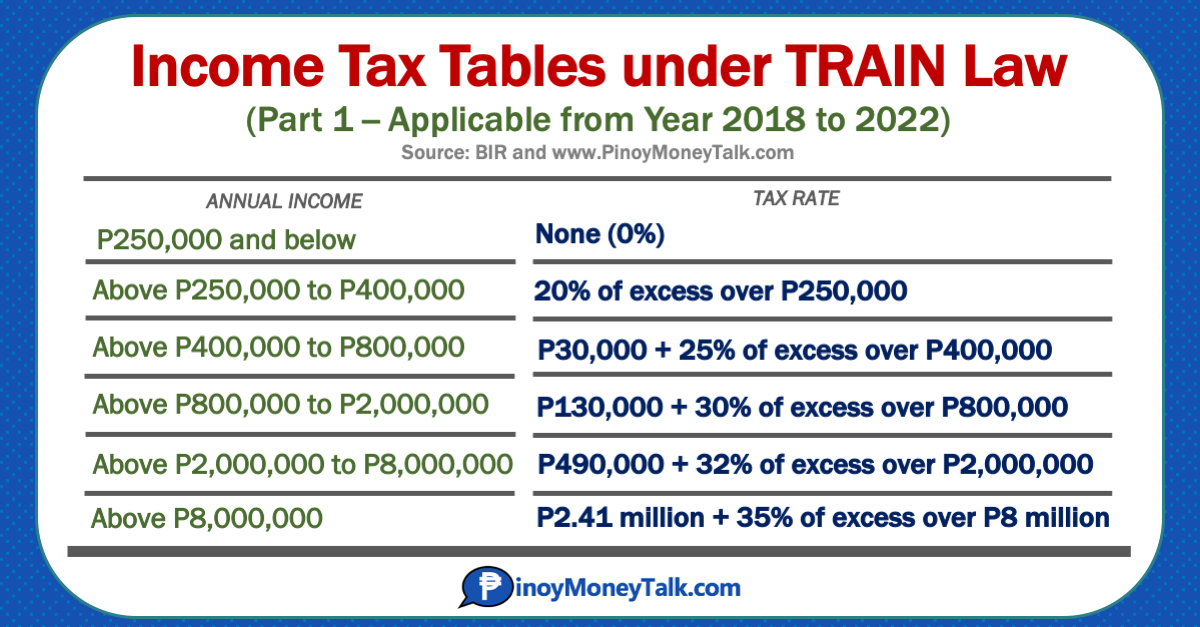

Tax Rate basis PH Tax rate pic of tax rate is attached

Transcribed Image Text:ASSETS

2010

2009

LIABILITIES AND EQUITY

2010

2009

Cash and equivalents

Short-term investments

$ 10

S 15

S 60

Accounts payable

$ 30

65

Notes payable

110

60

Accounts receivable

375

315

Accruals

140

130

S 310

S 220

Total current liabilities

Long-term bonds

Inventories

615

S1,000

415

Total current assets

S 810

754

580

Net plant and equipment

1,000

870

Total liabilities

S1,064

S 800

Preferred stock (400,000 shares)

40

40

Common stock (50,000,000 shares)

Retained eamings

Total common equity

Total liabilities and equity

130

130

766

710

$2,000

S 89%

$2,000

$ 840

$1,680

Total assets

S1,680

2010

2009

Net sales

$3,000.0

$2,850.0

Operating costs excluding depreciation and amortization

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

2,616.2

S 383.8

2,497.0

S 353.0

Depreciation

100.0

90.0

Amortization

0.0

0.0

S 100.0

S 283.8

88.0

S 195.8

Depreciation and amortization

Earnings before interest and taxes (EBIT, or operating income)

$ 90.0

$ 263.0

Less interest

60.0

Earnings before taxes (EBT)

Taxes (40%)

S 203.0

78.3

81.2

S 117.5

S 121.8

Net income before preferred dividends

Preferred dividends

4.0

S 113.5

4.0

Net income

S 1 17.8

Additional information:

2009

2010

$57.5

$56.0

Common Dividends

$53.0

$64.8

Addition

to Retained

Earnings

Common Stock Price

Outstanding Shares (in

millions)

WACC

20

23

50

50

5%

6%

Transcribed Image Text:Income Tax Tables under TRAIN Law

(Part 1- Applicable from Year 2018 to 2022)

Source: BIR and www.PinoyMoneyTalk.com

ANNUAL INCOME

TAX RATE

P250,000 and below

None (0%)

Above P250,000 to P400,000

20% of excess over P250,000

Above P400,000 to P800,000

P30,000 + 25% of excess over P400,000

Above P800,000 to P2,000,000

P130,000 + 30% of excess over P800,000

Above P2,000,000 to P8,000,000 P490,000 + 32% of excess over P2,000,000

Above P8,000,000

P2.41 million + 35% of excess over P8 million

PinoyMoneyTalk.com

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education