Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her (all are under age 16). She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. FILING STATUS 2019 2020 Single 12,200 12,400 Married, Filing Jointly 24,400 24,800 Surviving spoise 24,400 24,800 Head of Household 18,350 18,650 Married, Filing Seperate 12,200 12.400 A. a. Compute Charlotte's taxable income. B b. Using the Tax Rate Schedules (See attached), tax liability (before any allowable credits) for Charlotte is $ *Blank* for 2020. C. c. Compute Charlotte's child and dependent tax credit. Charlotte's child tax credit is $ ________, of which $ __________ may be refundable and her dependent tax credit is $ ______ of which $ 0 may be refundable.

Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her (all are under age 16). She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500.

| FILING STATUS | 2019 | 2020 |

| Single | 12,200 | 12,400 |

| Married, Filing Jointly | 24,400 | 24,800 |

| Surviving spoise | 24,400 | 24,800 |

| Head of Household | 18,350 | 18,650 |

| Married, Filing Seperate | 12,200 | 12.400 |

A. a. Compute Charlotte's taxable income.

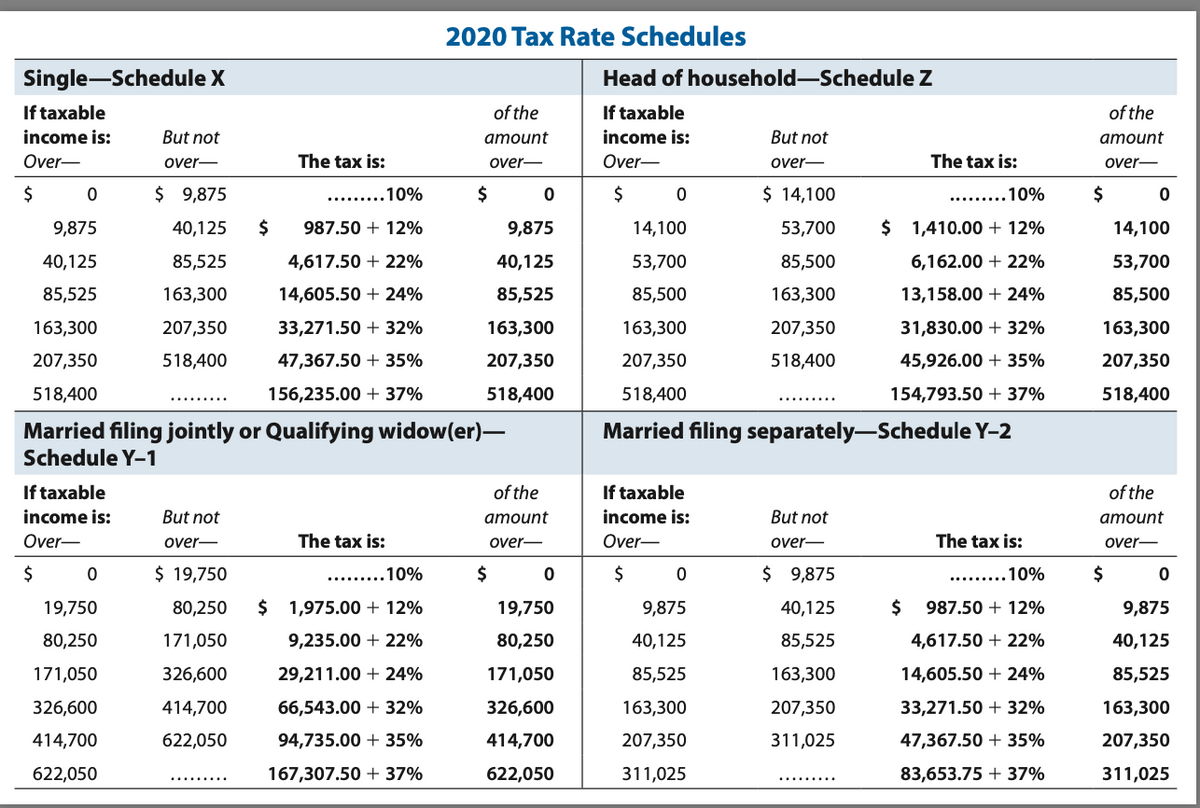

B b. Using the Tax Rate Schedules (See attached), tax liability (before any allowable credits) for Charlotte is $ *Blank* for 2020.

C. c. Compute Charlotte's child and dependent tax credit.

Charlotte's child tax credit is $ ________, of which $ __________ may be refundable and her dependent tax credit is $ ______ of which $ 0 may be refundable.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

c. Compute Charlotte's child and dependent tax credit.

Charlotte's child tax credit is $8,000, of which $ ______ may be refundable and her dependent tax credit is $1,000 of which $0 may be refundable.

I understand where the $8,000 comes from and the where the $1000 comes from, However the one blank, nothing seems to work, )1000, 500, 2000, etc.)