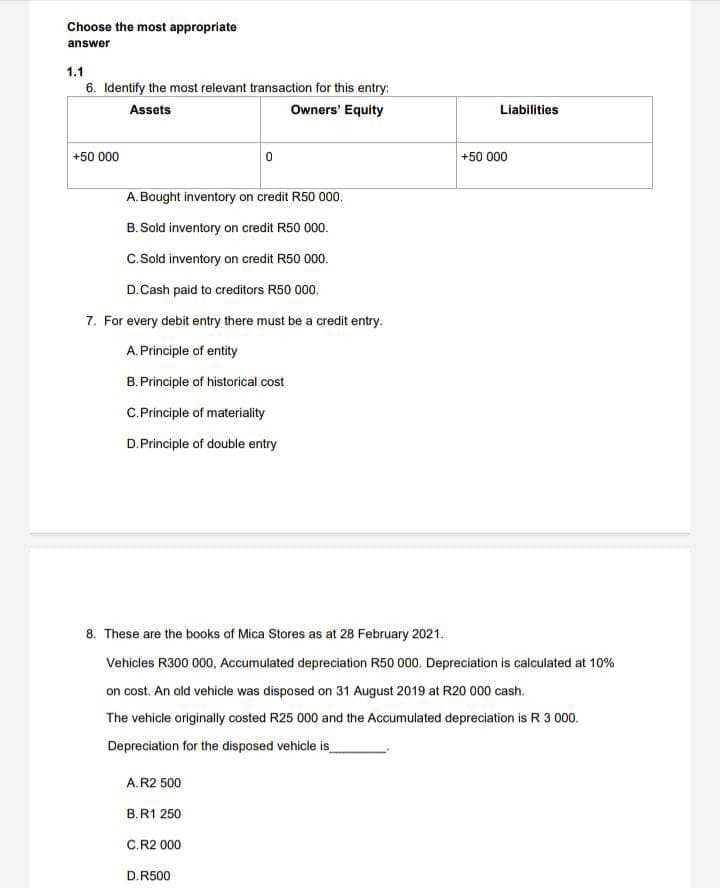

Choose the most appropriate answer 1.1 6. Identify the most relevant transaction for this entry: Assets Owners' Equity Liabilities +50 000 +50 000 A.Bought inventory on credit R50 000. B. Sold inventory on credit R50 000. C. Sold inventory on credit R50 000. D.Cash paid to creditors R50 000.

Choose the most appropriate answer 1.1 6. Identify the most relevant transaction for this entry: Assets Owners' Equity Liabilities +50 000 +50 000 A.Bought inventory on credit R50 000. B. Sold inventory on credit R50 000. C. Sold inventory on credit R50 000. D.Cash paid to creditors R50 000.

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 1M

Related questions

Question

Transcribed Image Text:Choose the most appropriate

answer

1.1

6. Identify the most relevant transaction for this entry:

Assets

Owners' Equity

Liabilities

+50 000

+50 000

A. Bought inventory on credit R50 000.

B. Sold inventory on credit R50 000.

C.Sold inventory on credit R50 000.

D.Cash paid to creditors R50 000.

7. For every debit entry there must be a credit entry.

A.Principle of entity

B.Principle of historical cost

C.Principle of materiality

D.Principle of double entry

8. These are the books of Mica Stores as at 28 February 2021.

Vehicles R300 000, Accumulated depreciation R50 000. Depreciation is calculated at 10%

on cost. An old vehicle was disposed on 31 August 2019 at R20 000 cash.

The vehicle originally costed R25 000 and the Accumulated depreciation is R 3 000.

Depreciation for the disposed vehicle is

A.R2 500

B.R1 250

C.R2 000

D.R500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning