Ceidi was notified by its depository bank that P1 millión had been credited to his savings account because of a million-dollar remittance by her sister in the United States through a US bank. Ceidi lost no time in spending most of the money for various purposes, such as the purchase of luxurious condominium unit and a luxury car, money market placement, gifts to relatives, etc. It tumed out that Ceidi's sister remitted only $1,000 dollars and not $1 million. Statement 1: The erroneous remittance is taxable.: Ador issued a check drawn on a bank in which he has no funds. He negotiated the check and received P15,000 and immediately proceeded to the casino to try his luck but lost. Later, he was charged and convicted for violation of Batas Pambansa Bla 22

Ceidi was notified by its depository bank that P1 millión had been credited to his savings account because of a million-dollar remittance by her sister in the United States through a US bank. Ceidi lost no time in spending most of the money for various purposes, such as the purchase of luxurious condominium unit and a luxury car, money market placement, gifts to relatives, etc. It tumed out that Ceidi's sister remitted only $1,000 dollars and not $1 million. Statement 1: The erroneous remittance is taxable.: Ador issued a check drawn on a bank in which he has no funds. He negotiated the check and received P15,000 and immediately proceeded to the casino to try his luck but lost. Later, he was charged and convicted for violation of Batas Pambansa Bla 22

Business Its Legal Ethical & Global Environment

10th Edition

ISBN:9781305224414

Author:JENNINGS

Publisher:JENNINGS

Chapter7: International Law

Section: Chapter Questions

Problem 10QAP

Related questions

Question

100%

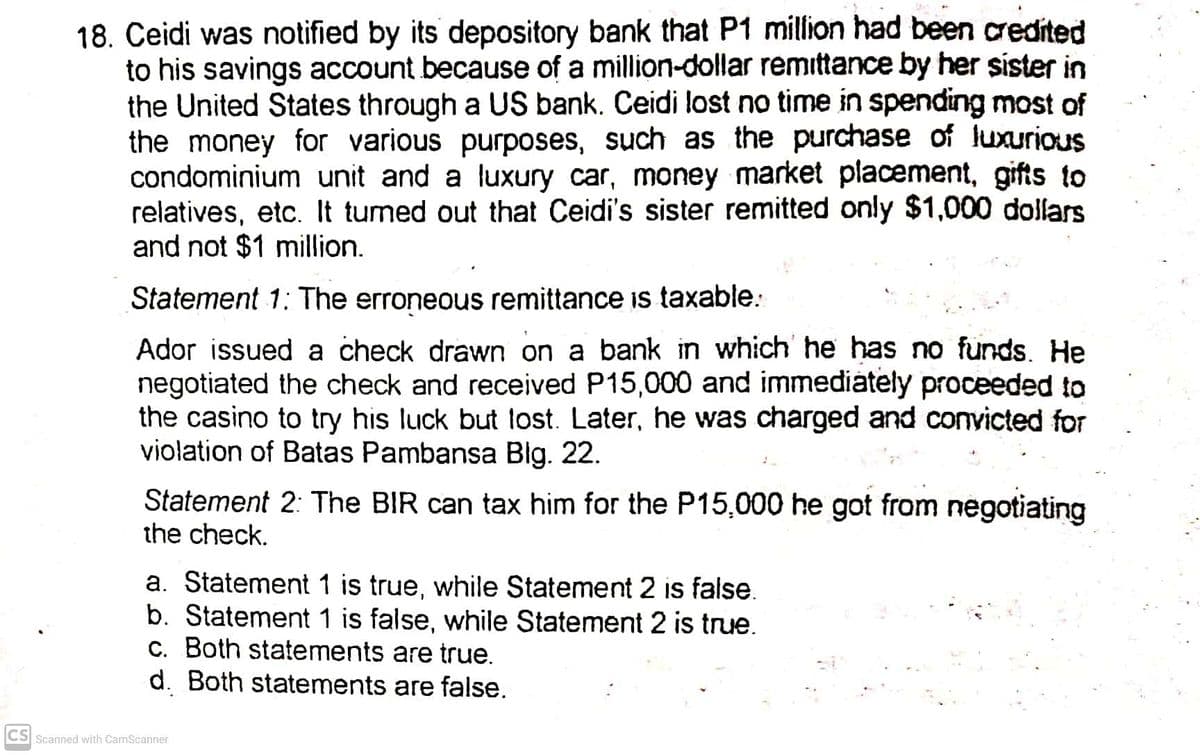

Transcribed Image Text:18. Ceidi was notified by its depository bank that P1 million had been credited

to his savings account because of a million-dollar remittance by her sister in

the United States through a US bank. Ceidi lost no time in spending most of

the money for various purposes, such as the purchase of luxurious

condominium unit and a luxury car, money market placement, gifts to

relatives, etc. It tumed out that Ceidi's sister remitted only $1,000 dollars

and not $1 million.

Statement 1: The erroneous remittance Is taxable:

Ador issued a check drawn on a bank in which he has no funds. He

negotiated the check and received P15,000 and immediátely proceeded to

the casino to try his luck but lost. Later, he was charged and convicted for

violation of Batas Pambansa Big. 22.

Statement 2: The BIR can tax him for the P15,000 he got from negotiating

the check.

a. Statement 1 is true, while Statement 2 is false.

b. Statement 1 is false, while Statement 2 is true.

c. Both statements are true.

d. Both statements are false.

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT