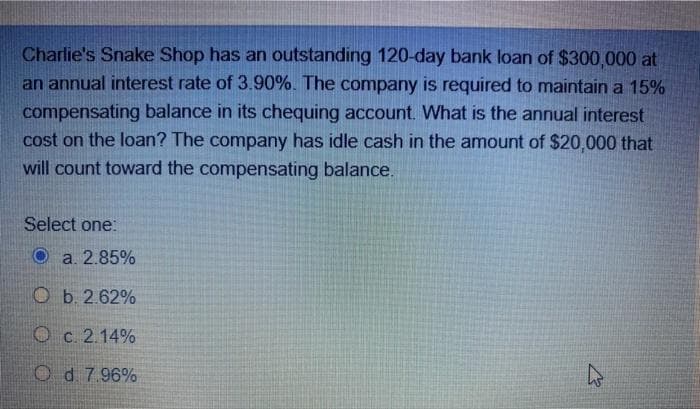

Charlie's Snake Shop has an outstanding 120-day bank loan of $300,000 at an annual interest rate of 3.90%. The company is required to maintain a 15% compensating balance in its chequing account. What is the annual interest cost on the loan? The company has idle cash in the amount of $20,000 that will count toward the compensating balance. Select one: a. 2.85% Ob. 2.62% Oc. 2.14% Od 7.96%

Q: Eric lives in Miami and runs a business that sells pianos. In an average year, he receives $851,000…

A: An implicit cost is a cost that has occurred already and is not necessarily reported as an expense…

Q: A man invests in a project that requires a fixed capital of P 2.5M with no salvage, and life of 12…

A: Payout can be defined as the financial returns that are anticipated from a particular investment or…

Q: You are considering developing an 18-hole championship golf course that requires an investment of…

A: Initial Investment = 25,000,000 Maintenance Cost = 660, 000 annually (Increasing by 45000 annually…

Q: The company you work for just bought a high end milling machine for $389,000, which the vendor is…

A: A Company has purchased a high-end milling machine for $ 3,89,000. The operating cost of the mill is…

Q: An industrial firm is considering purchasing several programmable controllers and automating their…

A:

Q: Estate & Co trades in the vegetable and fruit farming business During the year ended 31 December…

A: Capital allowances can be claimed against the expenses made for procuring the required capital for…

Q: Q7.Jett Gas LLC has total sales of $1,479,600 and costs of $914,300. Depreciation is$41,650 and the…

A: Operating cash flow (OCF) is a measure of the amount of cash generated by a company's normal…

Q: A businessman purchases a common stock worth P1,000 every year for a period of 10 years. At the…

A: A businessman purchases a common stock worth P1,000 every year for a period of 10 years. At the of…

Q: A corporation is considering purchasing a machine that will save $200,000 per year before taxes. The…

A: The net annual cash flow can be calculated as follows: Thus, the annual cash flow is $120,000

Q: Antonio lives in Chicago and runs a business that sells pianos. In an average year, he receives…

A: Accounting profit is the difference between revenue earned by a firm and explicit cost. Economic…

Q: A large electric utility company has proposed building an $820 million combined cycle, gas-powered…

A: Energy is an important factor required in the process of production to run the heavy power tools in…

Q: A company wants to renew its old natural gas fired boiler. According to the receivedprice offer, the…

A:

Q: You are considering developing an 18-hole championship golf course that requires an investment of…

A: Initial Investment = 18,000,000 Maintenance Cost = 640, 000 annually (Increasing by 55000…

Q: Dmitri lives in Dallas and runs a business that sells pianos. In an average year, he receives…

A: Explicit Costs refers to the cash payments made for expenses incurred during the business…

Q: For their replacements, the company is putting up a sinking fund to earn 16% interest compounded…

A: For offer A: Using sinking fund method inn computing depreciation Annual Cost = (Co-Cn)i1+in-1+Co(i)…

Q: A company is considering constructing a plant to manufacture a proposed new product. The land costs…

A: Land cost = $300,000 Building cost = $600,000 Equipment cost = $250,000 Additional working capital…

Q: A proposed project will require the immediate investment of $50,000 and is estimated to have…

A: Using Excel for explanation

Q: Nick lives in Detroit and runs a business that sells pianos. In an average year, he receives…

A: Here, Nick has two alternatives to choose such that selling piano or working as a financial advisor.…

Q: Calculate the capitalized cost of an equipment maintained at a rate of 6% every year for P10,000,…

A: Capitalized value represents the current worth of an asset. Capitalized cost is an expense incurred…

Q: ) You buy a $200,000 house using a 30-year mortgage. At the end of the 15th year you will need to…

A: Equivalent annual cost (EAC) is the annual cost of owning, operating, and maintaining an asset over…

Q: “The higher the MARR, the higher the price that a company should be willing to pay for equipment…

A: The given statement “the higher the MARR (minimum required rate of return), the higher the price…

Q: Nodhead College needs a new computer. It can either buy it for $295,000 or lease it from Compulease.…

