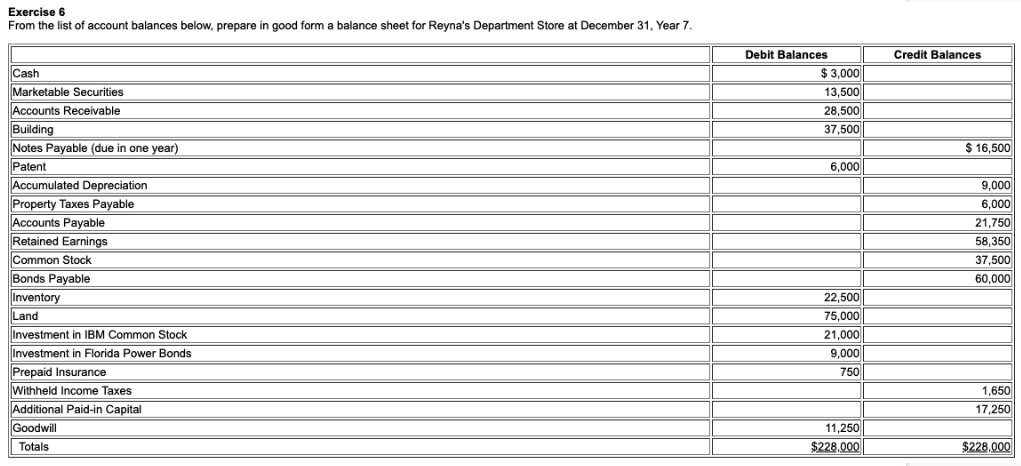

Exercise 6 From the list of account balances below, prepare in good form a balance sheet for Reyna's Department Store at December 31, Year 7. Debit Balances Credit Balances Cash Marketable Securities $ 3,000 13,500 Accounts Receivable Building Notes Payable (due in one year) Patent Accumulated Depreciation Property Taxes Payable Accounts Payable 28,500|| 37,500| $ 16,500 6,000 9,000 6,000 21,750 Retained Earnings Common Stock Bonds Payable 58,350 37,500 60,000 Inventory Land Investment in IBM Common Stock Investment in Florida Power Bonds Prepaid Insurance 22,500 75,000 21,000|| 9,000|| 750 Withheld Income Taxes Additional Paid-in Capital Goodwill 1,650 17,250 11,250 Totals $228.000 $228,000

Exercise 6 From the list of account balances below, prepare in good form a balance sheet for Reyna's Department Store at December 31, Year 7. Debit Balances Credit Balances Cash Marketable Securities $ 3,000 13,500 Accounts Receivable Building Notes Payable (due in one year) Patent Accumulated Depreciation Property Taxes Payable Accounts Payable 28,500|| 37,500| $ 16,500 6,000 9,000 6,000 21,750 Retained Earnings Common Stock Bonds Payable 58,350 37,500 60,000 Inventory Land Investment in IBM Common Stock Investment in Florida Power Bonds Prepaid Insurance 22,500 75,000 21,000|| 9,000|| 750 Withheld Income Taxes Additional Paid-in Capital Goodwill 1,650 17,250 11,250 Totals $228.000 $228,000

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.5APR: Multiple-step income statement and report form of balance sheet The following selected accounts and...

Related questions

Question

Transcribed Image Text:Exercise 6

From the list of account balances below, prepare in good form a balance sheet for Reyna's Department Store at December 31, Year 7.

Debit Balances

Credit Balances

Cash

Marketable Securities

Accounts Receivable

$ 3,000

|

13,500

28,500

37,500

Building

Notes Payable (due in one year)

$ 16,500

Patent

6,000

Accumulated Depreciation

Property Taxes Payable

Accounts Payable

Retained Earnings

9,000

6,000

21,750

58,350

Common Stock

Bonds Payable

37,500

60,000

Inventory

22,500|

Land

75,000

Investment in IBM Common Stock

Investment in Florida Power Bonds

Prepaid Insurance

21,000

9,000

750|

Withheld Income Taxes

1,650

Additional Paid-in Capital

17,250

Goodwill

11,250

Totals

$228.000

$228,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,