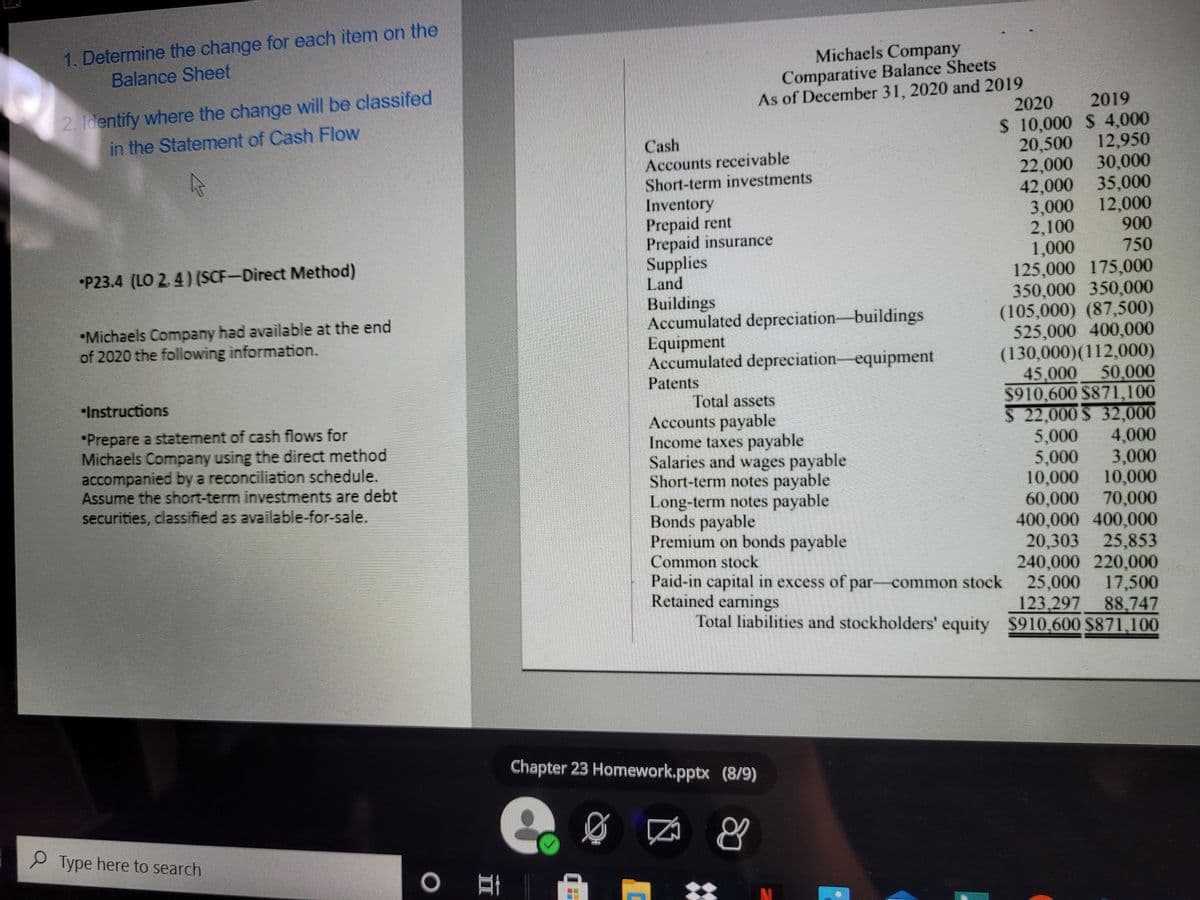

1. Determine the change for each item on the Balance Sheet 2.1dentify where the change will be classifed in the Statement of Cash Flow Michaels Company Comparative Balance Sheets As of December 31, 2020 and 2019 2020 $ 10,000 S 4,000 20,500 12,950 2019 Cash Accounts receivable Short-term investments Inventory Prepaid rent Prepaid insurance Supplies Land 22,000 42,000 3,000 2,100 1,000 125,000 175,000 350,000 350,000 (105,000) (87,500) 525,000 400,000 (130,000)(112,000) 45,000 30,000 35,000 12,000 900 750 *P23.4 (LO 2.4) (SCF-Direct Method) *Michaels Company had available at the end of 2020 the following information. Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment 50,000 $910,600 S871,100 S 22,000 S 32,000 5,000 5,000 10,000 Patents Instructions Total assets *Prepare a statement of cash flows for Michaels Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, classified as available-for-sale. Accounts payable Income taxes payable Salaries and wages payable Short-term notes payable Long-term notes payable Bonds payable Premium on bonds payable 4,000 3,000 10,000 60,000 70,000 400,000 400,000 20,303 25,853 240,000 220,000 25,000 Common stock Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $910,600 $871,100 17,500 123,297 88,747 Chapter 23 Homework.pptx (8/9) O Type here to search

1. Determine the change for each item on the Balance Sheet 2.1dentify where the change will be classifed in the Statement of Cash Flow Michaels Company Comparative Balance Sheets As of December 31, 2020 and 2019 2020 $ 10,000 S 4,000 20,500 12,950 2019 Cash Accounts receivable Short-term investments Inventory Prepaid rent Prepaid insurance Supplies Land 22,000 42,000 3,000 2,100 1,000 125,000 175,000 350,000 350,000 (105,000) (87,500) 525,000 400,000 (130,000)(112,000) 45,000 30,000 35,000 12,000 900 750 *P23.4 (LO 2.4) (SCF-Direct Method) *Michaels Company had available at the end of 2020 the following information. Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment 50,000 $910,600 S871,100 S 22,000 S 32,000 5,000 5,000 10,000 Patents Instructions Total assets *Prepare a statement of cash flows for Michaels Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, classified as available-for-sale. Accounts payable Income taxes payable Salaries and wages payable Short-term notes payable Long-term notes payable Bonds payable Premium on bonds payable 4,000 3,000 10,000 60,000 70,000 400,000 400,000 20,303 25,853 240,000 220,000 25,000 Common stock Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $910,600 $871,100 17,500 123,297 88,747 Chapter 23 Homework.pptx (8/9) O Type here to search

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14E: Interest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In...

Related questions

Question

I need help with this question.

Transcribed Image Text:1. Determine the change for each item on the

Balance Sheet

Michaels Company

Comparative Balance Sheets

As of December 31, 2020 and 2019

2. Identify where the change will be classifed

in the Statement of Cash Flow

2020

2019

S 10,000 S 4,000

20,500 12,950

22,000 30,000

42,000 35,000

12,000

Cash

Accounts receivable

Short-term investments

Inventory

Prepaid rent

Prepaid insurance

Supplies

Land

Buildings

Accumulated depreciation-buildings

Equipment

Accumulated depreciation equipment

Patents

3,000

2,100

1,000

125,000 175,000

350,000 350,000

(105,000) (87,500)

525,000 400,000

(130,000)(112,000)

45,000 50,000

$910,600 S871,100

S 22,000 S 32,000

5,000

900

750

*P23.4 (LO 2. 4) (SCF-Direct Method)

•Michaels Company had available at the end

of 2020 the following information.

•Instructions

Total assets

Accounts payable

Income taxes payable

Salaries and wages payable

Short-term notes payable

Long-term notes payable

Bonds payable

Premium on bonds payable

Common stock

Paid-in capital in excess of par- common stock 25,000 17,500

Retained earnings

Total liabilities and stockholders' equity $910,600 $871,100

•Prepare a statement of cash flows for

Michaels Company using the direct method

accompanied by a reconciliation schedule.

Assume the short-term investments are debt

4,000

5,000

3,000

10,000

10,000

60,000 70,000

400,000 400,000

20,303 25,853

240,000 220,000

securities, classified as available-for-sale.

123,297

88,747

Chapter 23 Homework.pptx (8/9)

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning