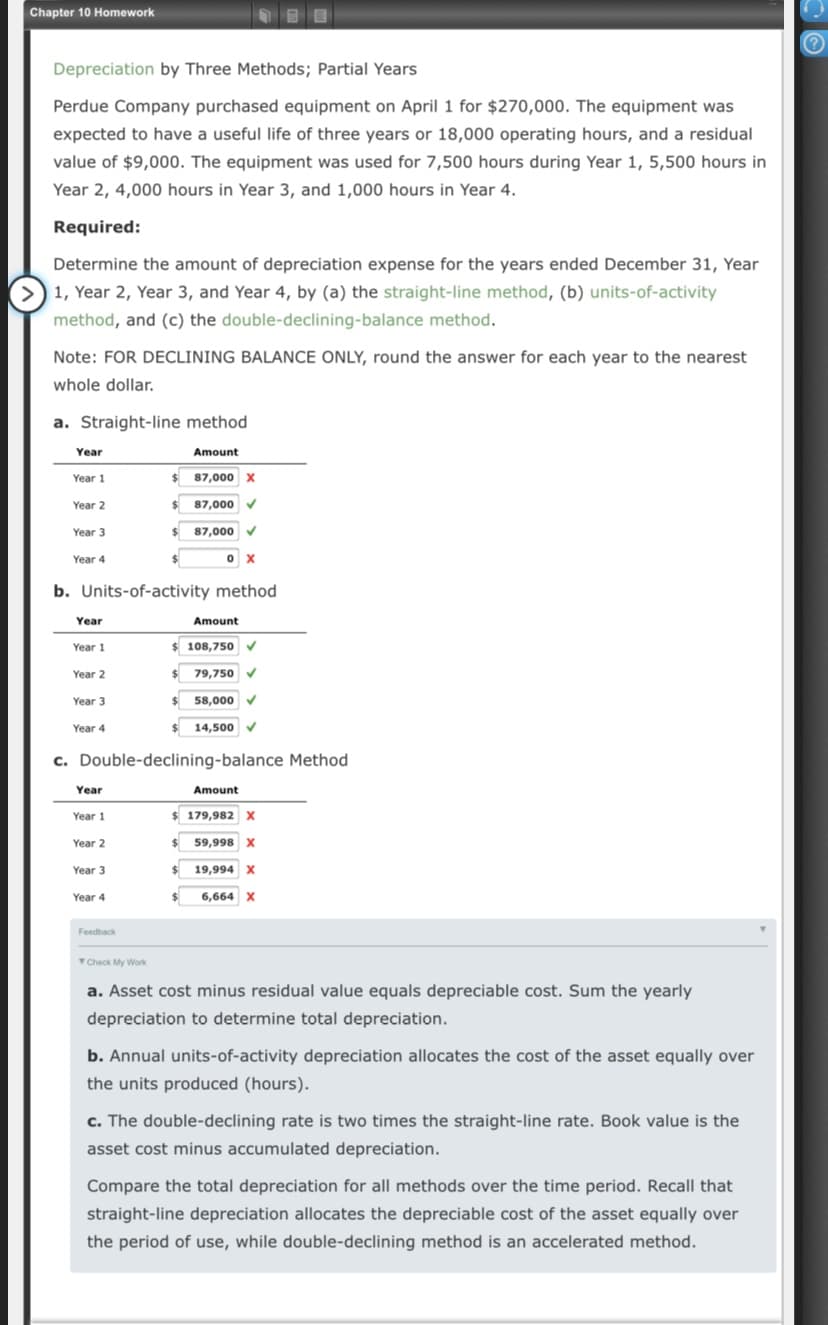

Chapter 10 Homework Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $270,000. The equipment was expected to have a useful life of three years or 18,000 operating hours, and a residual value of $9,000. The equipment was used for 7,500 hours during Year 1, 5,500 hours in Year 2, 4,000 hours in Year 3, and 1,000 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 87,000 X Year 2 %24 87,000 Year 3 87,000 Year 4 b. Units-of-activity method Year Amount Year 1 $ 108,750 Year 2 79,750 V Year 3 58,000 Year 4 14,500 c. Double-declining-balance Method Year Amount Year 1 $ 179,982 x Year 2 %24 59,998 X Year 3 %24 19,994 Year 4 6,664 Feedback Check My Work a. Asset cost minus residual value equals depreciable cost. Sum the yearly depreciation to determine total depreciation. b. Annual units-of-activity depreciation allocates the cost of the asset equally over the units produced (hours). c. The double-declining rate is two times the straight-line rate. Book value is the asset cost minus accumulated depreciation. Compare the total depreciation for all methods over the time period. Recall that straight-line depreciation allocates the depreciable cost of the asset equally over the period of use, while double-declining method is an accelerated method.

Chapter 10 Homework Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $270,000. The equipment was expected to have a useful life of three years or 18,000 operating hours, and a residual value of $9,000. The equipment was used for 7,500 hours during Year 1, 5,500 hours in Year 2, 4,000 hours in Year 3, and 1,000 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 87,000 X Year 2 %24 87,000 Year 3 87,000 Year 4 b. Units-of-activity method Year Amount Year 1 $ 108,750 Year 2 79,750 V Year 3 58,000 Year 4 14,500 c. Double-declining-balance Method Year Amount Year 1 $ 179,982 x Year 2 %24 59,998 X Year 3 %24 19,994 Year 4 6,664 Feedback Check My Work a. Asset cost minus residual value equals depreciable cost. Sum the yearly depreciation to determine total depreciation. b. Annual units-of-activity depreciation allocates the cost of the asset equally over the units produced (hours). c. The double-declining rate is two times the straight-line rate. Book value is the asset cost minus accumulated depreciation. Compare the total depreciation for all methods over the time period. Recall that straight-line depreciation allocates the depreciable cost of the asset equally over the period of use, while double-declining method is an accelerated method.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 20E: (Appendix 11.1) Depreciation for Financial Statements and Income Tax Purposes Dinkle Company...

Related questions

Question

About half of the answers I get back from this website are incorrect. Here are the answers I was given. I need the correct answers instead. I shouldn't have to use up more questions just to get the right answer.

Transcribed Image Text:Chapter 10 Homework

Depreciation by Three Methods; Partial Years

Perdue Company purchased equipment on April 1 for $270,000. The equipment was

expected to have a useful life of three years or 18,000 operating hours, and a residual

value of $9,000. The equipment was used for 7,500 hours during Year 1, 5,500 hours in

Year 2, 4,000 hours in Year 3, and 1,000 hours in Year 4.

Required:

Determine the amount of depreciation expense for the years ended December 31, Year

1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity

method, and (c) the double-declining-balance method.

Note: FOR DECLINING BALANCE ONLY, round the answer for each year to the nearest

whole dollar.

a. Straight-line method

Year

Amount

Year 1

87,000 X

Year 2

%24

87,000

Year 3

87,000

Year 4

b. Units-of-activity method

Year

Amount

Year 1

$ 108,750

Year 2

79,750 V

Year 3

58,000

Year 4

14,500

c. Double-declining-balance Method

Year

Amount

Year 1

$ 179,982 x

Year 2

%24

59,998 X

Year 3

%24

19,994

Year 4

6,664

Feedback

Check My Work

a. Asset cost minus residual value equals depreciable cost. Sum the yearly

depreciation to determine total depreciation.

b. Annual units-of-activity depreciation allocates the cost of the asset equally over

the units produced (hours).

c. The double-declining rate is two times the straight-line rate. Book value is the

asset cost minus accumulated depreciation.

Compare the total depreciation for all methods over the time period. Recall that

straight-line depreciation allocates the depreciable cost of the asset equally over

the period of use, while double-declining method is an accelerated method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning