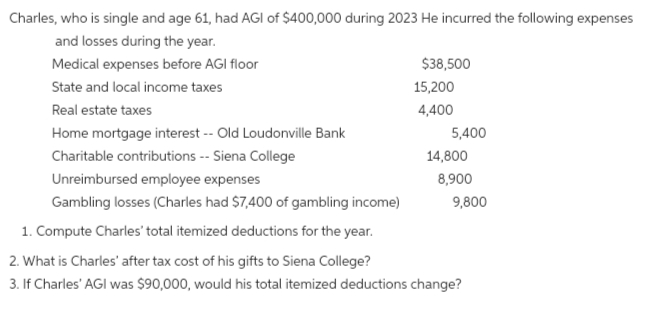

Charles, who is single and age 61, had AGI of $400,000 during 2023 He incurred the following expenses and losses during the year. Medical expenses before AGI floor State and local income taxes Real estate taxes Home mortgage interest -- Old Loudonville Bank Charitable contributions -- Siena College $38,500 15,200 4,400 5,400 14,800 Unreimbursed employee expenses Gambling losses (Charles had $7,400 of gambling income) 1. Compute Charles' total itemized deductions for the year. 2. What is Charles' after tax cost of his gifts to Siena College? 3. If Charles' AGI was $90,000, would his total itemized deductions change? 8,900 9,800

Charles, who is single and age 61, had AGI of $400,000 during 2023 He incurred the following expenses and losses during the year. Medical expenses before AGI floor State and local income taxes Real estate taxes Home mortgage interest -- Old Loudonville Bank Charitable contributions -- Siena College $38,500 15,200 4,400 5,400 14,800 Unreimbursed employee expenses Gambling losses (Charles had $7,400 of gambling income) 1. Compute Charles' total itemized deductions for the year. 2. What is Charles' after tax cost of his gifts to Siena College? 3. If Charles' AGI was $90,000, would his total itemized deductions change? 8,900 9,800

Chapter10: Deduct Ions And Losses: Certain Itemized Deduct Ions

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:Charles, who is single and age 61, had AGI of $400,000 during 2023 He incurred the following expenses

and losses during the year.

Medical expenses before AGI floor

State and local income taxes

Real estate taxes

Home mortgage interest -- Old Loudonville Bank

Charitable contributions -- Siena College

$38,500

15,200

4,400

5,400

14,800

Unreimbursed employee expenses

Gambling losses (Charles had $7,400 of gambling income)

1. Compute Charles' total itemized deductions for the year.

2. What is Charles' after tax cost of his gifts to Siena College?

3. If Charles' AGI was $90,000, would his total itemized deductions change?

8,900

9,800

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT