Cash balances in the cash registers at its retail outlets Accounts reccivable (net of doubtful accounts) Petty cash balances in head office Chequing account at the Bank of Toyland Accounts payable Inventory of goods for resale (at the lower of cost of market value) Term deposits with Investor's Trust Land (at cost)

Cash balances in the cash registers at its retail outlets Accounts reccivable (net of doubtful accounts) Petty cash balances in head office Chequing account at the Bank of Toyland Accounts payable Inventory of goods for resale (at the lower of cost of market value) Term deposits with Investor's Trust Land (at cost)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

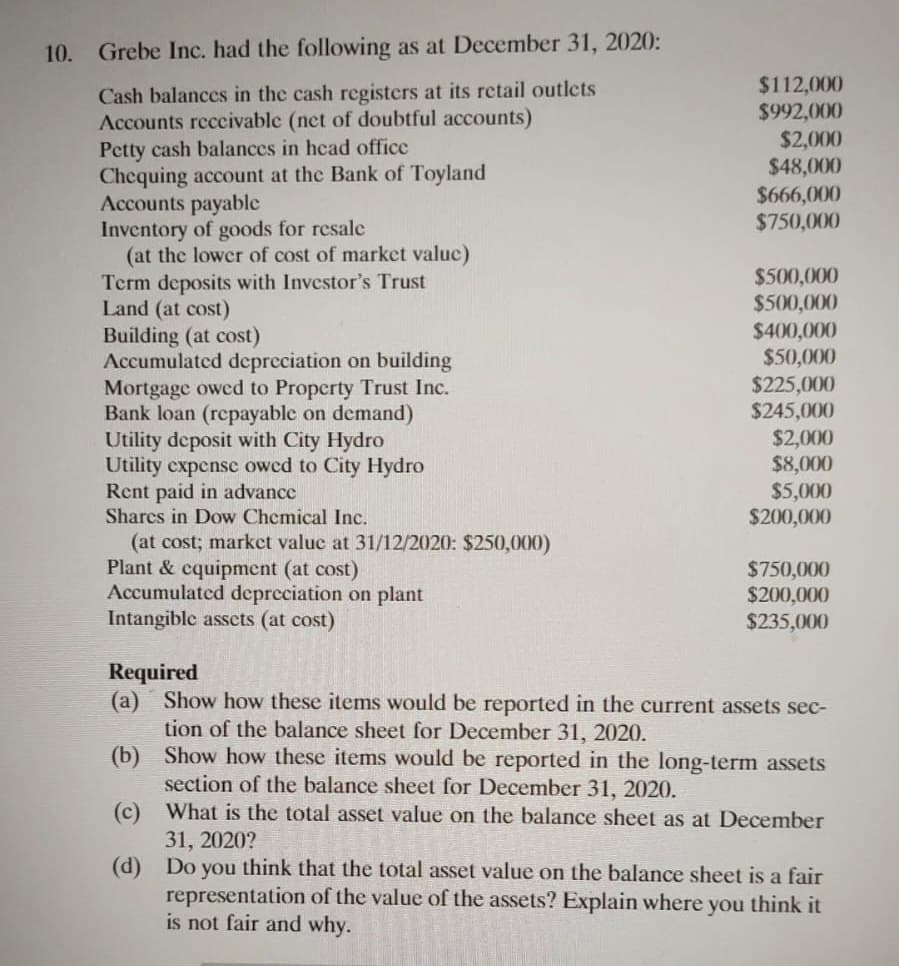

Transcribed Image Text:10. Grebe Inc. had the following as at December 31, 2020:

$112,000

$992,000

$2,000

$48,000

$666,000

$750,000

Cash balances in the cash registers at its retail outlets

Accounts reccivable (net of doubtful accounts)

Petty cash balances in head office

Chequing account at the Bank of Toyland

Accounts payable

Inventory of goods for resale

(at the lower of cost of market valuc)

Term deposits with Investor's Trust

Land (at cost)

Building (at cost)

Accumulated depreciation on building

Mortgage owed to Property Trust Inc.

Bank loan (repayable on demand)

Utility deposit with City Hydro

Utility cxpense owed to City Hydro

Rent paid in advance

Sharcs in Dow Chemical Inc.

$500,000

$500,000

$400,000

$50,000

$225,000

$245,000

$2,000

$8,000

$5,000

$200,000

(at cost; markct value at 31/12/2020: $250,000)

Plant & cquipment (at cost)

Accumulated depreciation on plant

Intangible assets (at cost)

$750,000

$200,000

$235,000

Required

(a) Show how these items would be reported in the current assets sec-

tion of the balance sheet for December 31, 2020.

(b) Show how these items would be reported in the long-term assets

section of the balance sheet for December 31, 2020.

(c) What is the total asset value on the balance sheet as at December

31, 2020?

(d) Do you think that the total asset value on the balance sheet is a fair

representation of the value of the assets? Explain where you think it

is not fair and why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning