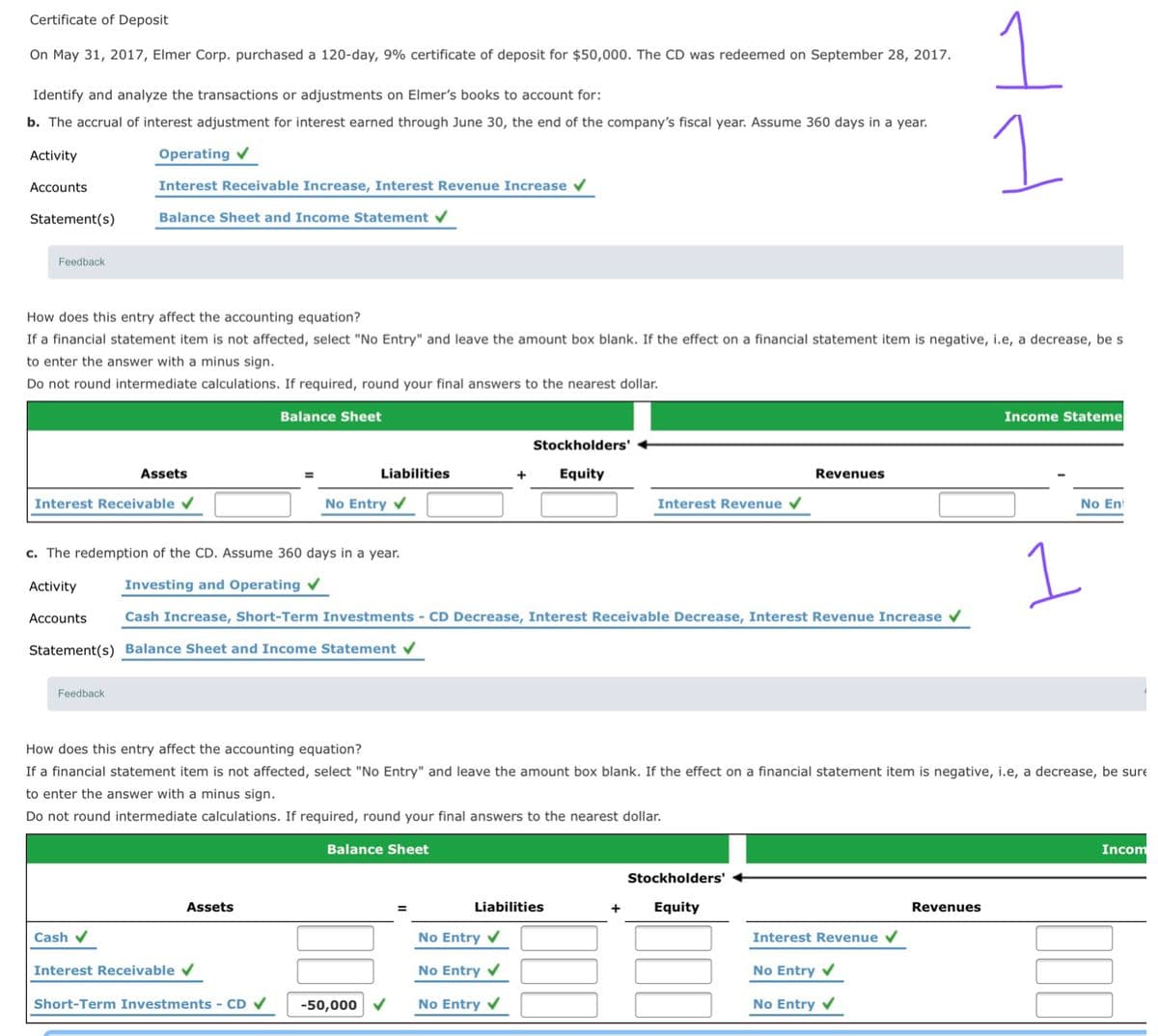

Certificate of Deposit On May 31, 2017, Elmer Corp. purchased a 120-day, 9% certificate of deposit for $50,000. The CD was redeemed on September 28, 2017. Identify and analyze the transactions or adjustments on Elmer's books to account for: b. The accrual of interest adjustment for interest earned through June 30, the end of the company's fiscal year. Assume 360 days in a year. Activity Operating v Accounts Interest Receivable Increase, Interest Revenue Increase v Statement(s) Balance Sheet and Income Statement v Feedback How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be s to enter the answer with a minus sign. Do not round intermediate calculations. If required, round your final answers to the nearest dollar.

Certificate of Deposit On May 31, 2017, Elmer Corp. purchased a 120-day, 9% certificate of deposit for $50,000. The CD was redeemed on September 28, 2017. Identify and analyze the transactions or adjustments on Elmer's books to account for: b. The accrual of interest adjustment for interest earned through June 30, the end of the company's fiscal year. Assume 360 days in a year. Activity Operating v Accounts Interest Receivable Increase, Interest Revenue Increase v Statement(s) Balance Sheet and Income Statement v Feedback How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be s to enter the answer with a minus sign. Do not round intermediate calculations. If required, round your final answers to the nearest dollar.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 92PSA

Related questions

Question

100%

Need help with attached problems. Thank you.

Transcribed Image Text:Certificate of Deposit

On May 31, 2017, Elmer Corp. purchased a 120-day, 9% certificate of deposit for $50,000. The CD was redeemed on September 28, 2017.

Identify and analyze the transactions or adjustments on Elmer's books to account for:

b. The accrual of interest adjustment for interest earned through June 30, the end of the company's fiscal year. Assume 360 days in a year.

Activity

Operating v

Accounts

Interest Receivable Increase, Interest Revenue Increase v

Statement(s)

Balance Sheet and Income Statement

Feedback

How does this entry affect the accounting equation?

If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be s

to enter the answer with a minus sign.

Do not round intermediate calculations. If required, round your final answers to the nearest dollar.

Balance Sheet

Income Stateme

Stockholders'

Assets

Liabilities

+

Equity

Revenues

Interest Receivable

No Entry v

Interest Revenue

No Ent

1

c. The redemption of the CD. Assume 360 days in a year.

Activity

Investing and Operating

Accounts

Cash Increase, Short-Term Investments - CD Decrease, Interest Receivable Decrease, Interest Revenue Increase

Statement(s) Balance Sheet and Income Statement v

Feedback

How does this entry affect the accounting equation?

If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure

to enter the answer with a minus sign.

Do not round intermediate calculations. If required, round your final answers to the nearest dollar.

Balance Sheet

Incom

Stockholders'

Assets

Liabilities

+

Equity

Revenues

=

Cash v

No Entry v

Interest Revenue v

Interest Receivable v

No Entry v

No Entry v

Short-Term Investments - CD V

-50,000 V

No Entry v

No Entry v

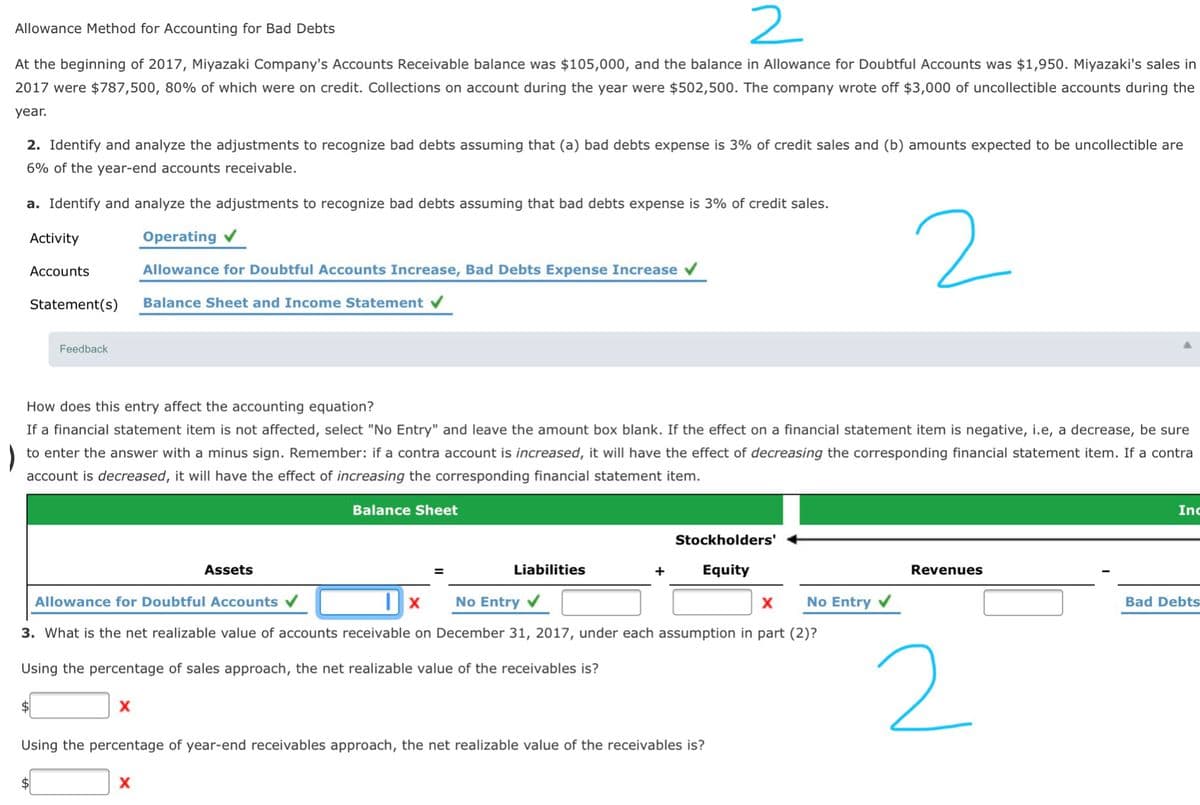

Transcribed Image Text:Allowance Method for Accounting for Bad Debts

At the beginning of 2017, Miyazaki Company's Accounts Receivable balance was $105,000, and the balance in Allowance for Doubtful Accounts was $1,950. Miyazaki's sales in

2017 were $787,500, 80% of which were on credit. Collections on account during the year were $502,500. The company wrote off $3,000 of uncollectible accounts during the

year.

2. Identify and analyze the adjustments to recognize bad debts assuming that (a) bad debts expense is 3% of credit sales and (b) amounts expected to be uncollectible are

6% of the year-end accounts receivable.

a. Identify and analyze the adjustments to recognize bad debts assuming that bad debts expense is 3% of credit sales.

2

Activity

Operating v

Accounts

Allowance for Doubtful Accounts Increase, Bad Debts Expense Increase

Statement(s)

Balance Sheet and Income Statement v

Feedback

How does this entry affect the accounting equation?

If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure

to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. If a contra

account is decreased, it will have the effect of increasing the corresponding financial statement item.

Balance Sheet

Inc

Stockholders'

Assets

Liabilities

+

Equity

Revenues

Allowance for Doubtful Accounts

No Entry v

No Entry v

Bad Debts

3. What is the net realizable value of accounts receivable on December 31, 2017, under each assumption in part (2)?

2

Using the percentage of sales approach, the net realizable value of the receivables is?

$

Using the percentage of year-end receivables approach, the net realizable value of the receivables is?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College