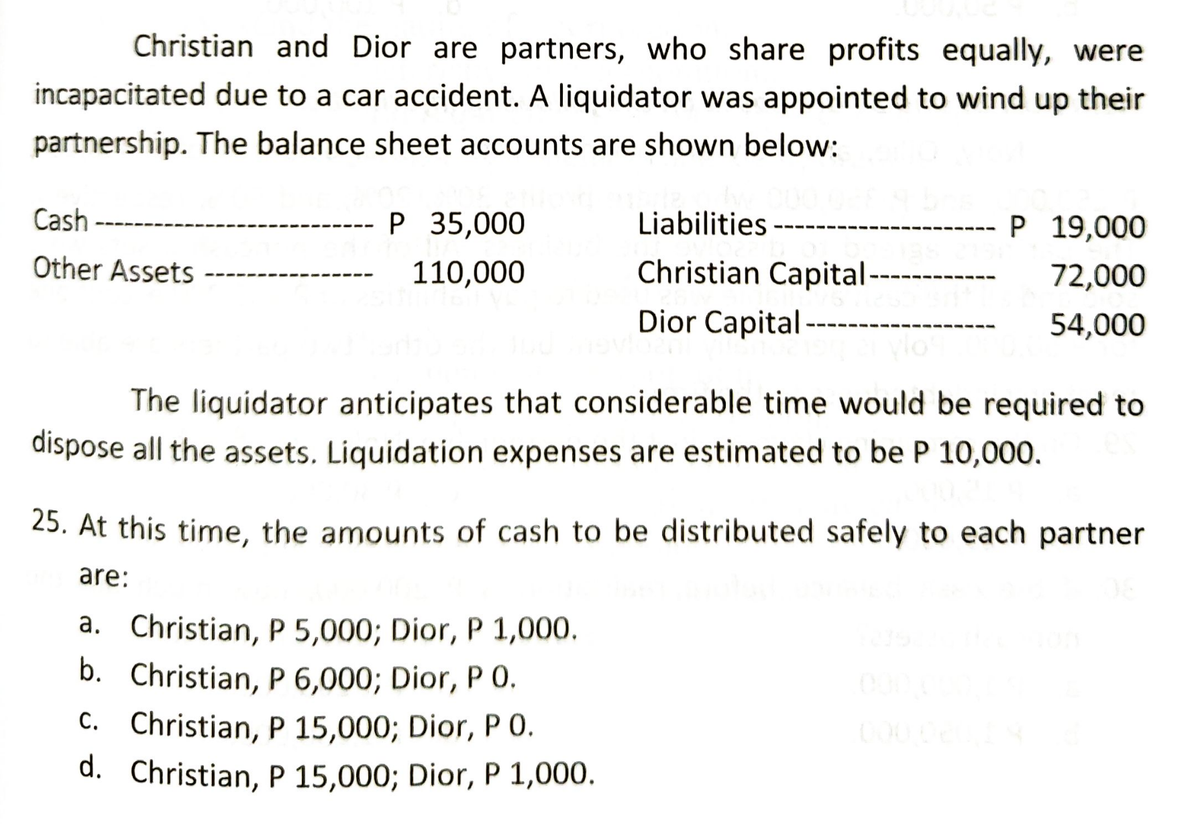

Christian and Dior are partners, who share profits equally, were incapacitated due to a car accident. A liquidator was appointed to wind up their partnership. The balance sheet accounts are shown below: Cash- P 35,000 Liabilities P 19,000 Other Assets 110,000 72,000 Christian Capital -- Dior Capital -- 54,000 The liquidator anticipates that considerable time would be required to dispose all the assets. Liquidation expenses are estimated to be P 10,000. 25. At this time, the amounts of cash to be distributed safely to each partner are: a. Christian, P 5,000; Dior, P 1,000. b. Christian, P 6,000; Dior, P 0. C. Christian, P 15,000; Dior, P O. d. Christian, P 15,000; Dior, P 1,000.

Q: Delia and Danny are partners with capital balances of P3,000,000 and P2,000,000, respectively. They…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Sadie White receives an hourly rate of $30, with time and a half for all hours worked in excess of…

A: Introduction: Excess hours worked: In general the number of hours to be worked in a week is 40 hours…

Q: Berry Industries is evaluating four projects for potential inclusion in their 2016 capital budget.…

A: A company's retained profits are the profits left over after paying all direct and indirect costs,…

Q: Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms…

A: Introduction: Journals: Recording of a business transactions in a chronological order. Each and…

Q: Lalua Co is a US firm has planning to export its products to Singapore since its decision to…

A: Cash Flow Statements: The amount of cash and cash equivalents entering and leaving a company is…

Q: Lawler and Riello formed a partnership on March 15, 2024. The partners agreed to contribute equal…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: 32.3A show the journal entries needed to correct the following errors: (a) Purchases £1,410 on…

A: The journal entries are prepared to record the day to day transactions on the regular basis.

Q: Mercedes, Melinda and Julieta are partners sharing profit and loss 40%, 30% and 30% respectively.…

A: A journal entry is the act of keeping or making records of any transactions either economic or…

Q: Find the capital beginning when, Additional Income = 150,000.00 Net Income = 120,000.00

A: Formula used: Ending capital = Beginning capital + Additional capital + Net profit - withdrawals

Q: My Fried Towel Company collected a note of ₱200,000 plus accrued interest of ₱20,000. The total…

A: Lets understand the basics. Note receivable is always as asset for the company. It shows how much…

Q: Centex, Inc. issued 47,000 shares of its $1 par value common stock for $30 per share. The journal…

A: The company can raise funds by various methods. Some of them are, by way of issuing common stock,…

Q: Blake Department Store sells television sets with one-year warranties that cover repair and…

A: Formula: Total sales revenue = Sales units x sales price per unit

Q: K1 and K2 are partners who have capital balances of P95,000 and P65,000 and who share profits 60%…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The following balance sheet accounts were taken from the partnership of J&J Co. on March 31, 2020…

A: Liquidation means where the business of firm is closed down , assets are sold out and liabilities…

Q: Selling price Current sales Break-even sales $ 93 per unit 10, 700 units 8,346 units

A: Formula: Margin of safety in dollars = Actual sales - Break even sales Deduction of break even…

Q: Research & Development. Edwards Corporation purchases a building for $2,000,000 which is to be used…

A: Research and Development Expense: - All those expenses which are related to the Research and…

Q: Marcos Putnam receives a regular salary of $3,120 a month and is paid 1½ times the regular hourly…

A: Introduction: Excess hours worked: In a week maximum 40 hours to be worked for normal pay rate and…

Q: Requirements: 1. Analyze and journalize the transactions for the May, 2021 of 5C's Computer Center.…

A: Here given the process of Accounting with the details of Journal entry posting of journal entry into…

Q: m Job 117 was completed, direct materials totaled $9,518; direct labor, $14,467; and factory…

A: The cost per unit is derived from the variable costs and fixed costs incurred by a production…

Q: Balance per bank... Balance per company records...... Bank service charges.... Deposit in…

A: In a bank reconciliation statement, the uninvested cash on a balance sheet of a company is compared…

Q: The new initiative being piloted is to produce goods in-house instead of buying them from wholesale…

A: Gross profit is the amount of money a company gets from selling selling of products and facilities…

Q: Joe Malay received the following report on the Division's operation for the month of August: Direct…

A: The variance is the difference between standard and actual cost of production for the period.

Q: Prepare accounting journal entries for 1 July 2019 & 30 June 2020.

A: Lease is a type of option in which the lessee who does not have the asset gets the asset for the use…

Q: K1 and K2 are partners who have capital balances of P95,000 and P65,000 and who share profits 60%…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: king with variances From the following data, determine the total actual costs incurred for direct…

A: The variance is the difference between standard and actual cost of production for the current…

Q: Use the information for the next two (2) questions. Bold Company estimated annual warranty expense…

A: Lets understand the basics. Warranty expense is an expense which are incurred to meet the warranty…

Q: Required information [The following information applies to the questions displayed below.] Kiyara…

A: Income tax liability is referred to as that taxable amount that is payable by the taxpayer in the…

Q: Franchise. Seattle Corporation pays a franchise fee of $20 million to enable it to sell Good's…

A: a . Annual Amortization = Franchise cost / useful life…

Q: Rodgers Company gathered the following reconciling information in preparing its May bank…

A: Introduction: BRS : BRS stands for Bank Reconciliation statement. To reconcile the difference…

Q: Question 8 of 43 Fill in the blanks Imperial Inc., an entity organized under Philippine laws has the…

A:

Q: Apollo reported the following in its 2021 financial statements: 2021 Sales P420,000 Cost of goods…

A: formula used: Inventory turnover = Cost of goods sold / Average inventory

Q: Question 3 of 43 Fill in the blanks La Pagayo Corporation commenced business operations in calendar…

