Chapter 12 Karen Smith and Abby Jones formed a partnership, investing $250,000 and $125,000, respectively. Determine their participation in the year's net income of $420,000 under each of the following independent assumptions. Please show your calculations. a. No agreement concerning division of net income. b. Divided in the ratio of original capital investment. c. Interest at the rate of 4% allowed on original investments and the remainder divided in the ratio of 4:1. I

Chapter 12 Karen Smith and Abby Jones formed a partnership, investing $250,000 and $125,000, respectively. Determine their participation in the year's net income of $420,000 under each of the following independent assumptions. Please show your calculations. a. No agreement concerning division of net income. b. Divided in the ratio of original capital investment. c. Interest at the rate of 4% allowed on original investments and the remainder divided in the ratio of 4:1. I

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Bb https://learn-us-east-1-prod-fleet02...

Bb https://learn-us-east-

Last edit was seconds ago

-1

18

+ BIU

EEEE

1

2

3

4

5

6

L

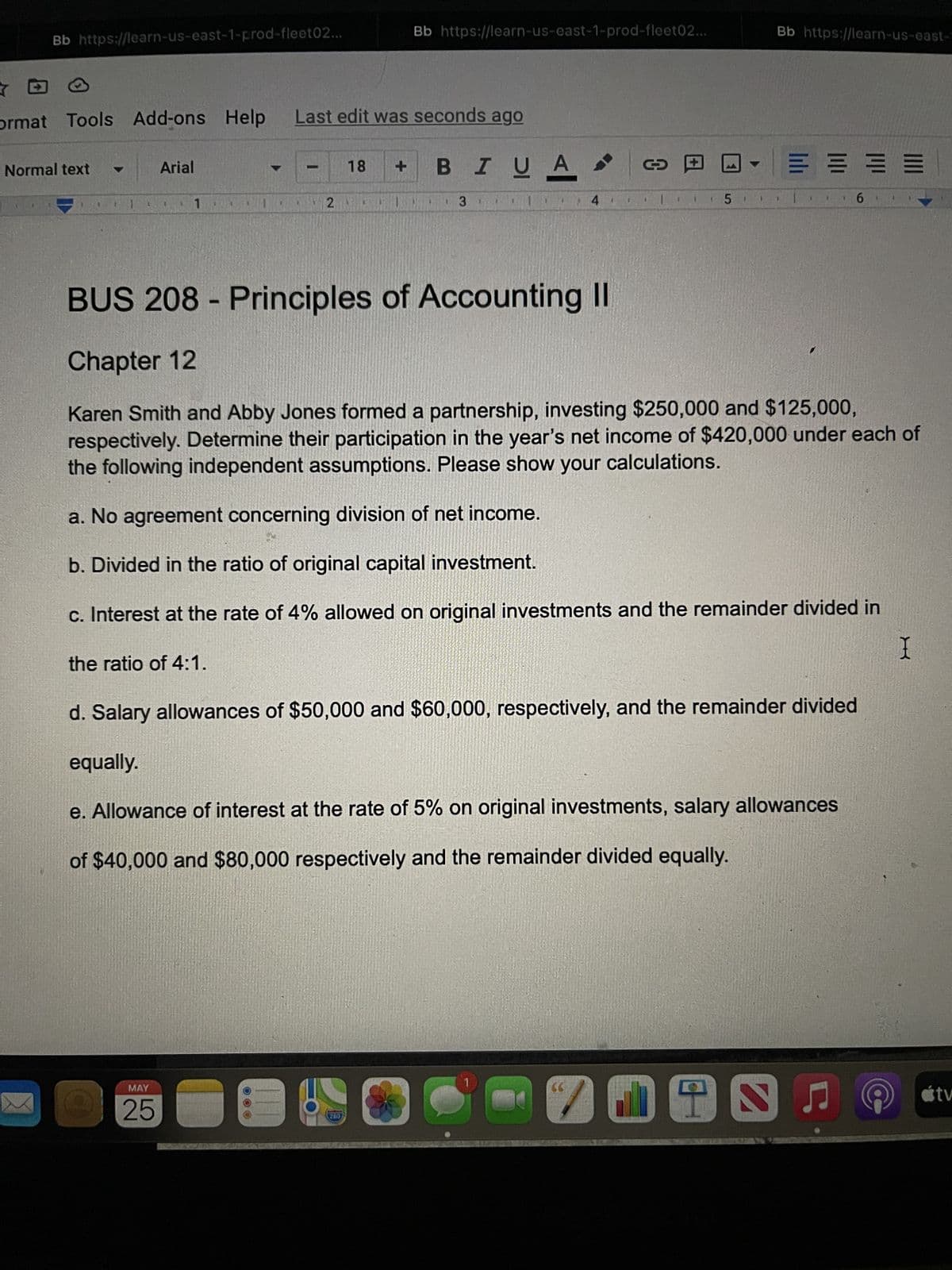

BUS 208 - Principles of Accounting II

Chapter 12

Karen Smith and Abby Jones formed a partnership, investing $250,000 and $125,000,

respectively. Determine their participation in the year's net income of $420,000 under each of

the following independent assumptions. Please show your calculations.

a. No agreement concerning division of net income.

b. Divided in the ratio of original capital investment.

c. Interest at the rate of 4% allowed on original investments and the remainder divided in

the ratio of 4:1.

X

d. Salary allowances of $50,000 and $60,000, respectively, and the remainder divided

equally.

e. Allowance of interest at the rate of 5% on original investments, salary allowances

of $40,000 and $80,000 respectively and the remainder divided equally.

MAY

25

280

J

ormat Tools Add-ons Help

Normal text

Arial

Bb https://learn-us-east-1-prod-fleet02...

G

-

1

71985

tv

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT