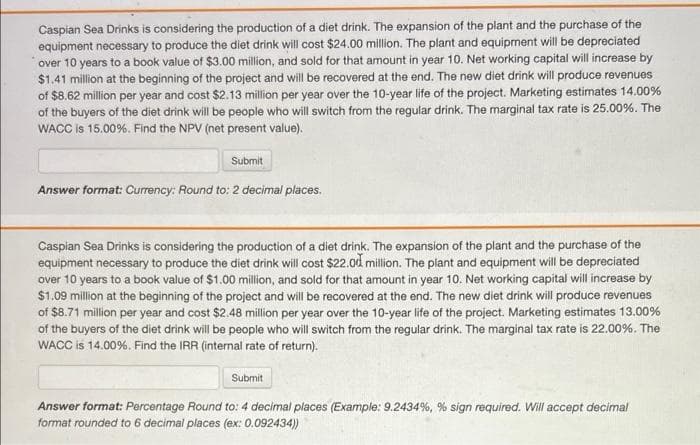

Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $24.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by $1.41 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.62 million per year and cost $2.13 million per year over the 10-year life of the project. Marketing estimates 14.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 25.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.

Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $24.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by $1.41 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.62 million per year and cost $2.13 million per year over the 10-year life of the project. Marketing estimates 14.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 25.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the

equipment necessary to produce the diet drink will cost $24.00 million. The plant and equipment will be depreciated

over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by

$1.41 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues

of $8.62 million per year and cost $2.13 million per year over the 10-year life of the project. Marketing estimates 14.00%

of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 25.00%. The

WACC is 15.00%. Find the NPV (net present value).

Submit

Answer format: Currency: Round to: 2 decimal places.

Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the

equipment necessary to produce the diet drink will cost $22.0d million. The plant and equipment will be depreciated

over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by

$1.09 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues

of $8.71 million per year and cost $2.48 million per year over the 10-year life of the project. Marketing estimates 13.00%

of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 22.00%. The

WACC is 14.00%. Find the IRR (internal rate of return).

Submit

Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal

format rounded to 6 decimal places (ex: 0.092434)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College