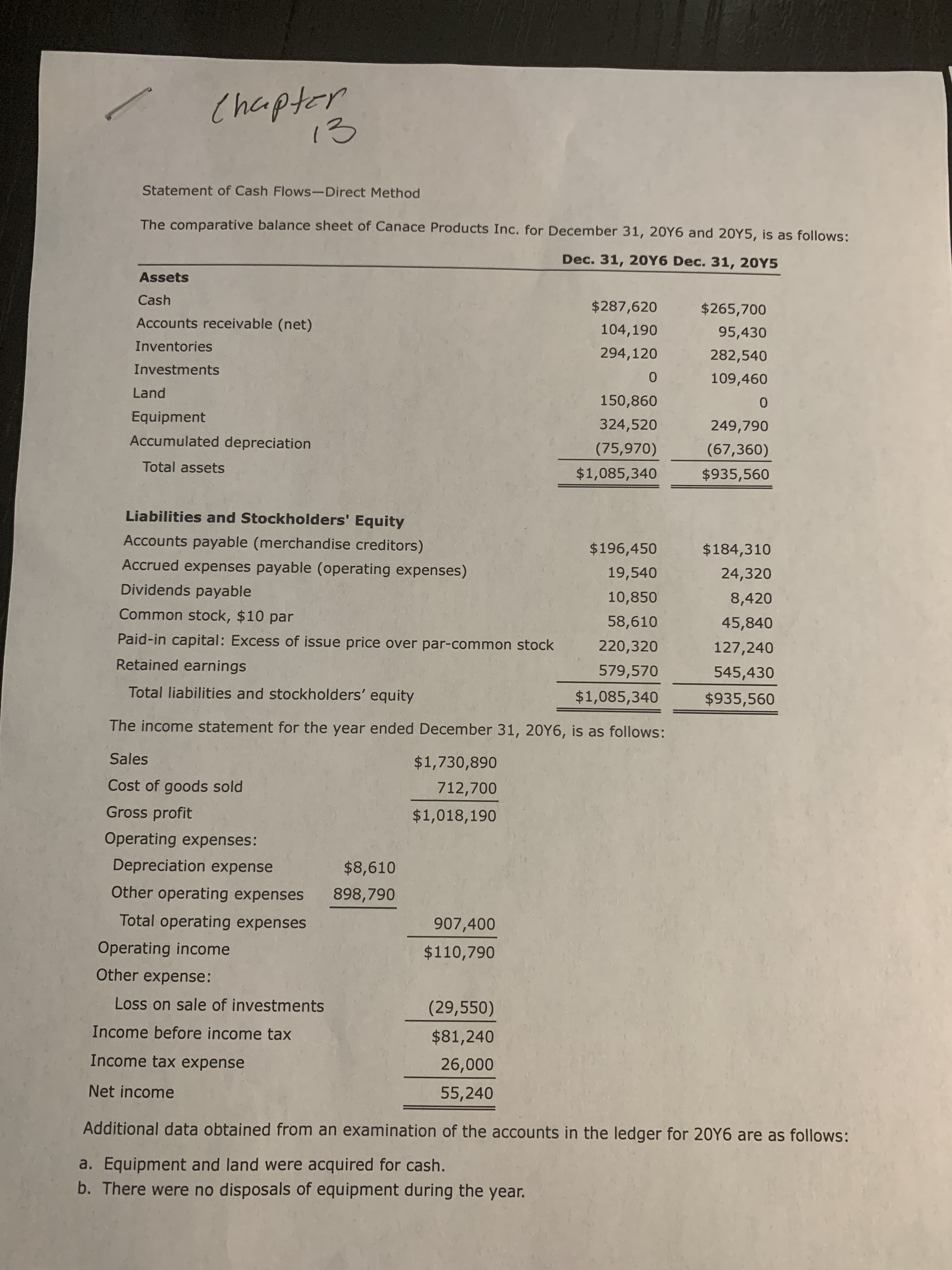

Chapter 13 Statement of Cash Flows-Direct Method The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows: Dec. 31, 20Y6 Dec. 31, 20Y5 Assets Cash $287,620 $265,700 Accounts receivable (net) 104,190 95,430 Inventories 294,120 282,540 Investments 109,460 Land 150,860 Equipment 324,520 249,790 Accumulated depreciation (75,970) (67,360) Total assets $1,085,340 $935,560 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $196,450 $184,310 Accrued expenses payable (operating expenses) 19,540 24,320 Dividends payable 10,850 8,420 Common stock, $10 par 58,610 45,840 Paid-in capital: Excess of issue price over par-common stock 220,320 127,240 Retained earnings 579,570 545,430 Total liabilities and stockholders' equity $1,085,340 $935,560 The income statement for the year ended December 31, 20Y6, is as follows: Sales $1,730,890 Cost of goods sold 712,700 Gross profit $1,018,190 Operating expenses: Depreciation expense $8,610 Other operating expenses 898,790 Total operating expenses 907,400 Operating income $110,790 Other expense: Loss on sale of investments (29,550) Income before income tax $81,240 Income tax expense 26,000 Net income 55,240 Additional data obtained from an examination of the accounts in the ledger for 20Y6 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. C The investments were sold for $79,910 cash d. The common stock was issued for cash. e. There was a $21,100 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the direct method of presenting cash fows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Canace Products Inc. Statement of Cash Flows For the Year Ended December 31, 20Y6 Cash flows from operating activites: Net cash flow from operating activities Cash flows from investing activitbes: Net cash flow used for investing activites Cash flows from financing activities: Net cash flow from financing activities ead aa p buuudag aa e use)

Chapter 13 Statement of Cash Flows-Direct Method The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows: Dec. 31, 20Y6 Dec. 31, 20Y5 Assets Cash $287,620 $265,700 Accounts receivable (net) 104,190 95,430 Inventories 294,120 282,540 Investments 109,460 Land 150,860 Equipment 324,520 249,790 Accumulated depreciation (75,970) (67,360) Total assets $1,085,340 $935,560 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $196,450 $184,310 Accrued expenses payable (operating expenses) 19,540 24,320 Dividends payable 10,850 8,420 Common stock, $10 par 58,610 45,840 Paid-in capital: Excess of issue price over par-common stock 220,320 127,240 Retained earnings 579,570 545,430 Total liabilities and stockholders' equity $1,085,340 $935,560 The income statement for the year ended December 31, 20Y6, is as follows: Sales $1,730,890 Cost of goods sold 712,700 Gross profit $1,018,190 Operating expenses: Depreciation expense $8,610 Other operating expenses 898,790 Total operating expenses 907,400 Operating income $110,790 Other expense: Loss on sale of investments (29,550) Income before income tax $81,240 Income tax expense 26,000 Net income 55,240 Additional data obtained from an examination of the accounts in the ledger for 20Y6 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. C The investments were sold for $79,910 cash d. The common stock was issued for cash. e. There was a $21,100 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the direct method of presenting cash fows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Canace Products Inc. Statement of Cash Flows For the Year Ended December 31, 20Y6 Cash flows from operating activites: Net cash flow from operating activities Cash flows from investing activitbes: Net cash flow used for investing activites Cash flows from financing activities: Net cash flow from financing activities ead aa p buuudag aa e use)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3APR

Related questions

Question

Transcribed Image Text:Chapter

13

Statement of Cash Flows-Direct Method

The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows:

Dec. 31, 20Y6 Dec. 31, 20Y5

Assets

Cash

$287,620

$265,700

Accounts receivable (net)

104,190

95,430

Inventories

294,120

282,540

Investments

109,460

Land

150,860

Equipment

324,520

249,790

Accumulated depreciation

(75,970)

(67,360)

Total assets

$1,085,340

$935,560

Liabilities and Stockholders' Equity

Accounts payable (merchandise creditors)

$196,450

$184,310

Accrued expenses payable (operating expenses)

19,540

24,320

Dividends payable

10,850

8,420

Common stock, $10 par

58,610

45,840

Paid-in capital: Excess of issue price over par-common stock

220,320

127,240

Retained earnings

579,570

545,430

Total liabilities and stockholders' equity

$1,085,340

$935,560

The income statement for the year ended December 31, 20Y6, is as follows:

Sales

$1,730,890

Cost of goods sold

712,700

Gross profit

$1,018,190

Operating expenses:

Depreciation expense

$8,610

Other operating expenses

898,790

Total operating expenses

907,400

Operating income

$110,790

Other expense:

Loss on sale of investments

(29,550)

Income before income tax

$81,240

Income tax expense

26,000

Net income

55,240

Additional data obtained from an examination of the accounts in the ledger for 20Y6 are as follows:

a. Equipment and land were acquired for cash.

b. There were no disposals of equipment during the year.

Transcribed Image Text:C The investments were sold for $79,910 cash

d. The common stock was issued for cash.

e. There was a $21,100 debit to Retained Earnings for cash dividends declared.

Required:

Prepare a statement of cash flows, using the direct method of presenting cash fows from operating

activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any

negative adjustments.

Canace Products Inc.

Statement of Cash Flows

For the Year Ended December 31, 20Y6

Cash flows from operating activites:

Net cash flow from operating activities

Cash flows from investing activitbes:

Net cash flow used for investing activites

Cash flows from financing activities:

Net cash flow from financing activities

ead aa p buuudag aa e use)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning