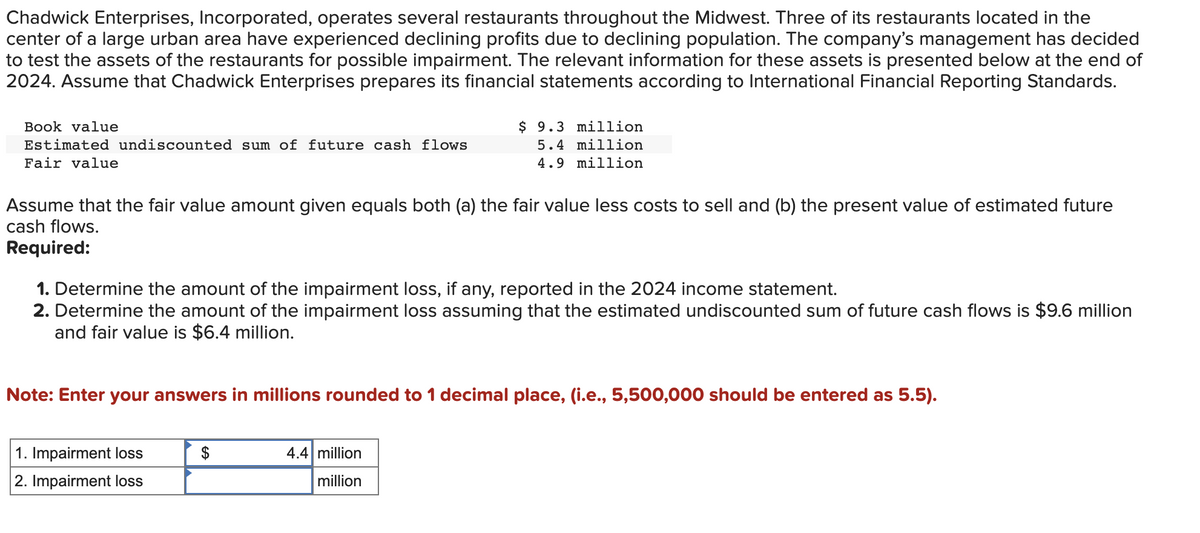

Chadwick Enterprises, Incorporated, operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company's management has decided to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below at the end of 2024. Assume that Chadwick Enterprises prepares its financial statements according to International Financial Reporting Standards. Book value Estimated undiscounted sum of future cash flows Fair value Assume that the fair value amount given equals both (a) the fair value less costs to sell and (b) the present value of estimated future cash flows. Required: 1. Determine the amount of the impairment loss, if any, reported in the 2024 income statement. 2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $9.6 million and fair value is $6.4 million. $9.3 million 5.4 million 4.9 million Note: Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). 1. Impairment loss 2. Impairment loss $ 4.4 million million

Chadwick Enterprises, Incorporated, operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company's management has decided to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below at the end of 2024. Assume that Chadwick Enterprises prepares its financial statements according to International Financial Reporting Standards. Book value Estimated undiscounted sum of future cash flows Fair value Assume that the fair value amount given equals both (a) the fair value less costs to sell and (b) the present value of estimated future cash flows. Required: 1. Determine the amount of the impairment loss, if any, reported in the 2024 income statement. 2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $9.6 million and fair value is $6.4 million. $9.3 million 5.4 million 4.9 million Note: Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). 1. Impairment loss 2. Impairment loss $ 4.4 million million

Chapter25: Taxation Of International Transactions

Section: Chapter Questions

Problem 26P

Related questions

Question

Please help me

Transcribed Image Text:Chadwick Enterprises, Incorporated, operates several restaurants throughout the Midwest. Three of its restaurants located in the

center of a large urban area have experienced declining profits due to declining population. The company's management has decided

to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below at the end of

2024. Assume that Chadwick Enterprises prepares its financial statements according to International Financial Reporting Standards.

Book value

Estimated undiscounted sum of future cash flows

Fair value

Assume that the fair value amount given equals both (a) the fair value less costs to sell and (b) the present value of estimated future

cash flows.

Required:

1. Determine the amount of the impairment loss, if any, reported in the 2024 income statement.

2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $9.6 million

and fair value is $6.4 million.

$ 9.3 million

5.4 million

4.9 million

Note: Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).

1. Impairment loss

2. Impairment loss

$

4.4 million

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning