Cash No. 101 Date Explanation Ref Debit Credit Balance Apr. 1 JI $20,000 $20,000 $1,500 18,500 JI Apr. 2 JI Apr. 11 $1,000 JI Apr. 20 Apr. 30 v JI $2,800 JI Apr. 30 $2,600 Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance $5,100 JI Аpr. 10 $5,100 Supplies No. 126 Date Explanation Ref Debit Credit Balance Apr. 3 $4,000 J1 $4,000 Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance $4,000 JI Apr. 3 $4,000 Apr. 30 JI $2,600 Unearned Service Revenue No. 209 Date Explanation Ref Debit Credit Balance $1,000 JI Apr. 11 $1,000 Owner's Capital No. 301 Date Explanation Ref Debit Credit Balance Apr. 1 $20,000 JI $20,000 Service Revenue No. 400 Date Explanation Ref Debit Credit Balance Apr. 10 J1 $5,100 $5,100 JI Apr. 20 $2,100 wwwww Salaries and Wages Expense No. 726 Date Explanation Ref Debit Credit Balance Apr. 30 v JI $2,800 $2,800 Rent Expense No. 729 Date Explanation Ref Debit Credit Balance Apr. 2 JI $1,500 $1,500

Cash No. 101 Date Explanation Ref Debit Credit Balance Apr. 1 JI $20,000 $20,000 $1,500 18,500 JI Apr. 2 JI Apr. 11 $1,000 JI Apr. 20 Apr. 30 v JI $2,800 JI Apr. 30 $2,600 Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance $5,100 JI Аpr. 10 $5,100 Supplies No. 126 Date Explanation Ref Debit Credit Balance Apr. 3 $4,000 J1 $4,000 Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance $4,000 JI Apr. 3 $4,000 Apr. 30 JI $2,600 Unearned Service Revenue No. 209 Date Explanation Ref Debit Credit Balance $1,000 JI Apr. 11 $1,000 Owner's Capital No. 301 Date Explanation Ref Debit Credit Balance Apr. 1 $20,000 JI $20,000 Service Revenue No. 400 Date Explanation Ref Debit Credit Balance Apr. 10 J1 $5,100 $5,100 JI Apr. 20 $2,100 wwwww Salaries and Wages Expense No. 726 Date Explanation Ref Debit Credit Balance Apr. 30 v JI $2,800 $2,800 Rent Expense No. 729 Date Explanation Ref Debit Credit Balance Apr. 2 JI $1,500 $1,500

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 40E: Exercise 2-40 Transaction Analysis Amanda Webb opened a home health care business under the name...

Related questions

Question

Fill out the missing boxes.

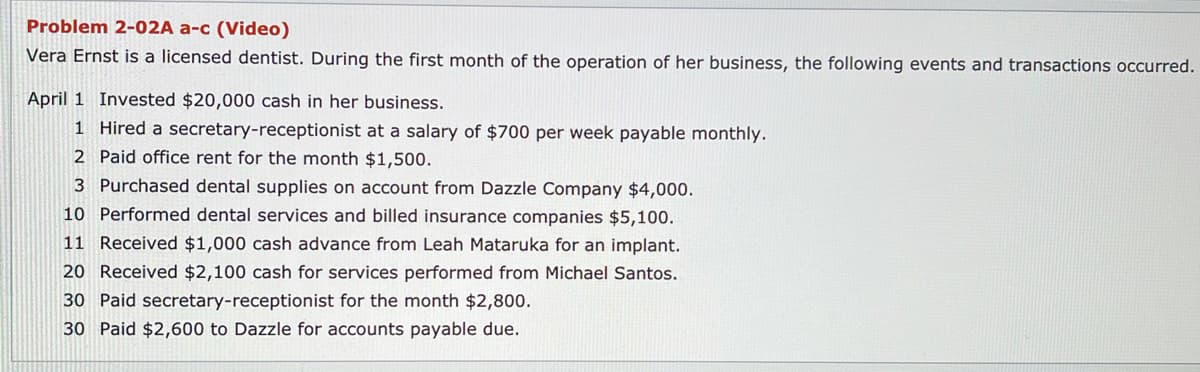

Transcribed Image Text:Problem 2-02A a-c (Video)

Vera Ernst is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred.

April 1 Invested $20,000 cash in her business.

1 Hired a secretary-receptionist at a salary of $700 per week payable monthly.

2 Paid office rent for the month $1,500.

3 Purchased dental supplies on account from Dazzle Company $4,000.

10 Performed dental services and billed insurance companies $5,100.

11 Received $1,000 cash advance from Leah Mataruka for an implant.

20 Received $2,100 cash for services performed from Michael Santos.

30 Paid secretary-receptionist for the month $2,800.

30 Paid $2,600 to Dazzle for accounts payable due.

Transcribed Image Text:Cash

No. 101

Date

Explanation Ref

Debit

Credit

Balance

Apr. 1

JI

$20,000

$20,000

$1,500

18,500

JI

Apr. 2

JI

Apr. 11

$1,000

J1

Apr. 20 v

Apr. 30

JI

$2,800

Apr. 30

J1

$2,600

Accounts Receivable

No. 112

Date

Explanation Ref

Debit

Credit

Balance

$5,100

J1

Apr. 10

$5,100

Supplies

No. 126

Date

Explanation Ref

Debit

Credit

Balance

Apr. 3

$4,000|

$4,000

JI

Accounts Payable

No. 201

Date

Explanation Ref

Debit

Credit

Balance

Apr. 3

JI

$4,000

$4,000

JI

Apr. 30

$2,600

Unearned Service Revenue

No. 209

Date

Explanation Ref

Debit

Credit

Balance

Apr. 11

JI

$1,000

$1,000

Owner's Capital

No. 301

Date

Explanation Ref

Debit

Credit

Balance

Apr. 1

JI

$20,000

$20,000

Service Revenue

No. 400

Date

Explanation Ref

Debit

Credit

Balance

Apr. 10 v

JI

$5,100

$5,100

Apr. 20

JI

$2,100

Salaries and Wages Expense

No. 726

Date

Explanation Ref

Debit

Credit

Balance

Apr. 30 v

JI

$2,800

$2,800

Rent Expense

No. 729

Date

Explanation Ref

Debit

Credit

Balance

Apr. 2 v

J1

$1,500

$1,500

Expert Solution

Step 1 Introduction

Ledgers: It is the main book or principal book of account. It is recording and totaling economic transaction measures in terms of a monetary unit of account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning