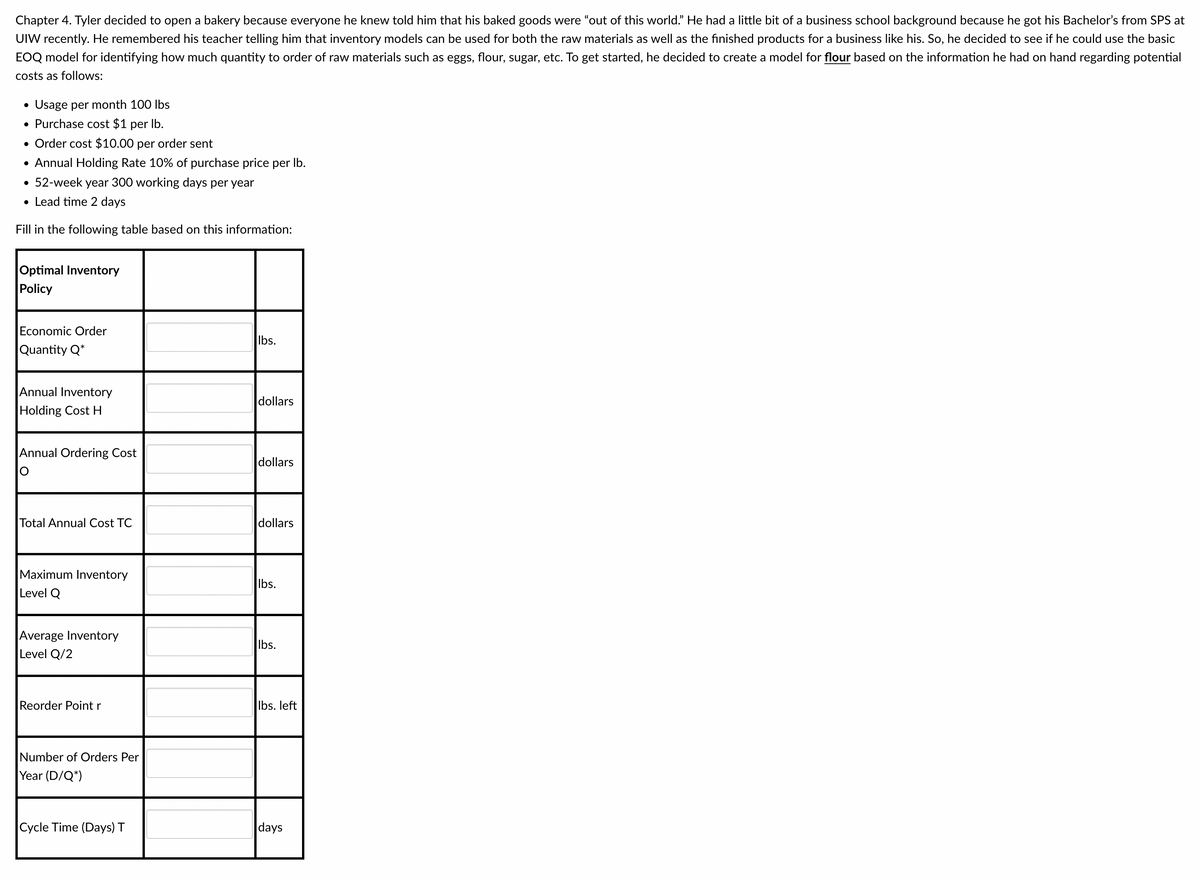

Chapter 4. Tyler decided to open a bakery because everyone he knew told him that his baked goods were "out of this world." He had a little bit of a business school background because he got his Bachelor's from SPS at UIW recently. He remembered his teacher telling him that inventory models can be used for both the raw materials as well as the finished products for a business like his. So, he decided to see if he could use the basic EOQ model for identifying how much quantity to order of raw materials such as eggs, flour, sugar, etc. To get started, he decided to create a model for flour based on the information he had on hand regarding potential costs as follows: • Usage per month 100 lbs • Purchase cost $1 per Ib. • Order cost $10.00 per order sent • Annual Holding Rate 10% of purchase price per Ib. • 52-week year 300 working days per year • Lead time 2 days Fill in the following table based on this information: Optimal Inventory Policy Economic Order Quantity Q Ibs. Annual Inventory dollars Holding Cost H Annual Ordering Cost dollars lo

Chapter 4. Tyler decided to open a bakery because everyone he knew told him that his baked goods were "out of this world." He had a little bit of a business school background because he got his Bachelor's from SPS at UIW recently. He remembered his teacher telling him that inventory models can be used for both the raw materials as well as the finished products for a business like his. So, he decided to see if he could use the basic EOQ model for identifying how much quantity to order of raw materials such as eggs, flour, sugar, etc. To get started, he decided to create a model for flour based on the information he had on hand regarding potential costs as follows: • Usage per month 100 lbs • Purchase cost $1 per Ib. • Order cost $10.00 per order sent • Annual Holding Rate 10% of purchase price per Ib. • 52-week year 300 working days per year • Lead time 2 days Fill in the following table based on this information: Optimal Inventory Policy Economic Order Quantity Q Ibs. Annual Inventory dollars Holding Cost H Annual Ordering Cost dollars lo

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter10: Introduction To Simulation Modeling

Section10.4: Simulation With Built-in Excel Tools

Problem 15P

Related questions

Question

100%

Transcribed Image Text:Chapter 4. Tyler decided to open a bakery because everyone he knew told him that his baked goods were "out of this world." He had a little bit of a business school background because he got his Bachelor's from SPS at

UIW recently. He remembered his teacher telling him that inventory models can be used for both the raw materials as well as the finished products for a business like his. So, he decided to see if he could use the basic

EOQ model for identifying how much quantity to order of raw materials such as eggs, flour, sugar, etc. To get started, he decided to create a model for flour based on the information he had on hand regarding potential

costs as follows:

• Usage per month 100 lbs

• Purchase cost $1 per Ib.

• Order cost $10.00 per order sent

• Annual Holding Rate 10% of purchase price per Ib.

• 52-week year 300 working days per year

• Lead time 2 days

Fill in the following table based on this information:

Optimal Inventory

Policy

Economic Order

Ibs.

Quantity Q*

Annual Inventory

dollars

Holding Cost H

Annual Ordering Cost

dollars

Total Annual Cost TC

dollars

Maximum Inventory

Level Q

Ibs.

Average Inventory

Level Q/2

Ibs.

Reorder Point r

Ibs. left

Number of Orders Per

Year (D/Q*)

Cycle Time (Days) T

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,