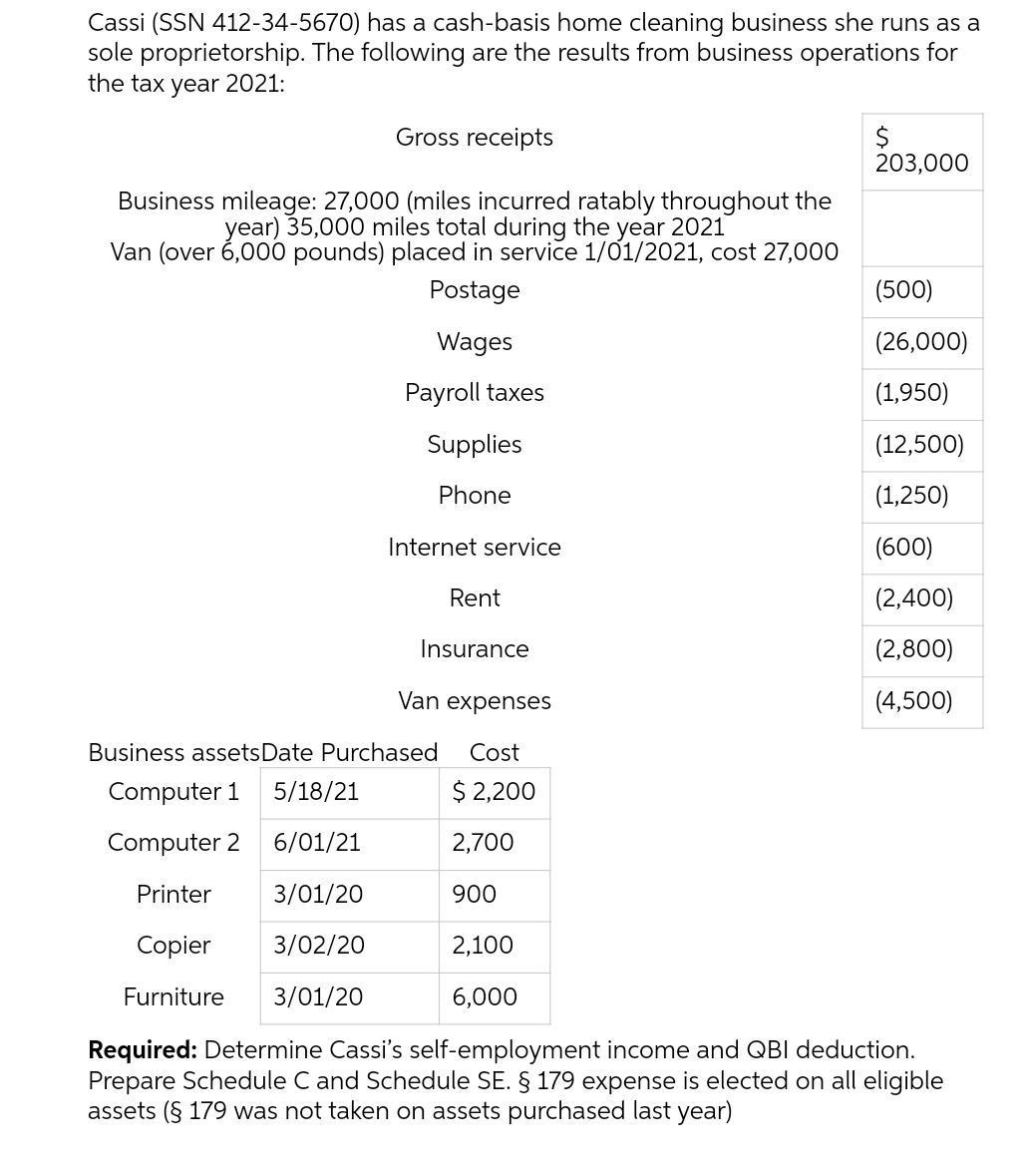

Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2021: Gross receipts 203,000 Business mileage: 27,000 (miles incurred ratably throughout the year) 35,000 miles total during the year 2021 Van (over 6,000 pounds) placed in service 1/01/2021, cost 27,000 Postage (500) Wages (26,000) Payroll taxes (1,950) Supplies (12,500) Phone (1,250) Internet service (600) Rent (2,400) Insurance (2,800) Van expenses (4,500) Business assetsDate Purchased Cost Computer 1 5/18/21 $ 2,200 Computer 2 6/01/21 2,700 Printer 3/01/20 900 Copier 3/02/20 2,100 Furniture 3/01/20 6,000 Required: Determine Cassi's self-employment income and QBI deduction. Prepare Schedule C and Schedule SE. § 179 expense is elected on all eligible assets (§ 179 was not taken on assets purchased last year)

Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2021: Gross receipts 203,000 Business mileage: 27,000 (miles incurred ratably throughout the year) 35,000 miles total during the year 2021 Van (over 6,000 pounds) placed in service 1/01/2021, cost 27,000 Postage (500) Wages (26,000) Payroll taxes (1,950) Supplies (12,500) Phone (1,250) Internet service (600) Rent (2,400) Insurance (2,800) Van expenses (4,500) Business assetsDate Purchased Cost Computer 1 5/18/21 $ 2,200 Computer 2 6/01/21 2,700 Printer 3/01/20 900 Copier 3/02/20 2,100 Furniture 3/01/20 6,000 Required: Determine Cassi's self-employment income and QBI deduction. Prepare Schedule C and Schedule SE. § 179 expense is elected on all eligible assets (§ 179 was not taken on assets purchased last year)

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a

sole proprietorship. The following are the results from business operations for

the tax year 2021:

Gross receipts

203,000

Business mileage: 27,000 (miles incurred ratably throughout the

year) 35,000 miles total during the year 2021

Van (over 6,000 pounds) placed in serviče 1/01/2021, cost 27,000

Postage

(500)

Wages

(26,000)

Payroll taxes

(1,950)

Supplies

(12,500)

Phone

(1,250)

Internet service

(600)

Rent

(2,400)

Insurance

(2,800)

Van expenses

(4,500)

Business assetsDate Purchased

Cost

Computer 1

5/18/21

$ 2,200

Computer 2

6/01/21

2,700

Printer

3/01/20

900

Copier

3/02/20

2,100

Furniture

3/01/20

6,000

Required: Determine Cassi's self-employment income and QBI deduction.

Prepare Schedule C and Schedule SE. § 179 expense is elected on all eligible

assets (§ 179 was not taken on assets purchased last year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Expert Answers to Latest Homework Questions

Q: None

Q: The rate of plant growth on an island near Isle Royale is such that the carrying capacity of moose…

Q: None

Q: افي

can you create an original syntheic scheme to the given target and write a paragraph that…

Q: Chemistry

Q: You are considering two mutually exclusive projects with unequal lives. One of the

projects has an…

Q: None

Q: None

Q: None

Q: 5

You invest $15,000 at 18% interest, compounded monthly, for 2 years. Use the compound interest…

Q: Question 8

Utilize the appropriate t test technique to complete the following.

The Eastern…

Q: Chegg

Home

Expert Q&A

My solutions

Student question

8

Time Left: 00:09:35

Answer the question based…

Q: The 2020 Arizona graduated tax rate is given in the table below for those filing

status is single or…

Q: The demand functions for two products are given below. P1, P2, 91, and q2 are the prices (in…

Q: None

Q: 3. Blackadder and Baldrick are rational, self-interested criminals imprisoned in separate cells in a…

Q: None

Q: None

Q: None

Q: None

Q: Please don't provide handwritten solution ...