From page 4-3 of the VLN, which statement is true regarding cash sales? O We always recognize the sale at the agreed upon transaction price regardless of how the customer pays for it. O The company will record a higher sale amount if the customer pays with paper cash rather than paying with a debit card. O If a customer pays with a credit card, it is not considered a cash sale. O If a customer pays with a check, we record the sale as if it was on account.

From page 4-3 of the VLN, which statement is true regarding cash sales? O We always recognize the sale at the agreed upon transaction price regardless of how the customer pays for it. O The company will record a higher sale amount if the customer pays with paper cash rather than paying with a debit card. O If a customer pays with a credit card, it is not considered a cash sale. O If a customer pays with a check, we record the sale as if it was on account.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash And Marketable Securities

Section: Chapter Questions

Problem 32MCQ

Related questions

Topic Video

Question

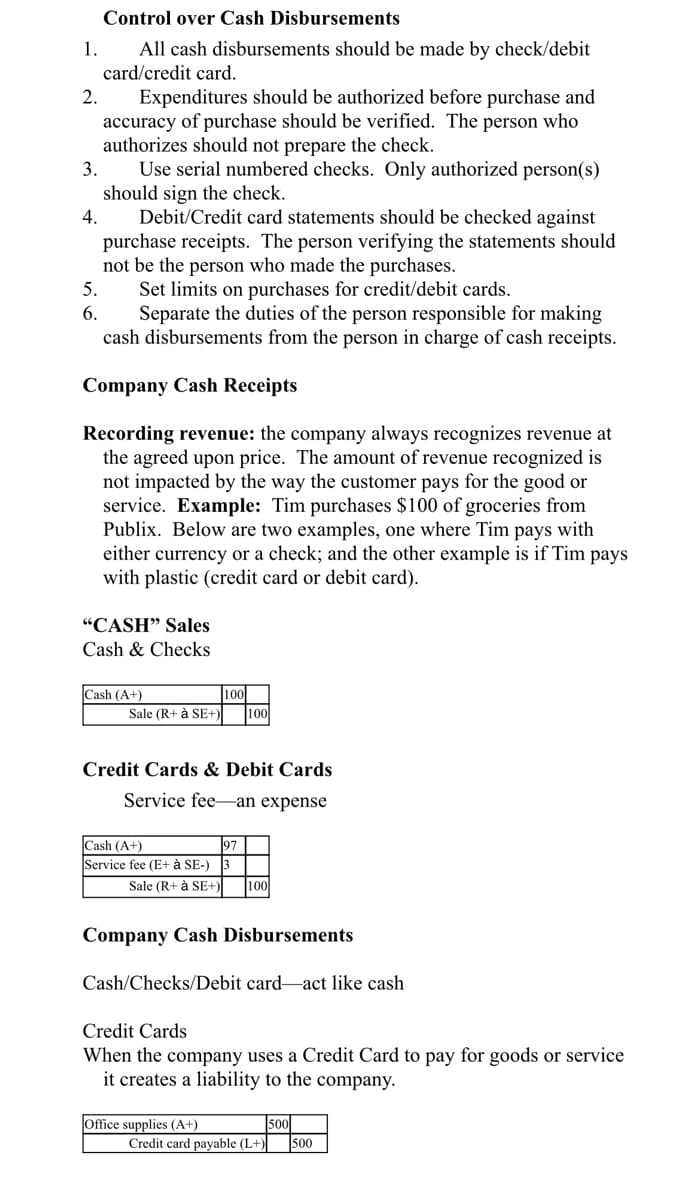

Transcribed Image Text:Control over Cash Disbursements

All cash disbursements should be made by check/debit

card/credit card.

1.

2.

Expenditures should be authorized before purchase and

accuracy of purchase should be verified. The person who

authorizes should not prepare the check.

Use serial numbered checks. Only authorized person(s)

should sign the check.

Debit/Credit card statements should be checked against

3.

4.

purchase receipts. The person verifying the statements should

not be the person who made the purchases.

Set limits on purchases for credit/debit cards.

Separate the duties of the person responsible for making

cash disbursements from the person in charge of cash receipts.

5.

6.

Company Cash Receipts

Recording revenue: the company always recognizes revenue at

the agreed upon price. The amount of revenue recognized is

not impacted by the way the customer pays for the good or

service. Example: Tim purchases $100 of groceries from

Publix. Below are two examples, one where Tim pays with

either currency or a check; and the other example is if Tim pays

with plastic (credit card or debit card).

"CASH" Sales

Cash & Checks

Cash (A+)

100

Sale (R+ à SE+)

100

Credit Cards & Debit Cards

Service fee-an expense

97

Cash (A+)

Service fee (E+ à SE-)

Sale (R+ à SE+)

100

Company Cash Disbursements

Cash/Checks/Debit card-act like cash

Credit Cards

When the company uses a Credit Card to pay for goods or service

it creates a liability to the company.

Office supplies (A+)

500

Credit card payable (L+)|

500

Transcribed Image Text:D Question 3

0.2 pts

From page 4-3 of the VLN, which

statement is true regarding cash sales?

O We always recognize the sale at the agreed

upon transaction price regardless of how

the customer pays for it.

O The company will record a higher sale

amount if the customer pays with paper

cash rather than paying with a debit card.

O If a customer pays with a credit card, it is

not considered a cash sale.

O If a customer pays with a check, we record

the sale as if it was on acCcount.

Expert Solution

Step 1

Cash refers to the monetary value and resource that is important for the company to operate. It is classified as the most liquid asset and recorded under the head current asset on the balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College