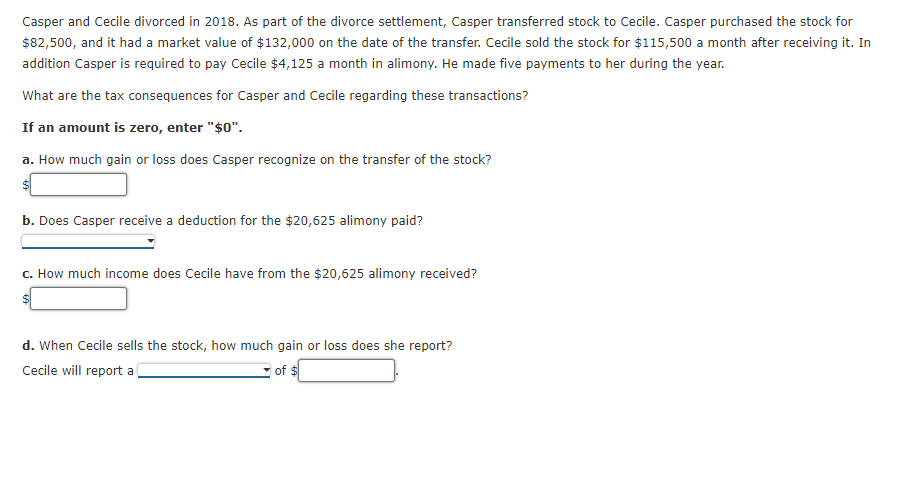

Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $82,500, and it had a market value of $132,000 on the date of the transfer. Cecile sold the stock for $115,500 a month after receiving it. In addition Casper is required to pay Cecile $4,125 a month in alimony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? b. Does Casper receive a deduction for the $20,625 alimony paid? c. How much income does Cecile have from the $20,625 alimony received?

Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for $82,500, and it had a market value of $132,000 on the date of the transfer. Cecile sold the stock for $115,500 a month after receiving it. In addition Casper is required to pay Cecile $4,125 a month in alimony. He made five payments to her during the year. What are the tax consequences for Casper and Cecile regarding these transactions? If an amount is zero, enter "$0". a. How much gain or loss does Casper recognize on the transfer of the stock? b. Does Casper receive a deduction for the $20,625 alimony paid? c. How much income does Cecile have from the $20,625 alimony received?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter10: Individuals: Income, Deductions, And Credits

Section: Chapter Questions

Problem 1CE

Related questions

Question

Transcribed Image Text:Casper and Cecile divorced in 2018. As part of the divorce settlement, Casper transferred stock to Cecile. Casper purchased the stock for

$82,500, and it had a market value of $132,000 on the date of the transfer. Cecile sold the stock for $115,500 a month after receiving it. In

addition Casper is required to pay Cecile $4,125 a month in alimony. He made five payments to her during the year.

What are the tax consequences for Casper and Cecile regarding these transactions?

If an amount is zero, enter "$0".

a. How much gain or loss does Casper recognize on the transfer of the stock?

b. Does Casper receive a deduction for the $20,625 alimony paid?

c. How much income does Cecile have from the $20,625 alimony received?

$

d. When Cecile sells the stock, how much gain or loss does she report?

Cecile will report a

of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT