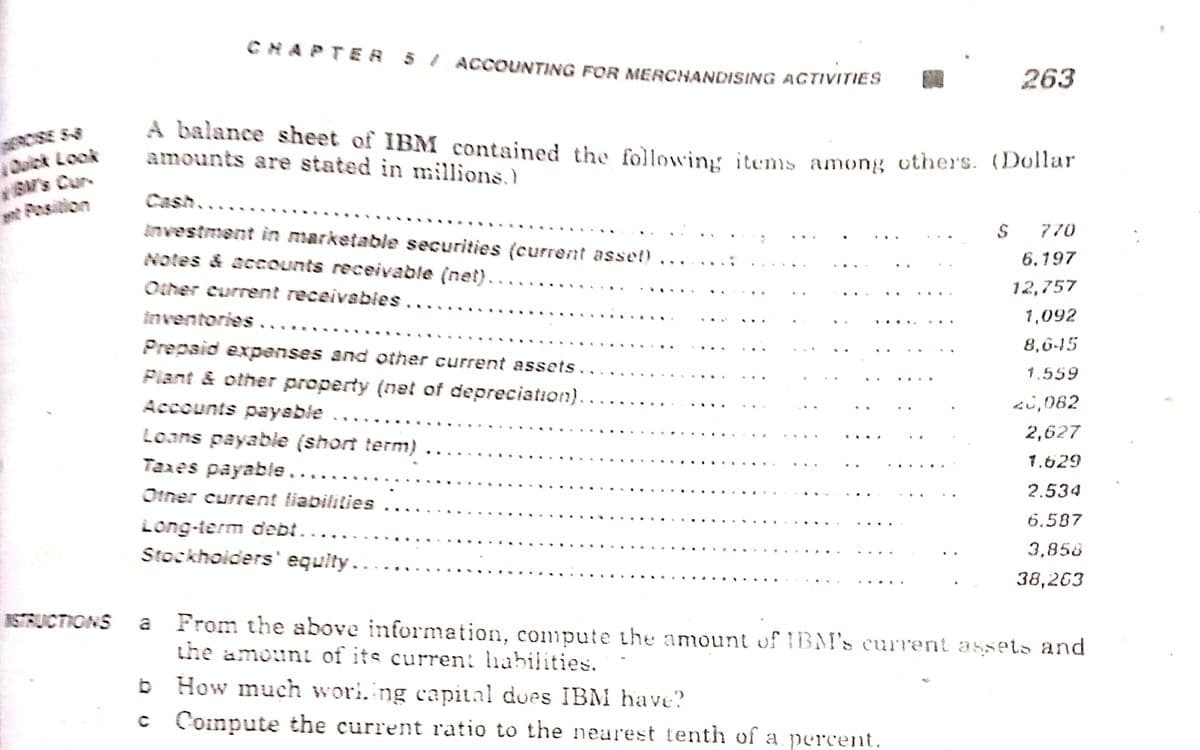

CHAPTER 5 I ACCOUNTING FOR MERCHANDISING ACTIVITIES 263 SE 58 R Look s Cur nsitlon A balance sheet of IBM contained the following items among others. (1)onal amounts are stated in millions.) Cash.. investment in marketable securities (current asset) 770 Notes & accounts receivable (net). 6.197 Other current receivabies. 12,757 inventories....... 1,092 Prepaid expenses and other current assets.. 8,6-15 Plant & other property (net of depreciation). 1.559 Accounts paysble... Loans payabie (short term) Taxes payable ... 2i,062 2,627 1.629 Otner current liabilities 2.534 6.587 Long-term debt.. Stockhoiders' equity. 3,858 38,263 JCTIONS From the above information, compute the amount of BM's current assets and the amount of its curren: habilities. a b How much wori.ing capital does IBM have? c Compute the current ratio to the nearest tenth of a percent,

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 2 steps