Ch 13-3 Exercises & Problems EPS Junkyard Arts, Inc., had earnings of $300,600 for the year. The company had 32,000 shares of common stock outstanding during the year and issued 1,800 shares of $150o par value preferred stock. The preferred stock has a dividend of $7 per share. There were no transactions in either common or preferred stock during the year. Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places. per share

Ch 13-3 Exercises & Problems EPS Junkyard Arts, Inc., had earnings of $300,600 for the year. The company had 32,000 shares of common stock outstanding during the year and issued 1,800 shares of $150o par value preferred stock. The preferred stock has a dividend of $7 per share. There were no transactions in either common or preferred stock during the year. Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places. per share

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4BE: Entries for stock dividends Alpine Energy Corporation has 1,500,000 shares of 40 par common stock...

Related questions

Question

How would i go about solving this problem?

Transcribed Image Text:Ch 13-3 Exercises & Problems

EPS

Junkyard Arts, Inc., had earnings of $300,600 for the year. The company had 32,000 shares of common stock outstanding during the year and issued 1,800

shares of $150o par value preferred stock. The preferred stock has a dividend of $7 per share. There were no transactions in either common or preferred stock

during the year.

Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places.

per share

Expert Solution

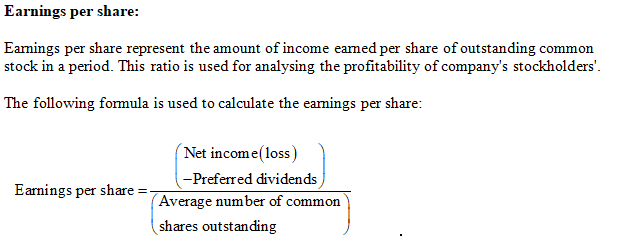

Defintion

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning