Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDs and a basic equipment set (blocks, strap, and small pillows). Last year, Cherry Blossom Products sold 13,500 DVDs and 4,500 equipment sets. Information on the two products is as follows: DVDs Equipment Sets Price $8 $25 Variable cost per unit 4 15 Total fixed cost is $84,660. Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $17 and a variable cost per unit of $11. Total fixed cost must be increased by $28,220 (making total fixed cost $112,880). Assume that anticipated sales of the other products, as well as their prices and variable costs, remain the same. 1. What is the sales mix of DVDs, equipment sets, and yoga mats? 3:1:2 2. Compute the break-even quantity of each product. Break-even DVDs units Break-even equipment sets units Break-even yoga mats units

Multiple-Product Break-even, Break-Even Sales Revenue

Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDs and a basic equipment set (blocks, strap, and small pillows). Last year, Cherry Blossom Products sold 13,500 DVDs and 4,500 equipment sets. Information on the two products is as follows:

| DVDs | Equipment Sets | |

| Price | $8 | $25 |

| Variable cost per unit | 4 | 15 |

Total fixed cost is $84,660.

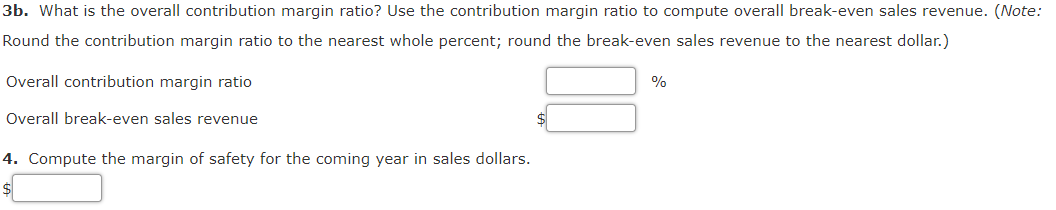

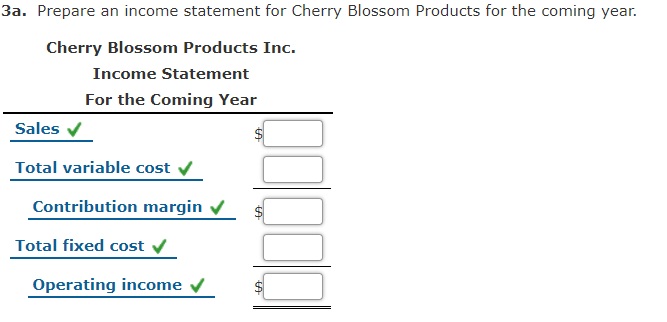

Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $17 and a variable cost per unit of $11. Total fixed cost must be increased by $28,220 (making total fixed cost $112,880). Assume that anticipated sales of the other products, as well as their prices and variable costs, remain the same.

1. What is the sales mix of DVDs, equipment sets, and yoga mats?

3:1:2

2. Compute the break-even quantity of each product.

| Break-even DVDs | units |

| Break-even equipment sets | units |

| Break-even yoga mats | units |

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images