Problem 11-26A (Algo) Recording and reporting stock transactions and cash dividends across two accounting cycles LO 11-3, 11-6 [The following Information applles to the questions displayed below] Sun Corporation recelved a charter that authorized the Issuance of 85,000 shares of $6 par common stock and 22,000 shares of $100 par, 4 percent cumulative preferred stock. Sun Corporation completed the following transactions during Its first two years of operation. Year 1 Jan. 5 Sold 12,750 shares of the $6 par common stock for $8 per share. 12 Sold 2,200 shares of the 4 percent preferred stock for $11e per share. Apr. 5 Sold 17,ee0 shares of the $6 par common stock for $10 per share. Dec. 31 During the year, earned $311,900 in cash revenue and paid $238,400 for cash operating expenses. 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. Year 2 Feb.15 Paid the cash dividend declared on December 31, Year 1. Mar. 3 Sold 3, 300 shares of the $100 par preferred stock for $120 per share. May. 5 Purchased see shares of the common stock as treasury stock at $12 per share. Dec.31 During the year, earned $248,400 in cash revenues and paid $175, eee for cash operating expenses. 31 Declared the annual dividend on the preferred stock and a se.se per share dividend on the common stock.

Problem 11-26A (Algo) Recording and reporting stock transactions and cash dividends across two accounting cycles LO 11-3, 11-6 [The following Information applles to the questions displayed below] Sun Corporation recelved a charter that authorized the Issuance of 85,000 shares of $6 par common stock and 22,000 shares of $100 par, 4 percent cumulative preferred stock. Sun Corporation completed the following transactions during Its first two years of operation. Year 1 Jan. 5 Sold 12,750 shares of the $6 par common stock for $8 per share. 12 Sold 2,200 shares of the 4 percent preferred stock for $11e per share. Apr. 5 Sold 17,ee0 shares of the $6 par common stock for $10 per share. Dec. 31 During the year, earned $311,900 in cash revenue and paid $238,400 for cash operating expenses. 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. Year 2 Feb.15 Paid the cash dividend declared on December 31, Year 1. Mar. 3 Sold 3, 300 shares of the $100 par preferred stock for $120 per share. May. 5 Purchased see shares of the common stock as treasury stock at $12 per share. Dec.31 During the year, earned $248,400 in cash revenues and paid $175, eee for cash operating expenses. 31 Declared the annual dividend on the preferred stock and a se.se per share dividend on the common stock.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 7SPB: STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Dans Hobby Stores had the following...

Related questions

Question

![Requlred Informatlon

Problem 11-26A (Algo) Recording and reporting stock transactions and cash dividends across two

accounting cycles LO 11-3, 11-6

[The following Information applies to the questions displayed below.]

Sun Corporation recelved a charter that authorized the Issuance of 85,000 shares of S6 par common stock and 22,000

shares of $100 par, 4 percent cumulative preferred stock. Sun Corporation completed the following transactions during Its

first two years of operation.

Year 1

Jan. 5 Sold 12,750 shares of the $6 par common stock for $8 per share.

12 Sold 2,20e shares of the 4 percent preferred stock for $110 per share.

Apr. 5 Sold 17,000 shares of the $6 par common stock for $18 per share.

Dec. 31 During the year, earned $311,980 in cash revenue and paid $238,400 for cash operating expenses.

31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid

on February 15 to stockholders of record on January 10, Year 2.

Year 2

Feb.15 Paid the cash dividend declared on December 31, Year 1.

Mar. 3 Sold 3,300 shares of the $10e par preferred stock for $120 per share.

May. 5 Purchased 500 shares of the common stock as treasury stock at $12 per share.

Dec.31 During the year, earned $248,480 in cash revenues and paid $175,000 for cash operating expenses.

31 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F5d5c8c92-5a65-47bc-9859-d57ea08ed644%2F04a4e088-5463-4791-9427-7d31e81c2db8%2Fz2llq4_processed.png&w=3840&q=75)

Transcribed Image Text:Requlred Informatlon

Problem 11-26A (Algo) Recording and reporting stock transactions and cash dividends across two

accounting cycles LO 11-3, 11-6

[The following Information applies to the questions displayed below.]

Sun Corporation recelved a charter that authorized the Issuance of 85,000 shares of S6 par common stock and 22,000

shares of $100 par, 4 percent cumulative preferred stock. Sun Corporation completed the following transactions during Its

first two years of operation.

Year 1

Jan. 5 Sold 12,750 shares of the $6 par common stock for $8 per share.

12 Sold 2,20e shares of the 4 percent preferred stock for $110 per share.

Apr. 5 Sold 17,000 shares of the $6 par common stock for $18 per share.

Dec. 31 During the year, earned $311,980 in cash revenue and paid $238,400 for cash operating expenses.

31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid

on February 15 to stockholders of record on January 10, Year 2.

Year 2

Feb.15 Paid the cash dividend declared on December 31, Year 1.

Mar. 3 Sold 3,300 shares of the $10e par preferred stock for $120 per share.

May. 5 Purchased 500 shares of the common stock as treasury stock at $12 per share.

Dec.31 During the year, earned $248,480 in cash revenues and paid $175,000 for cash operating expenses.

31 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock.

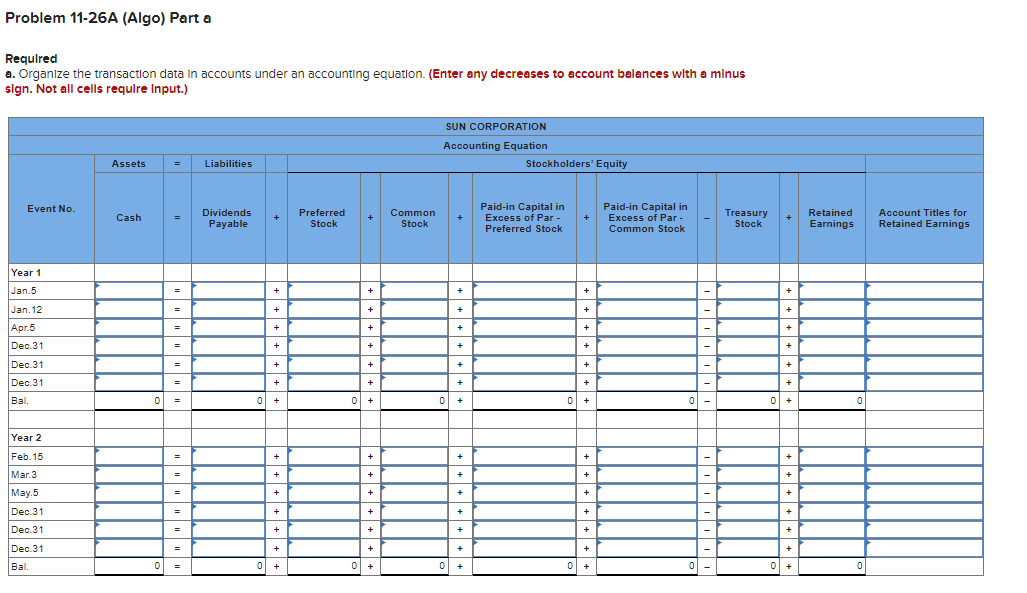

Transcribed Image Text:Problem 11-26A (Algo) Part a

Requlred

a. Organize the transaction data In accounts under an accounting equation. (Enter any decreases to account balances with a minus

slgn. Not all cells requlre Input.)

SUN CORPORATION

Accounting Equation

Assets

Liabilities

Stockholders' Equity

Paid-in Capital in

Excess of Par -

Paid-in Capital in

Excess of Par -

Event No.

Dividends

Preferred

Common

Stock

Treasury

Stock

Retained

Earnings

Account Titles for

Cash

+

+

Payable

Stock

Preferred Stock

Common Stock

Retained Earnings

Year 1

Jan.5

+

+

+

+

Jan. 12

+

+

+

+

Apr.5

+

+

+

+

Dec.31

=

+

+

+

Dec.31

+

+

+

Dec.31

+

+

Bal.

+

ol +

+

Year 2

Feb. 15

+

Mar.3

+

May.5

+

+

=

+

+

+

Dec.31

+

+

+

+

Dec.31

+

+

+

+

Dec.31

+

+

+

Bal.

+

+

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage