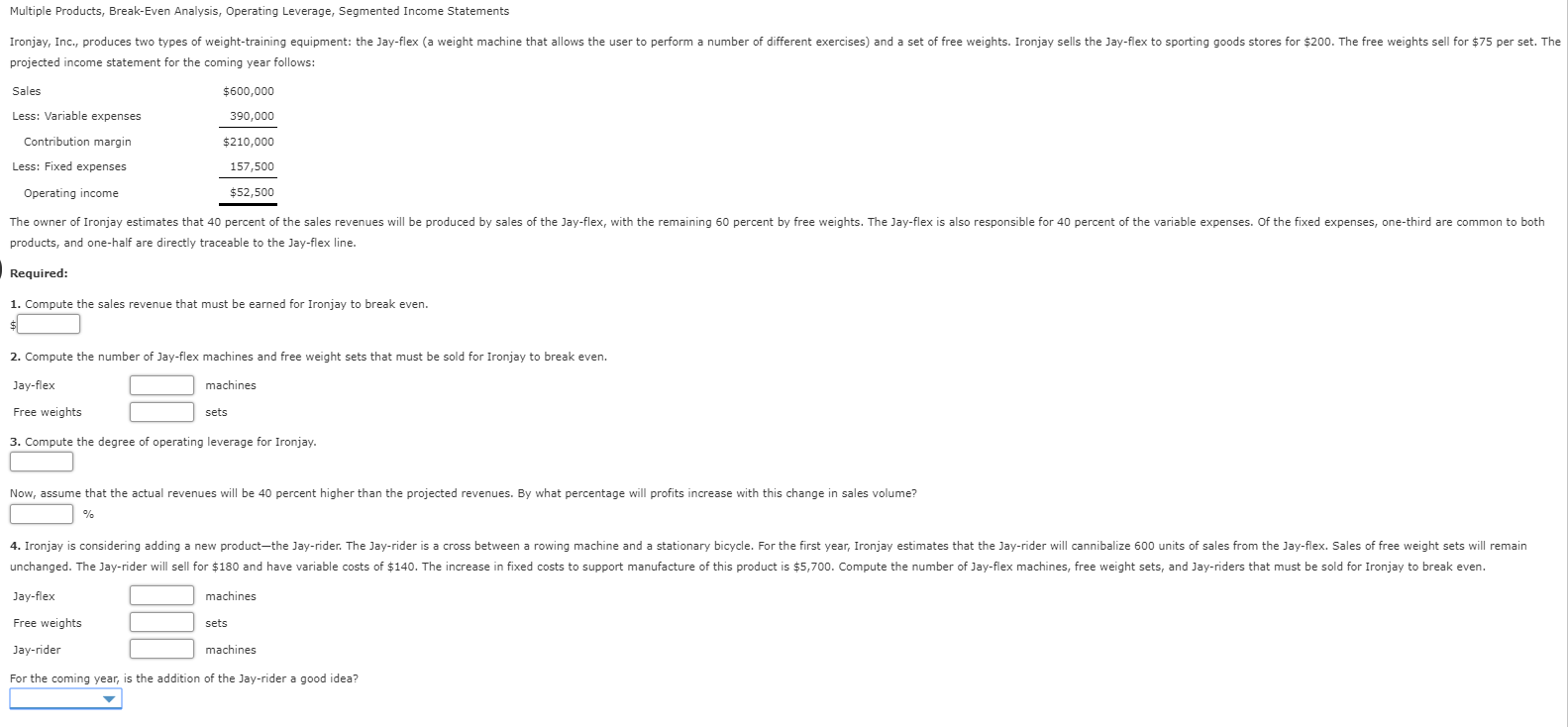

Multiple Products, Break-Even Analysis, Operating Leverage, Segmented Income Statements Ironjay, Inc., produces two types of weight-training equipment: the Jay-flex (a weight machine that allows the user to perform a number of different exercises) and a set of free weights. Ironjay sells the Jay-flex to sporting goods stores for $200. The free weights sell for $75 per set. The projected income statement for the coming year follows: Sales $600,000 Less: Variable expenses 390,000 Contribution margin $210,000 Less: Fixed expenses 157,500 $52,500 Operating income The owner of Ironjay estimates that 40 percent of the sales revenues will be produced by sales of the Jay-flex, with the remaining 60 percent by free weights. The Jay-flex is also responsible for 40 percent of the variable expenses. Of the fixed expenses, one-third are common to both products, and one-half are directly traceable to the Jay-flex line. Required: 1. Compute the sales revenue that must be earned for Ironjay to break even 2. Compute the number of Jay-flex machines and free weight sets that must be sold for Ironjay to break even machines Jay-flex Free weights sets 3. Compute the degree of operating leverage for Ironjay. Now, assume that the actual revenues will be 40 percent higher than the projected revenues. By what percentage will profits increase with this change in sales volume? 4. Ironjay is considering adding a new product-the Jay-rider. The Jay-rider is a cross between a rowing machine and a stationary bicycle. For the first year, Ironjay estimates that the Jay-rider will cannibalize 600 units of sales from the Jay-flex. Sales of free weight sets will remain unchanged. The Jay-rider will sell for $180 and have variable costs of $140. The increase in fixed costs to support manufacture of this product is $5,700. Compute the number of Jay-flex machines, free weight sets, and Jay-riders that must be sold for Ironjay to break even Jay-flex machines Free weights sets Jay-rider machines For the coming year, is the addition of the Jay-rider a good idea?

Multiple Products, Break-Even Analysis, Operating Leverage, Segmented Income Statements Ironjay, Inc., produces two types of weight-training equipment: the Jay-flex (a weight machine that allows the user to perform a number of different exercises) and a set of free weights. Ironjay sells the Jay-flex to sporting goods stores for $200. The free weights sell for $75 per set. The projected income statement for the coming year follows: Sales $600,000 Less: Variable expenses 390,000 Contribution margin $210,000 Less: Fixed expenses 157,500 $52,500 Operating income The owner of Ironjay estimates that 40 percent of the sales revenues will be produced by sales of the Jay-flex, with the remaining 60 percent by free weights. The Jay-flex is also responsible for 40 percent of the variable expenses. Of the fixed expenses, one-third are common to both products, and one-half are directly traceable to the Jay-flex line. Required: 1. Compute the sales revenue that must be earned for Ironjay to break even 2. Compute the number of Jay-flex machines and free weight sets that must be sold for Ironjay to break even machines Jay-flex Free weights sets 3. Compute the degree of operating leverage for Ironjay. Now, assume that the actual revenues will be 40 percent higher than the projected revenues. By what percentage will profits increase with this change in sales volume? 4. Ironjay is considering adding a new product-the Jay-rider. The Jay-rider is a cross between a rowing machine and a stationary bicycle. For the first year, Ironjay estimates that the Jay-rider will cannibalize 600 units of sales from the Jay-flex. Sales of free weight sets will remain unchanged. The Jay-rider will sell for $180 and have variable costs of $140. The increase in fixed costs to support manufacture of this product is $5,700. Compute the number of Jay-flex machines, free weight sets, and Jay-riders that must be sold for Ironjay to break even Jay-flex machines Free weights sets Jay-rider machines For the coming year, is the addition of the Jay-rider a good idea?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 37P: Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions...

Related questions

Question

Transcribed Image Text:Multiple Products, Break-Even Analysis, Operating Leverage, Segmented Income Statements

Ironjay, Inc., produces two types of weight-training equipment: the Jay-flex (a weight machine that allows the user to perform a number of different exercises) and a set of free weights. Ironjay sells the Jay-flex to sporting goods stores for $200. The free weights sell for $75 per set. The

projected income statement for the coming year follows:

Sales

$600,000

Less: Variable expenses

390,000

Contribution margin

$210,000

Less: Fixed expenses

157,500

$52,500

Operating income

The owner of Ironjay estimates that 40 percent of the sales revenues will be produced by sales of the Jay-flex, with the remaining 60 percent by free weights. The Jay-flex is also responsible for 40 percent of the variable expenses. Of the fixed expenses, one-third are common to both

products, and one-half are directly traceable to the Jay-flex line.

Required:

1. Compute the sales revenue that must be earned for Ironjay to break even

2. Compute the number of Jay-flex machines and free weight sets that must be sold for Ironjay to break even

machines

Jay-flex

Free weights

sets

3. Compute the degree of operating leverage for Ironjay.

Now, assume that the actual revenues will be 40 percent higher than the projected revenues. By what percentage will profits increase with this change in sales volume?

4. Ironjay is considering adding a new product-the Jay-rider. The Jay-rider is a cross between a rowing machine and a stationary bicycle. For the first year, Ironjay estimates that the Jay-rider will cannibalize 600 units of sales from the Jay-flex. Sales of free weight sets will remain

unchanged. The Jay-rider will sell for $180 and have variable costs of $140. The increase in fixed costs to support manufacture of this product is $5,700. Compute the number of Jay-flex machines, free weight sets, and Jay-riders that must be sold for Ironjay to break even

Jay-flex

machines

Free weights

sets

Jay-rider

machines

For the coming year, is the addition of the Jay-rider a good idea?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College