A: Cost of Computer = $ 2,95,000 and Lease Payments = $ 71,000 for 6 years. Rate of discount = 6 % Part…

Q: A machine that costs $12,000 is expected to operate for 10 years. The estimated salvage value at the…

A: Answer a) The following calculation is done to calculate IRR

Q: Consider the following two mutually exclusive service projects with projectlives of three years and…

A: Present value is the sum of money to be earned in the potential that is equal in worth to a…

Q: Suppose you have a certain amount of cash on hand at the moment and you decide to invest it in a…

A: Given information Monetary correction rate=1.0% per month The difference between nominal interest…

Q: You are buying a house which cost $150,000. This house will have an estimated life of 10 years with…

A: Investment returns are measured by the real after-tax rate of return, which takes inflation and…

Q: Hubert lives in Detroit and runs a business that sells pianos. In an average year, he receives…

A: Ans. Explicit cost is the cost a firm pays for the use of the factor of production during the…

Q: ABC Company's management believes that every 9% increase in the selling price of one of the…

A: Selling price increases = 9% production fall by = 10% Variable Cost = 12.60/unit administrative cost…

Q: If you invest $10,000 now into a project that will yield net revenues of $1,327 at the end of each…

A: IRR is calculated using excel as follows: Ms Excel -formula-Irr

Q: 4. A stopwatch used for Time and Motion Study has a selling price of P1,500. If its selling price is…

A: Given; Selling price stopwatch used for Time and Motion Study= ₱1500 Selling price is expected to…

Q: A startup is considering buying a $295,000 piece of equipment. If it purchases the equipment, it…

A: Given information Initial investment= $295000---- by taking a loan Interest rate for repayment of…

Q: Joe's Taco Hut can purchase a delivery truck for $20,000, for which he will take out a loan from the…

A: A) The information is Given about buying one truck only. So, VMP=4000

Q: Your friend made an investment of P 45,000.00 for 60 days at 15% simple interest. If withholding tax…

A: In the above question, it is given that : Initial Amount = P 45,000 Time period = 60 days Interest…

Q: You have recently learned that the company where you work is being sold for $500,000. The company's…

A: Opportunity cost can be defined as the benefit that has been forgone of the next best alternative…

Q: A startup is considering buying a $295,000 piece of equipment. If it purchases the equipment, it…

A: Given information Initial investment= $295000---- by taking a loan Interest rate for repayment of…

Q: You want to establish your own business and are thinking about releasing a new product. Customers…

A: Profit = TR - TC Breakeven occurs if the profit is 0 and TR=TC

Q: The internal rate of return (IRR) is the interest rate that sets the net present value (NPV) of the…

A: IRR helps in the analysis of various different investment decisions that the company has to make.

Q: How does the IRR become a useful gauge against which to judge project acceptability?

A: Answer - IRR (Internal Rate of Return) - It is the tool or measurement on which investor decides to…

Q: · A young mechanical engineer is considering establishing his own small company. An investment of…

A: GIVEN A young mechanical engineer is considering establishing his own small company. An investment…

Q: Assume a machine that has a useful life of only one year costs $2,000. Assume, also, that net of…

A: In economics, present value refers to the current value of a future stream of cash flows. Net…

Q: You are the Chief Financial Officer (CFO) for a Toronto-based Biotech company. Your company has…

A: Interest refers to the amount paid in excess of the principal amount by the borrower to the lender.…

Q: Assume r = 0.1 is the present real interest rate and this rate is expected to prevail for the next 2…

A:

Q: You are considering starting a new doughnut shop in the Prince Kuhio Mall. You wish to complete a…

A: Answer Years 0 1 2 3 Sales 1,000,000 1,000,000 1,000,000…

Q: 1. What is the value of ROR (i*) for the following equation? 0 = -20,000 + (29,000 - 21,000) (P/A,…

A: Let us convert above equation into formula based one - 0 = -20,000 + (80000)*1 -(1+i)-4i As , (P/A…

Q: Clancy lives in San Francisco and runs a business that sells pianos. In an average year, he receives…

A: Explicit cost- Explicit business costs include all transactions relating to production factors used…

Q: Question A8 Vermonto Ltd is putting together a tender for a one-off contract using relevant costing…

A: The given question has been solved below.

Step by step

Solved in 5 steps

- You are considering purchasing a dump truck.The truck will cost $75,000 and have operating andmaintenance costs that start at $18,000 the first yearand increases by $2,000 per year. Assume that thesalvage value at the end of five years is $22,000 andinterest rate is 12%. What is the equivalent annualcost of owning and operating the truck?A process plant making 5000kg /day of a product selling for $1.75 per kg has annual directproduction costs of $2 million at 100 percent capacity and other fixed costs of $700,000. What isthe fixed charge per kg at the break-even point? If the selling price of the product is increased by10 percent, what is the dollar increase in net profit at full capacity if the income tax rate is 35percent of gross earnings?2. It is estimated that depositing 20.000 pesos every end of the 6 months in a sinking fund that gives an interest rate of 14% compounded semi-annually, will provide the money that could replace a machine at the end of 10 years. If the machine has no salvage value, what is the cost of replacement. a. $19,909.85 b. 729.546.06 c. 889.754.30 d. 746.852.58

- Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow 0 - S1,785,000 1 610,000 2 707,000 3 580,000 4 483,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 4 percent. If Anderson uses a required return of 11 percent on this project, what are the NPV and IRR of the project?Please use excel to solve and show equations. A project is being evaluated. The project will create the following cash flows: Year Cash Flow 0 $ 1,290,000 1 465,000 2 530,000 3 425,000 4 380,000 In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are blocked and must be reinvested with the government for one year. The reinvestment rate for these funds is 3 percent. If Anderson uses a required return of 12 percent on this project, what are the NPV and IRR of the project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your IRR as a percent.) Whats is the NPV and IRR of the project of the project? Please use excel to solve and show equations.Sunflower Manufacturing recently applied for a $10 million loan at The Democrat Federal Bank (known simplyas The Democrat). The purpose of the loan is to support its working capital needs (short-term funds) duringthe next nine months. Sunflower has been a loyal customer of the bank for many years and has beenextended whatever amount of credit it requested in the past.Sheli Crocker, who is a new, young loan officer at The Democrat, reviewed Sunflower's loan application anddecided to turn down the loan for the requested amount. In her report to Henry, her boss and the senior loanofficer, Sheli indicated that she thought Sunflower would have trouble repaying a $10 million loan because itsfinancial positions has deteriorated in recent months. Sheli noted that the company's ability to pay its currentobligation - that is, its liquidity position - is poor and that analysts are pessimistic about Sunflower's ability toimprove its liquidity during the next two years. As a result, Sheli…

- Racine Tire Co. manufactures tires for all-terrain bicycles, The tires sell for P60 and variable cost per tire is P45; monthly fixed cost is P450,000. Requirement: 1. Calculate the firm's break-even point in sales pesos 2. What will be the new net income? 3. If the company can increase sales volume by 15 percent above the current level, 8,400,000 tires monthly What will be the increase in net income?Mr. Don is the director of A-Design Inc., a federally incorporatedcompany in Canada, specializing in the design and manufacturing of armrests for the wheelchair industry. A-Design invested $100,000 in a production machine, which has a useful life of 10 years, and put $10,000 in its bank account. In an attempt to improve company sales and profits, Mr. Don planned tooffer two purchasing options to the clients of his company. Option 1:$250 deposit upfront$500 yearly fee for 5 years Option 2:$1300 deposit upfront$300 yearly fee for 3 years Calculate the depreciated cost per year of the machine.Scenario 13-9Ellie has been working for an engineering firm and earning an annual salary of $80,000. She decides to open her own engineering business. Her annual expenses will include $15,000 for office rent, $3,000 for equipment rental, $1,000 for supplies, $1,200 for utilities, and a $35,000 salary for a secretary/bookkeeper. Ellie will cover her start-up expenses by cashing in a $20,000 certificate of deposit on which she was earning annual interest of $500. Refer to Scenario 13-9. According to an economist, which of the following revenue totals will yield Ellie’s business $50,000 in economic profits?

- Moriarty started living in his own condominium after turning 25 years old. When he turned 26, he became fond of buying a pack of Gardenia wheat bread every Saturday at 5:30PM. The price of the bread is Php85.00 per pack. Assume the following: 1. Moriarty will live until 95 years old. 2. The price of the bread will remain constant, 3. Moriarty’s purchasing habits will not change. What is the lifetime value that can be generated from Moriarty as a customer of Gardenia wheat bread?Lewis’s management has been considering movingto a new downtown location, and they are concerned that these plans may come to fruition priorto the equipment lease’s expiration. If the moveoccurs then Lewis would buy or lease an entirelynew set of equipment, so management wouldlike to include a cancellation clause in the leasecontract. What effect would such a clause haveon the riskiness of the lease from Lewis’s standpoint? From the lessor’s standpoint? If you werethe lessor, would you insist on changing any ofthe other lease terms if a cancellation clause wereadded? Should the cancellation clause containprovisions similar to call premiums or any restrictive covenants and/or penalties of the type contained in bond indentures? Explain your answer.CLP is planning to go into the designer jeans business. They project the following costs for the first year of operation: Rental payments $1,500 per month Direct Labor $9.50 per hour Raw Materials $6 per pair of jeans Overhead $975 per week Interest on Capital $1,350 per month It takes 20 minutes of direct labor to assemble a pair of pants, and CLP sells his designer jeans for $39.50 a pair. How many pairs of jeans must be sold to break even the first year? (assume a 50 week year) If profits total $38,500 for the first year, what is CLP’s safety margin? After a successful first year, CLP foresees a decline in designer jeans demand as a result of a weakening economy. If CLP wants a break-even point of 2,300 units, how much of a reduction in fixed costs would be necessary? What three alternative methods are available for reducing the break-even point? Using each of these methods,…