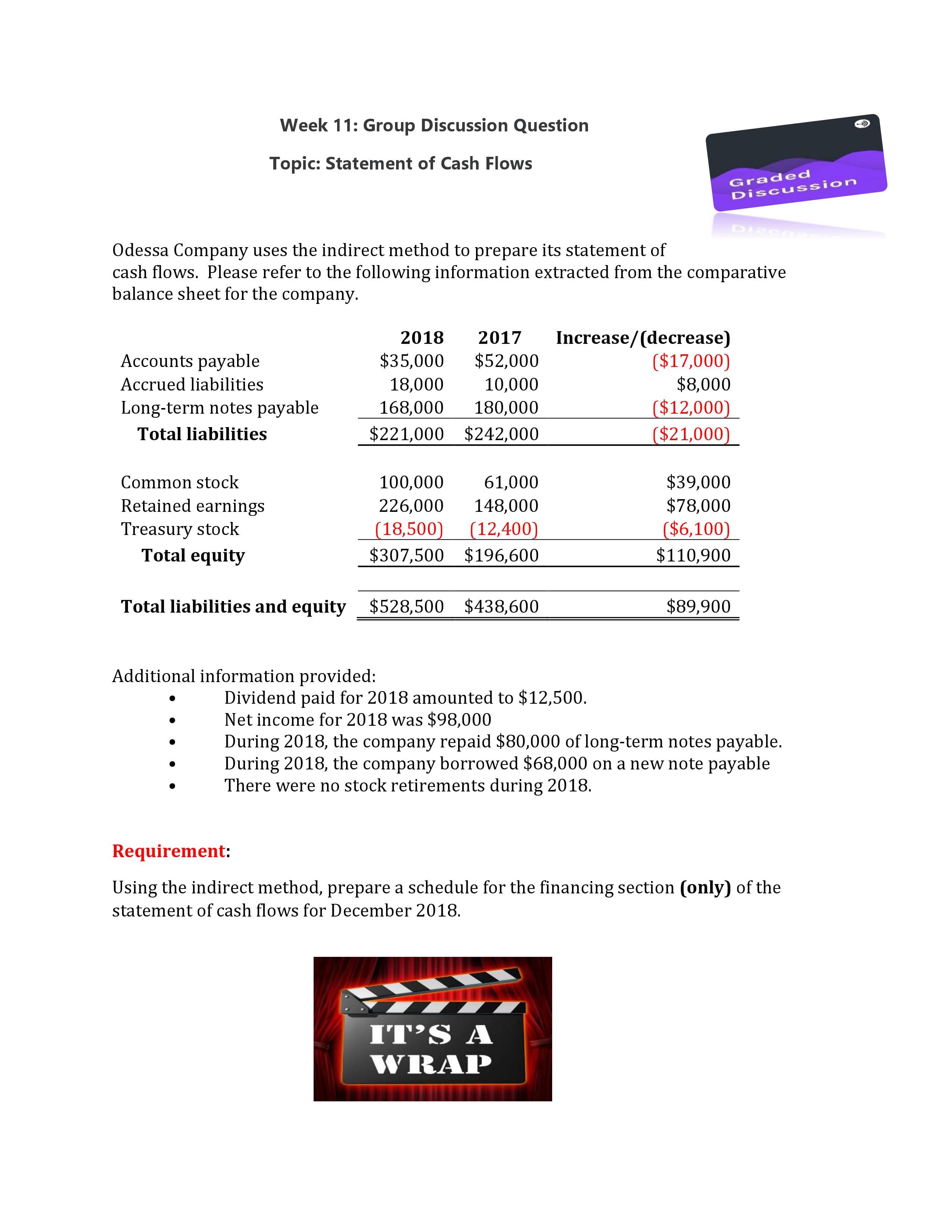

Week 11: Group Discussion Question Topic: Statement of Cash Flows Graded Discussion DIRCO Odessa Company uses the indirect method to prepare its statement of cash flows. Please refer to the following information extracted from the comparative balance sheet for the company Increase/(decrease) ($17,000) $8,000 ($12,000) ($21,000) 2017 2018 Accounts payable $35,000 $52,000 Accrued liabilities 18,000 10,000 Long-term notes payable 168,000 180,000 $221,000 $242,000 Total liabilities $39,000 $78,000 Common stock 100,000 61,000 Retained earnings 226,000 148,000 (18,500) (12,400) $307,500 $196,600 Treasury stock Total equity ($6,100) $110,900 $528,500 $438,600 $89,900 Total liabilities and equity Additional information provided: Dividend paid for 2018 amounted to $12,500. Net income for 2018 was $98,000 During 2018, the company repaid $80,000 of long-term notes payable. During 2018, the company borrowed $68,000 on a new note payable There were no stock retirements during 2018. Requirement: Using the indirect method, prepare a schedule for the financing section (only) of the statement of cash flows for December 2018 IT'S A WRAP

Week 11: Group Discussion Question Topic: Statement of Cash Flows Graded Discussion DIRCO Odessa Company uses the indirect method to prepare its statement of cash flows. Please refer to the following information extracted from the comparative balance sheet for the company Increase/(decrease) ($17,000) $8,000 ($12,000) ($21,000) 2017 2018 Accounts payable $35,000 $52,000 Accrued liabilities 18,000 10,000 Long-term notes payable 168,000 180,000 $221,000 $242,000 Total liabilities $39,000 $78,000 Common stock 100,000 61,000 Retained earnings 226,000 148,000 (18,500) (12,400) $307,500 $196,600 Treasury stock Total equity ($6,100) $110,900 $528,500 $438,600 $89,900 Total liabilities and equity Additional information provided: Dividend paid for 2018 amounted to $12,500. Net income for 2018 was $98,000 During 2018, the company repaid $80,000 of long-term notes payable. During 2018, the company borrowed $68,000 on a new note payable There were no stock retirements during 2018. Requirement: Using the indirect method, prepare a schedule for the financing section (only) of the statement of cash flows for December 2018 IT'S A WRAP

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.12MCP

Related questions

Question

Transcribed Image Text:Week 11: Group Discussion Question

Topic: Statement of Cash Flows

Graded

Discussion

DIRCO

Odessa Company uses the indirect method to prepare its statement of

cash flows. Please refer to the following information extracted from the comparative

balance sheet for the company

Increase/(decrease)

($17,000)

$8,000

($12,000)

($21,000)

2017

2018

Accounts payable

$35,000

$52,000

Accrued liabilities

18,000

10,000

Long-term notes payable

168,000

180,000

$221,000 $242,000

Total liabilities

$39,000

$78,000

Common stock

100,000

61,000

Retained earnings

226,000

148,000

(18,500) (12,400)

$307,500 $196,600

Treasury stock

Total equity

($6,100)

$110,900

$528,500

$438,600

$89,900

Total liabilities and equity

Additional information provided:

Dividend paid for 2018 amounted to $12,500.

Net income for 2018 was $98,000

During 2018, the company repaid $80,000 of long-term notes payable.

During 2018, the company borrowed $68,000 on a new note payable

There were no stock retirements during 2018.

Requirement:

Using the indirect method, prepare a schedule for the financing section (only) of the

statement of cash flows for December 2018

IT'S A

WRAP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning