Cast Exercise Equipment, Inc. reported the following financial statements for 2024: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Read the requirements. Requirement 1. Compute the amount of Cast Exercise's acquisition of plant assets. Cast Exercise disposed of plant assets at book value. The cost and accumulated depreciation of the disposed asset was $43,400. No cash was received upon disposal. The acquisitions of plant assets amounts to Data table Cast Exercise Equipment, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Other Operating Expenses Total Operating Expenses Net Income Print $ 47,000 195,000 Done $ $ - X 716,000 346,000 370,000 242.000 128,000

Cast Exercise Equipment, Inc. reported the following financial statements for 2024: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Read the requirements. Requirement 1. Compute the amount of Cast Exercise's acquisition of plant assets. Cast Exercise disposed of plant assets at book value. The cost and accumulated depreciation of the disposed asset was $43,400. No cash was received upon disposal. The acquisitions of plant assets amounts to Data table Cast Exercise Equipment, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Other Operating Expenses Total Operating Expenses Net Income Print $ 47,000 195,000 Done $ $ - X 716,000 346,000 370,000 242.000 128,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 19P

Related questions

Question

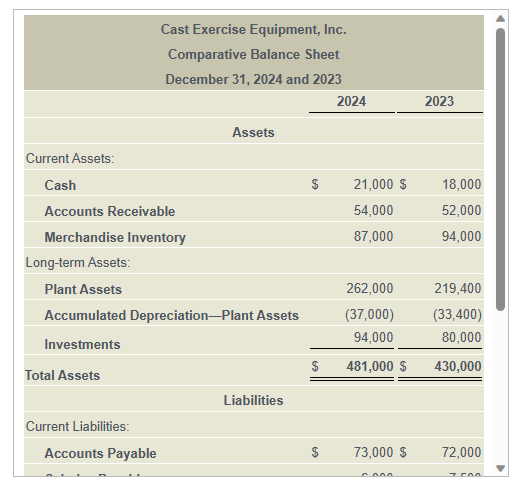

Transcribed Image Text:Current Assets:

Cash

Accounts Receivable

Merchandise Inventory

Long-term Assets:

Plant Assets

Total Assets

Cast Exercise Equipment, Inc.

Comparative Balance Sheet

December 31, 2024 and 2023

Accumulated Depreciation-Plant Assets

Investments

Current Liabilities:

Accounts Payable

Assets

Liabilities

$

CA

2024

21,000 $

54,000

87,000

262,000

(37,000)

94,000

481,000 $

73,000 $

2023

18,000

52,000

94,000

219,400

(33,400)

80,000

430,000

72,000

7.500

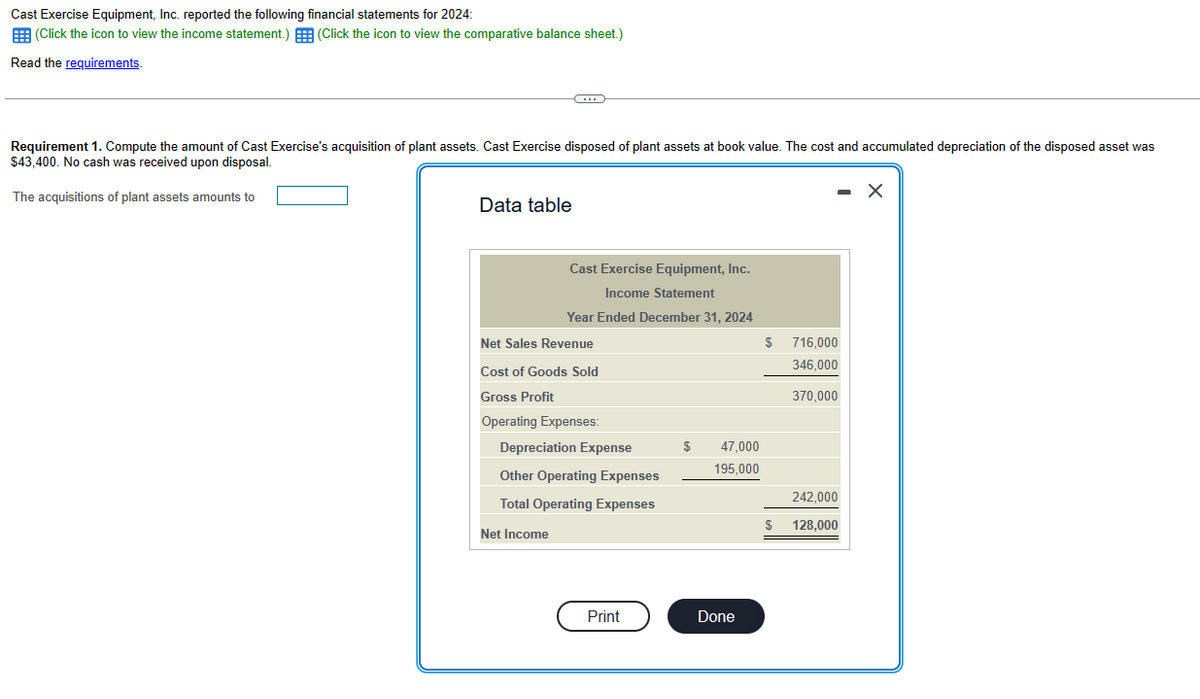

Transcribed Image Text:Cast Exercise Equipment, Inc. reported the following financial statements for 2024:

(Click the icon to view the income statement.)(Click the icon to view the comparative balance sheet.)

Read the requirements.

Requirement 1. Compute the amount of Cast Exercise's acquisition of plant assets. Cast Exercise disposed of plant assets at book value. The cost and accumulated depreciation of the disposed asset was

$43,400. No cash was received upon disposal.

The acquisitions of plant assets amounts to

Data table

C

Cast Exercise Equipment, Inc.

Income Statement

Year Ended December 31, 2024

Net Sales Revenue

Cost of Goods Sold

Gross Profit

Operating Expenses:

Net Income

Depreciation Expense

Other Operating Expenses

Total Operating Expenses

Print

$

47,000

195,000

Done

$

$

- X

716,000

346,000

370,000

242,000

128,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College