at the inception of the process. Conversion costs are incurred evenly throughout the process. The machine broke down at 60% stage of completion due to inefficient operator that caused some of the units in process to be spoiled with no market value. Daily Custom Company uses FIFO in accumulating costs. Data provided for September of the current year are as follows Work in process, beg. Started 30,000 units 80,000 units 86,000 units Mat-100%; CC-89.5% Completed & transferred Work in process, end Costs: 20,000 units Mat-100%; CC-75% Work in Process, beg. Materials Conversion costs P70,000 40,000 Added during the period: | Materials P160,000 Conversion costs 122,480

at the inception of the process. Conversion costs are incurred evenly throughout the process. The machine broke down at 60% stage of completion due to inefficient operator that caused some of the units in process to be spoiled with no market value. Daily Custom Company uses FIFO in accumulating costs. Data provided for September of the current year are as follows Work in process, beg. Started 30,000 units 80,000 units 86,000 units Mat-100%; CC-89.5% Completed & transferred Work in process, end Costs: 20,000 units Mat-100%; CC-75% Work in Process, beg. Materials Conversion costs P70,000 40,000 Added during the period: | Materials P160,000 Conversion costs 122,480

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 4CMA: A company is using process costing with the first-in, first-out (FIFO) method, and all costs are...

Related questions

Topic Video

Question

What is the cost of ending inventory?

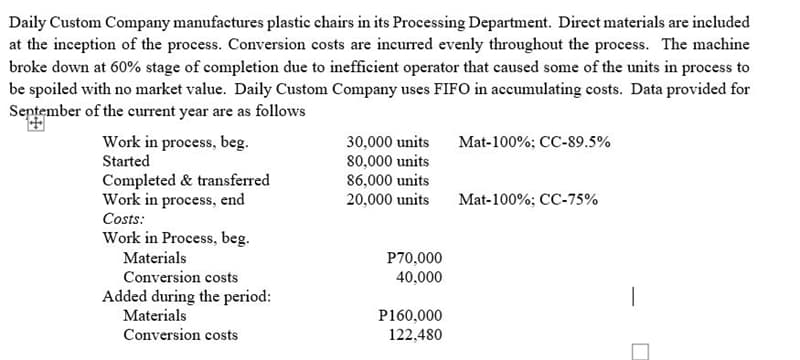

Transcribed Image Text:Daily Custom Company manufactures plastic chairs in its Processing Department. Direct materials are included

at the inception of the process. Conversion costs are incurred evenly throughout the process. The machine

broke down at 60% stage of completion due to inefficient operator that caused some of the units in process to

be spoiled with no market value. Daily Custom Company uses FIFO in accumulating costs. Data provided for

September of the current year are as follows

Work in process, beg.

30,000 units

80,000 units

86,000 units

Mat-100%; CC-89.5%

Started

Completed & transferred

Work in process, end

Costs:

20,000 units

Mat-100%; CC-75%

Work in Process, beg.

Materials

P70,000

Conversion costs

40,000

Added during the period:

Materials

Conversion costs

P160,000

122,480

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,