Chapter 05 HomewoP Land held as investment property 175,000 Goodwill 80,000 Cash surrender value of life insurance policy Prepaid expenses Accounts payable 90,000 12,000 135,000 Notes payable 125,000 Pension obligation Income tax payable Premium on bonds payable 82,000 49,000 53,000 Bonds payable 500,000 Deferred tax asset 5,000 Common stock 290,000 Paid-in capital in excess of par value 160,000 Retained earnings 784,000 Accumulated other comprehensive loss 15,000 Total $ 2,500,000 $ 2,500,000 Additional information: 1. At year-end, the fair value of available-for-sale securities is $120,000. 2. At year-end, the net realizable value of inventory is $408,000. 3. There are 400,000 shares of $1 par value common stock authorized and 290,000 shares issued and outstanding. 4. Notes payable is due next year. 5. The bonds payable are due in 3 years. Instructions: Prepare a classified balance sheet.

Chapter 05 HomewoP Land held as investment property 175,000 Goodwill 80,000 Cash surrender value of life insurance policy Prepaid expenses Accounts payable 90,000 12,000 135,000 Notes payable 125,000 Pension obligation Income tax payable Premium on bonds payable 82,000 49,000 53,000 Bonds payable 500,000 Deferred tax asset 5,000 Common stock 290,000 Paid-in capital in excess of par value 160,000 Retained earnings 784,000 Accumulated other comprehensive loss 15,000 Total $ 2,500,000 $ 2,500,000 Additional information: 1. At year-end, the fair value of available-for-sale securities is $120,000. 2. At year-end, the net realizable value of inventory is $408,000. 3. There are 400,000 shares of $1 par value common stock authorized and 290,000 shares issued and outstanding. 4. Notes payable is due next year. 5. The bonds payable are due in 3 years. Instructions: Prepare a classified balance sheet.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 19E

Related questions

Question

Please answer competely and properly

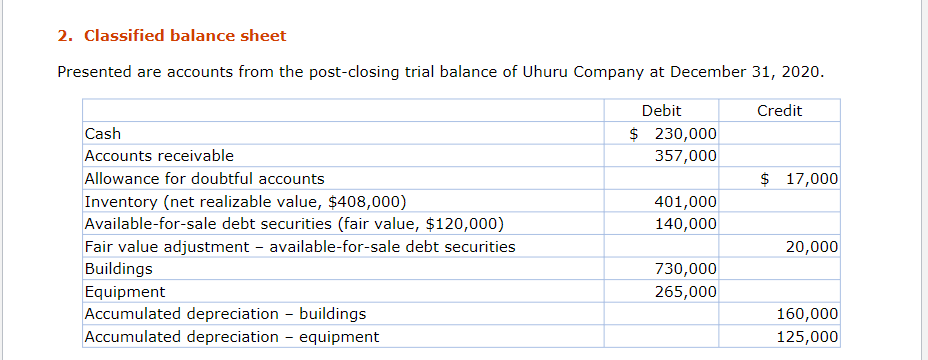

Transcribed Image Text:2. Classified balance sheet

Presented are accounts from the post-closing trial balance of Uhuru Company at December 31, 2020.

Debit

Credit

Cash

$ 230,000

Accounts receivable

357,000

Allowance for doubtful accounts

$ 17,000

Inventory (net realizable value, $408,000)

Available-for-sale debt securities (fair value, $120,000)

401,000

140,000

Fair value adjustment - available-for-sale debt securities

20,000

Buildings

730,000

Equipment

Accumulated depreciation - buildings

Accumulated depreciation - equipment

265,000

160,000

125,000

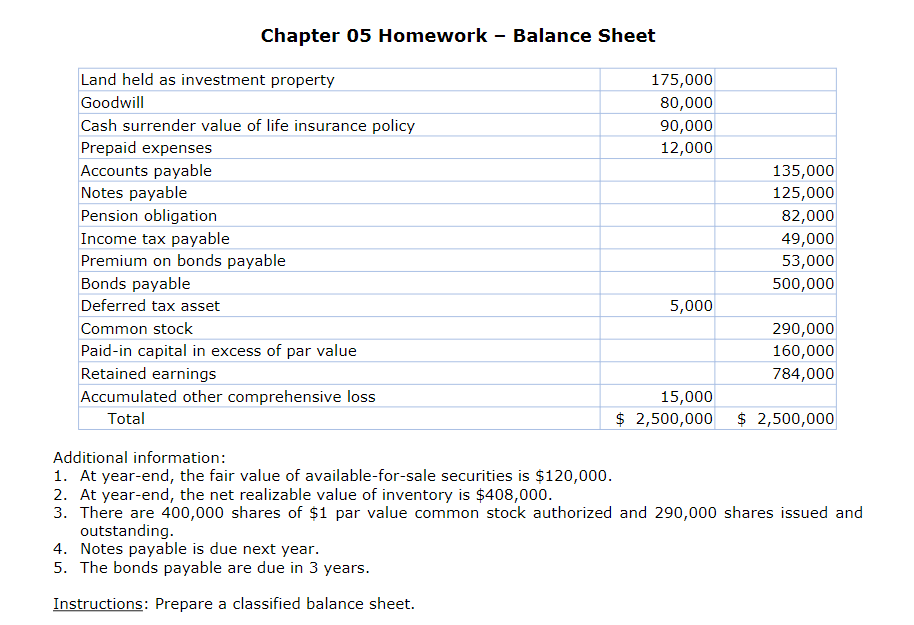

Transcribed Image Text:Chapter 05 Homework - Balance Sheet

Land held as investment property

175,000

Goodwill

80,000

Cash surrender value of life insurance policy

Prepaid expenses

90,000

12,000

Accounts payable

Notes payable

135,000

125,000

Pension obligation

Income tax payable

82,000

49,000

Premium on bonds payable

53,000

Bonds payable

500,000

Deferred tax asset

5,000

Common stock

290,000

Paid-in capital in excess of par value

160,000

Retained earnings

Accumulated other comprehensive loss

784,000

15,000

Total

$ 2,500,000

$ 2,500,000

Additional information:

1. At year-end, the fair value of available-for-sale securities is $120,000.

2. At year-end, the net realizable value of inventory is $408,000.

3. There are 400,000 shares of $1 par value common stock authorized and 290,000 shares issued and

outstanding.

4. Notes payable is due next year.

5. The bonds payable are due in 3 years.

Instructions: Prepare a classified balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning