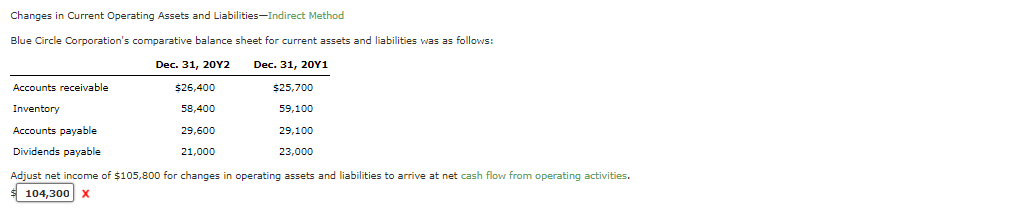

Changes in Current Operating Assets and Liabilities-Indirect Method Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $26,400 $25,700 Inventory 58,400 59,100 Accounts payable 29,600 29,100 Dividends payable 21,000 23,000 Adjust net income of $105,800 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. 104,300 X

Cash flow statement provided information about the cash inflows and cash outflows of the company.

Cash flow statement consists of three activities: Operating activities, investing activities and Financing activities.

Cash flow from operating activities is computed by direct method or indirect method.

Under indirect method, cash flow from operating activities is computed by adjusting the net income to non-cash expenses and changes in current assets and current liabilities.

Increase in operating current assets should be deducted from net income and decrease in operating current assets should be added to net income.

Increase in operating current liabilities should be added to the net income and decrease in operating current liabilities should be deducted from the net income.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images