Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $130,000, and it had a market value of $208,000 on the date of the transfer. Cecile sold the stock for $182,000 a month after receiving it. In addition Casper is required to pay Cecile $6,500 a month in alimony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? b. Does Casper receive a deduction for the $32,500 alimony paid? c. How much income does Cecile have from the $32,500 alimony received? $4 d. When Cecile sells the stock, how much does she report? Cecile will report a of $

Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $130,000, and it had a market value of $208,000 on the date of the transfer. Cecile sold the stock for $182,000 a month after receiving it. In addition Casper is required to pay Cecile $6,500 a month in alimony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? b. Does Casper receive a deduction for the $32,500 alimony paid? c. How much income does Cecile have from the $32,500 alimony received? $4 d. When Cecile sells the stock, how much does she report? Cecile will report a of $

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 23CE: LO.3 Simba and Zola are married but file separate returns. Simba received 80,000 of salary and 1,200...

Related questions

Question

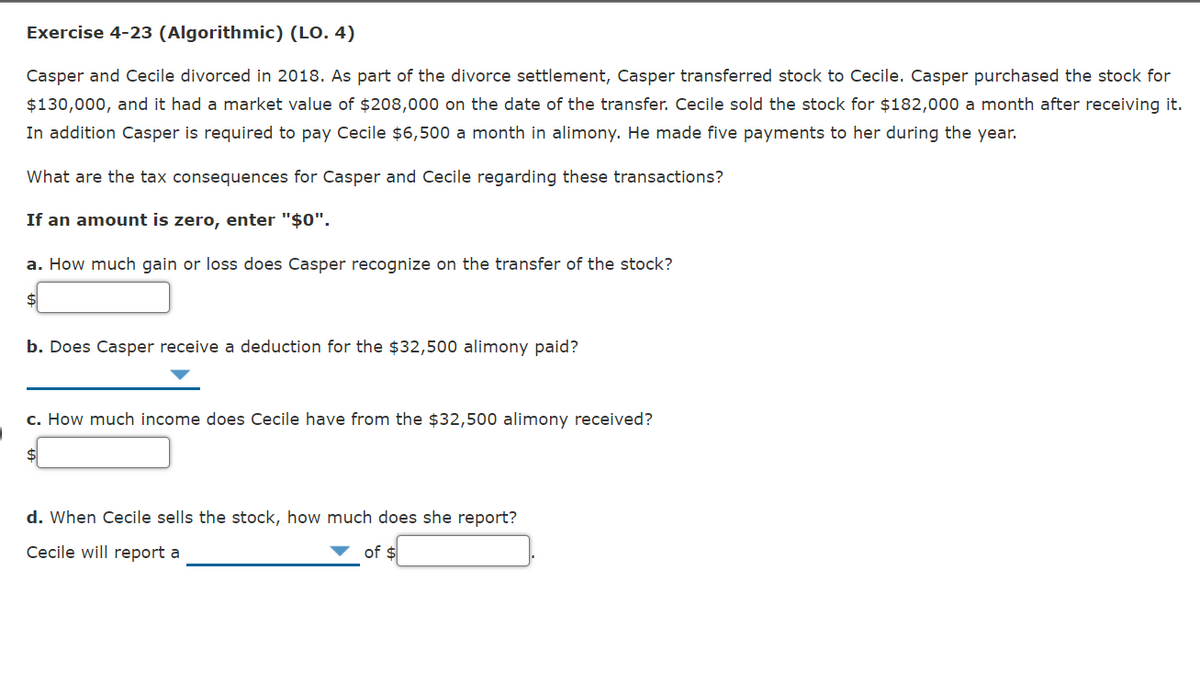

Transcribed Image Text:Exercise 4-23 (Algorithmic) (LO. 4)

Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for

$130,000, and it had a market value of $208,000 on the date of the transfer. Cecile sold the stock for $182,000 a month after receiving it.

In addition Casper is required to pay Cecile $6,500 a month in alimony. He made five payments to her during the year.

What are the tax consequences for Casper and Cecile regarding these transactions?

If an amount is zero, enter "$0".

a. How much gain or loss does Casper recognize on the transfer of the stock?

b. Does Casper receive a deduction for the $32,500 alimony paid?

c. How much income does Cecile have from the $32,500 alimony received?

$4

d. When Cecile sells the stock, how much does she report?

Cecile will report a

of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT