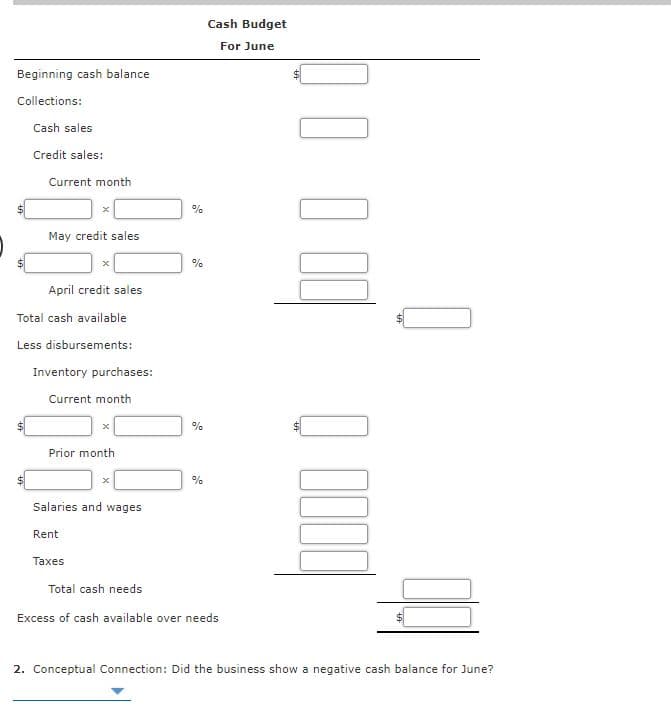

Cash Budget The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: Cash balance on June 1 is $1,436. Actual sales for April and May are as follows: April May Cash sales $10,000 $18,000 Credit sales 28,900 35,000 Total sales $38,900 $53,000 Credit sales are collected over a 3-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible. Inventory purchases average 68% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner. Rent is $4,800 per month. Taxes to be paid in June are $6,780. The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn’t have access to short-term loans. Required: 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest dollar. Be sure to enter percentages as whole numbers.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following:

- Cash balance on June 1 is $1,436.

- Actual sales for April and May are as follows:

April May Cash sales $10,000 $18,000 Credit sales 28,900 35,000 Total sales $38,900 $53,000 - Credit sales are collected over a 3-month period: 40% in the month of sale, 30% in the second month, and 20% in the third month. The sales collected in the third month are subject to a 2% late fee, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible.

- Inventory purchases average 68% of a month's total sales. Of those purchases, 20% are paid for in the month of purchase. The remaining 80% are paid for in the following month.

- Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner.

- Rent is $4,800 per month.

- Taxes to be paid in June are $6,780.

The owner also tells you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn’t have access to short-term loans.

Required:

1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest dollar. Be sure to enter percentages as whole numbers.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps