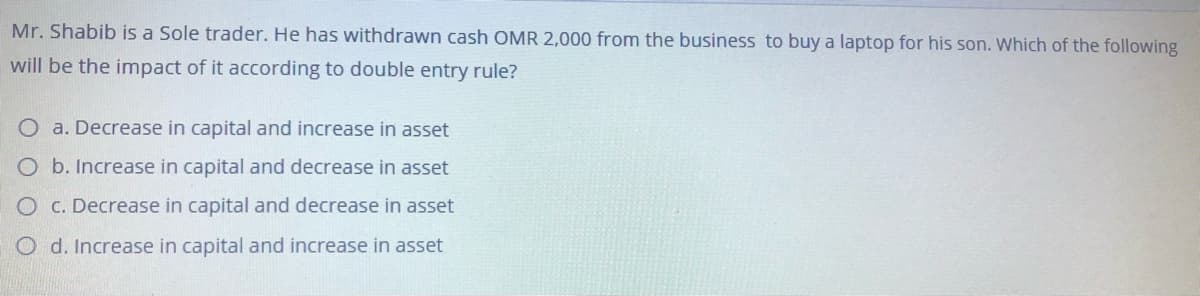

Mr. Shabib is a Sole trader. He has withdrawn cash OMR 2,000 from the business to buy a laptop for his son. Which of the following will be the impact of it according to double entry rule?

Q: Ceidi was notified by its depository bank that P1 millión had been credited to his savings account…

A: Here both situation was contradiction in part of the taxation affairs because in the first situation…

Q: Faith D. Nakpil started her accounting practice on November 3, 2021 by investing P138,000 cash and…

A: The initial capital if Faith will be fair value of assets & cash invested by her.

Q: This year William provided $4,200 of services to a large client on credit. Unfortunately, this…

A: Bad debt expenses are the amount of debtors which are not expected to be recovered. It is considered…

Q: Vicky is a physician who uses the cash method of accounting for tax purposes. During the current…

A: The cash method is a way of recording revenues and expenses based on cash, that is the revenue is…

Q: Kareem owns 100% of an apartment building in California but hasn't been there since he signed the…

A: Income is recognized by the person who earns it i.e. the company, partnership firm or individual…

Q: Nancy owns a small dress store. During 2015, Nancy gives business gifts having the indicated cost to…

A: Introduction: Business Gifts deduction: Deduction for gifts is allowed only for business purpose.…

Q: Prepare the trial balance as of 31st March 2021

A: Journal entries are the first entry which is made on every business transaction on the journal book…

Q: siness. While there, she spent 60% of the time on business and 40% on vacation. How much of the air…

A: Nicole can deduct the amount of airface that belongs to the business part only ,therefore in the…

Q: Joanna has an unpaid balance of $2500 on her account as of October 9, 2020. On October 15 and…

A: A credit card of an individual is a type of payment card that is used by individuals to make…

Q: How much is the estate tax?

A: The law states that one can withdraw the bank deposits of a deceased person after settling the…

Q: What is Ms. Eun’s reportable gross estate?

A: Gross estate is the value of all property at any time of a person at any time before any deductions…

Q: Jennifer uses the cash method. Which of the following transactions result in gross income in the…

A: If a business uses cash method, then the transaction is included in income only when it gets…

Q: The sole proprietor of the FM2 Financial Services, Bondo, receives all accounting profits earned by…

A: Economic Profit Economic Profit and accounting profit are different. The calculation of economic…

Q: 100 each son every month. En. Ereeman total income for the year of assessment 2020 was RM130,000.…

A: The tax payable is given as,

Q: Enrique Requiestas, resident citizen, widower, with a dependent minor brother, had the following…

A: The answer is stated below:

Q: Advise Clara Hammond and Never-Do-Well. w

A:

Q: Clara Hammond persuaded her daughter, Never-Do-Well to give up her secretarial work and read BSc…

A: As within the initial case, there was no legal agreement between Clara Hammond and her female…

Q: Barry is a self-employed attorney who travels to New York on a business trip during the year.…

A: Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Lokalalo knows that not all their customers will pay so they take out insurance for that purpose.…

A: Following is the answer to the given question

Q: Barry is a self-employed attorney who travels to New York on a business trip during the year.…

A: Taxation-Taxation means imposing a tax on individuals and different types of organizations. Which…

Q: Lokalalo knows that not all their customers will pay so they take out insurance for that purpose.…

A: Following is the answer to the given question

Q: Faith D. Nakpil started her accounting practice on November 3, 2021 by investing P145,000 cash and…

A: Initial Capital = Cash Contribution + Fair Value of Non monetary asset

Q: Clara Hammond persuaded her daughter, Never-Do-Well to give up her secretarial work and read BSc…

A: The area of law for the above case would contract law as there is some contractual agreement or…

Q: Vernon is left RM10,000 by his great aunt in his will. He puts RM4,000 into his own current account…

A: As per our protocol we provide solution to one question only but you have asked multiple questions…

Q: Samantha, who is single and has MAGI of $48,600, recently was employed by an accounting firm. During…

A: SOLUTION- REIMBURSEMENT IS MONEY PAID TO AN EMPLOYEE OR CUSTOMER OR ANY OTHER PARTY , AS A…

Q: A resident citizen died leaving a cash in bank in local domestic bank with face value of P1,000,000…

A: Law related to the question: According to Section 97 of the National Internal Revenue Code of 1997,…

Q: Candice, who is a sole trader, drives a small van from which she sells ice cream and drinks. Candice…

A: Reporting Entity : A Reporting Entity is an entity which is obliged to prepare financial statements…

Q: Scrooge is thinking of selling his money lending business. He has been the sole owner for 6 years…

A: Howey test was given by Supreme court whether transactions qualified as security.There were…

Q: Harry has just started a business with $500,000 of assets, funded by $300,000 of personal funds and…

A: Setting up the business as a private company, in this case, the return on equity is 100% as all the…

Q: leth Adriano, who plans to go abroad, is selling her mini-donut business. Her friend, Benita Solido…

A: Journal entry is the practice of recording commercial transactions for the first time in the books…

Q: For each of the following scenarios, determine if the event is included or excluded from gross…

A: As per protocol, we provide solution to the first 3-subparts only if the subparts are more than 3.…

Q: Mario is engaged in a pharmaceutical business. One day, Mario unnecessarily bought from Dario a…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Ken Lewin, a factory worker in Toronto, Ontario asks you to help him find out how much he is worth…

A: Accounting equation means the relation between the assets , liabilities and owner equity. Assets…

Q: st he joined 100,000 Prize received for achievement in literature (did not join the contest) 10,000…

A: The total final tax is given as,

Q: Alisha, a resident citizen residing in Singapore during his lifetime, left the following properties:…

A: Includes immovable , movable ,personal,scrips,etc. but does not includes any debt.

Q: How much would Xia and John recover from their accounts?

A: FDIC is the type of insurance which has been taken by the depositors of the banks so that they can…

Q: Sandra, a cash-basis taxpayer, operated a pet store on the cash method of accounting. She lent…

A: Bad Debt Expenses: Bad debt expenses are the uncollectable amount of sale of goods to the customer…

Q: Marco Brolo is one of three partners who own and operate Silkroad Partners, a global import– export…

A: 1. State whether the action of MB is ethical or not.The behavior of MB is unethical, because an S…

Q: Marco Brolo is one of three partners who own and operate Silkroad Partners, a global import–export…

A: Ethics means the behaviour of the individuals deciding what is right and wrong by them. It guides…

Q: m to sign an agreem

A: To find the correct option as,

Q: Jessica is a professional consultant. She agrees to consulting services for Joe for $2,000. After…

A: This question deals with the IFRS 15 " Revenue from contracts with customer". As per IFRS 15, When…

Q: Antonio supplies you the following information about his income and expenses for the financial year…

A:

Q: Marvin had the following transactions: Salary $50,000 Compensation of body injury due to…

A: Adjusted gross total income is calculated by subtracting the deductions for AGI or specified to be…

Q: Jack is a lawyer who is a member at Ocean Spray Country Club where he spends $7,200 in dues, $4,000…

A: Formula: Total expense = Business meals + Rotary club fees Sum of both business meals and rotary…

Q: Auchiel and Ben are working in patnership as accountants. Kuria gives auchiel ksh. 100,000 for…

A: Partnership: A partnership is a for-benefit business association included at least two people. State…

Q: Martin Manera is one of three partners who own and operate TaftWorld, a global import and export…

A: When a partner ship business is formed it should run with following with compliance of law and…

Q: On January 1st, 20X1, TK transfers the business liability insurance for the year 20X1 in the amount…

A: Here the question which are related with the effect of private nature transaction whether this was…

Q: during 2017, Regina, a sole proprietor, had the following income and expenses from herhome jewelry…

A: Schedule C is the form that is filled by sole proprietors. In this form, the amount of gains or…

Q: curred RM4,800 on entertaining business clie ng these four months. estic servant (reimbursed from…

A: As per taxation rules in Malaysia for salaried employees RM 5000 is exempt limit…

Step by step

Solved in 2 steps

- X had started business with $2,00,000 in the beginning of the year. During the year, he borrowed $1,00,000 from Y. He further introduced $2,00,000 in the business. He also gave $50,000 as loan to his son. Goods given away as charity by him were $20,000. Profits earned by him were $2,50,000. He also withdraw $30,000 from the business. His capital at the end of the year would be__________.P is a sole proprietor whose accounting records are incomplete. All the sales are cash sales and during the year $50,000 was banked, including $5,000 from the sale of a business car. He paid $12,000 wages in cash from the till and withdrew $2,000 per month as drawings. The cash in the till at the beginning and end of the year was $300 and $400 respectively. What was the value of P’s sales revenue for the year? A $80,900 B $81,000 C $81,100 D $86,100Direction: Read the following case study and answer the question: During the period, the business acquires an equipment costing P150,000 in cash. The owner of the business is questioning why you as his accountant, did not include the P150,000 equipment as one of the items of operating expense in the income statement which resulted in a higher income tax of the business?

- Mark Waugh starts business. Before any sales, he has purchased fixtures $12,000, motor vehicle $30,000 and stock of goods $21,000. Although he has paid in full for the fixtures and motor vehicle, he still owes $8,400 for some of the stock. His brother Steve has lent him $18,000. Mark, after the above, has $16,800 in the business bank account and $600 cash in hand. Calculate Mark’s capital?Faith D. Nakpil started her accounting practice on November 3, 2021 by investing P138,000 cash and her old laptop with an original cost of P64,000 but with a fair value of P31,000 at the time of investment. How much was the initial capital of Faith?Fae and Carley had a tech business. After two unprofitable years, the business closed. At that point, the liabilities of the business were $100,000 larger than its assets. Under each separate situation, how much money (if any) can creditors take from Carley’s personal assets to pay the unpaid business debts? a. The business is set up as a limited liability company (LLC). b. The business is set up as an S corporation.

- Ferris Wheeler is a trader in entertainment services. The business reported a net loss of $18,800 for the year 2012. At the start of the year the owners equity was $378,800, and at the end of the year the equity was $330,000. During the year the owner took goods valued at $10,000 as well as cash for personal use. What is the amount of cash drawings for the year? a. $57,600 b. $47,600 c. $30,000 d. $20,000 The Quaker Valley operates travel service The following is a schedule of its non current assets for 2021 Asset Book Value Jan 1 Book Value Dec 31 Property Pant and Equipment $3, 450,000 $3,850,000 Motor Vehicle $2,700,000 $3,300,000 It was reported that an old equipment with a…David Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the following account balances as of December 31, 2020: Cash Equipment Accum.Deprec.Equipment AccountsPayable NotesPayable DavidWallace,Capital OlenaDunn,Capital DannyLin,Capital Account balances December 31, 2020 $ 40,300 $ 191,000 $ 102,000 $ 8,300 $ 25,000 $ 44,000 $ 27,000 $ 25,000 Due to several unprofitable periods, the partners decided to liquidate the partnership. The equipment was sold for $69,000 on January 1, 2021. The partners share any profit (loss) in the ratio of 2:1:1 for Wallace, Dunn, and Lin, respectively. The Schedule is complete, however, I'm struggling with the journal entries. I attached images of the completed schedule to assist with the journal entries. 2. Prepare the liquidation entries (sale of equipment, allocation of gain/loss, payment of creditors, final distribution of cash). 1 Record the sale…David Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the following account balances as of December 31, 2020: Cash Equipment Accum.Deprec.Equipment AccountsPayable NotesPayable DavidWallace,Capital OlenaDunn,Capital DannyLin,Capital Account balances December 31, 2020 $ 40,300 $ 191,000 $ 102,000 $ 8,300 $ 25,000 $ 44,000 $ 27,000 $ 25,000 Due to several unprofitable periods, the partners decided to liquidate the partnership. The equipment was sold for $69,000 on January 1, 2021. The partners share any profit (loss) in the ratio of 2:1:1 for Wallace, Dunn, and Lin, respectively.Required:1. Complete the schedule. (Negative answers should be indicated by a minus sign.) Cash Equipment Accum. deprec. Equipment Accounts Pay. Notes Pay. David Wallace, Capital Olena Dunn, Capital Danny Lin, Capital Account balance, December 31, 2020 $40,300 $191,000 $102,000 $8,300 $25,000 $44,000…

- David Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the following account balances as of December 31, 2020: Cash Equipment Accum.Deprec.Equipment AccountsPayable NotesPayable DavidWallace,Capital OlenaDunn,Capital DannyLin,Capital Account balances December 31, 2020 $ 40,300 $ 191,000 $ 102,000 $ 8,300 $ 25,000 $ 44,000 $ 27,000 $ 25,000 Due to several unprofitable periods, the partners decided to liquidate the partnership. The equipment was sold for $69,000 on January 1, 2021. The partners share any profit (loss) in the ratio of 2:1:1 for Wallace, Dunn, and Lin, respectively.Required:1. Complete the schedule. (Negative answers should be indicated by a minus sign.)Tom, a cash basis sole proprietor, provides the following information: Gross receipts $30,000 Dividend income (on personal investments) 200 Cost of sales 15,400 Other operating expenses 3,000 State business taxes paid 300 What amount should Tom report as net profits from his business? a.$11,400 b.$10,900 c.$11,300 d.$14,400 e.None of these choices are correct.What is the creditor and debtor in these transactions? 10 – 4 – 2021Mr. Salman invested additional Capital 15,000 to develop his business.18 – 4 – 2021He purchased Phones from Mina Phones for RO 10,000 out of which 60% paid in cash and 40% on credit. (Credit Invoice No. B1)22 – 4 – 2021The owner sold phones to Grand Phones for RO 12,000 (Credit Invoice No.1)25 – 4 – 2021The business returned RO 2,000 worth of phones27 - 4 – 2021Mr. Salman received an invoice for RO 500 from Akbar Travels.This invoice includes RO 200 towards Ticket expense RO 300 towards Dubai trip undertaken by him. (Invoice No. AB1) Term : 10 days29 – 4 – 2021Grand Phones returned RO 800 worth of phones30 – 4 – 2021The owner received cash from Grand phones RO 11,150 in full settlement of their account.