A: The MCIT is 1%% of the gross income of the corporation at the end of the taxable year. Any excess of…

Q: Show in tabular form (depreciation schedule) the computation for the depreciation expenses,…

A: Depreciation is the drop in the book value of fixed assets. It occurs as a result of the passage of…

Q: Compute the net profit if, Service Revenue OMR 110,000; Other income OMR12,000; salary Expenses OMR…

A: Theory concept: Net profit: Net profit is a income statement item. In income statement all the items…

Q: ABC is Limited Liability Retailer Company. The following transactions took place during 2021…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: The management of Sheridan Company is trying to decide whether it can increase its dividend. During…

A: Free cash flow refers to the cash a firm generates after taking into account financial outflows to…

Q: On December 31, 2021, Precious Company sold an equipment with carrying amount of P2,000,000 and…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: From page 9-2 of the VLN, what is the first thing you want to identify when approaching a bond…

A: When a firm issues bonds to earn cash, bonds payable are documented. Money market securities and…

Q: During 2014, Canton Company's assets increased $97,500 and their liabilities decreased $37,300.…

A: As per accounting equation, assets equals to sum of liabilities and shareholders equity.

Q: Batangas Company estimates its total cash outlays at $160 million during the coming year. The…

A: Note: Hi! Thank you for the question As per the honor code, We’ll answer the first question since…

Q: valuate the key elements of a human resource management strategy.

A: HRM strategy is a plan that lead to the implementation of a company's human resources department's…

Q: taxes): 2014 revenues were $80,500. 2014 net income was $34,500. Dividends declared and paid…

A: As per accounting equation, assets equals to sum of liabilities and shareholders equity.

Q: Research & Development. Edwards Corporation purchases a building for $2,000,000 which is to be used…

A: Research and development expenses (R&D) refers to those expenditure which are related to the…

Q: A company's January 1, 2014 balance sheet reported total assets of $163,000 and total liabilities of…

A: Lets understand the basics. As per balance sheet equation, total asset is always equal to total…

Q: Refer to the following data of SG Company: Assets to be realized 1,375,000 Liabilities liquidated…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: View Policies Current Attempt in Progress Pharoah Company was organized on January 1, 2022. It is…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: The management of Sheridan Company is trying to decide whether it can increase its dividend. During…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Net income $133,720 12,060 Preferred dividends Average stockholders' equity 1,064,390 Average common…

A: Formula used: Return on stock holders equity = ( Net income / Average Stockholders equity ) x 100…

Q: Find the rate of interest and final amount resulting from an investment of P800 at 12% simple…

A: Simple interest: It is the return an individual gets on the amount invested by him at the end of…

Q: Note: If E=P28,091.16 and N = P11,213.00, what is the value of D? E= Total Earnings D Deduction N =…

A: Formula: Net pay = Total earnings - Deductions All the deductions are to be deducted from total…

Step by step

Solved in 2 steps

- When Conde and Dalmacio, partners who share earnings equally, were incapacitated in an airplane accident, a liquidator was appointed to wind up their business. the accounts showed cash, P70,000; other assets, P220,000; liabilities, P40,000; Conde's Capital, P142,000; and Dalmacio's Capital, P108,000. Because of the highly speacialized nature of the non cash assets, the liquidator anticipated that considerable time would be required to dispose them. the expenses of the liquidating business (advertising, rent, travel, etc) are estimated at P20,000Determine the amoint of cash that can be distributed safely to each partner using the Safe Cash Distribution Method.Carney, Pierce, Menton, and Hoehn are partners who share profits and losses on a 4:3:2:1 basis, respectively. They are beginning to liquidate the business. At the start of this process, capital balances are Carney, capital $ 79,000 Pierce, capital 32,700 Menton, capital 62,000 Hoehn, capital 25,700 Which of the following statements is true? (1)Carney will collect a portion of any available cash before Hoehn receives money. (2)The first available $7,700 will go to Hoehn. (3)The first available $10,600 will go to Manton. (4) Carney will be the last partner to receive any available cash.Carney, Pierce, Menton, and Hoehn are partners who share profits and losses on a 4:3:2:1 basis, respectively. They are beginning to liquidate the business. At the start of this process, capital balances are: Carney, capital. . . . . . . . . .. . . $60,000Pierce, capital. . . . . . . . . . . . . . 27,000Menton, capital. . . . . . . . . . . . 43,000Hoehn, capital. . . . . . . . . . . . . 20,000 Which of the following statements is true? Choose the correct.a. The first available $2,000 will go to Hoehn.b. Carney will be the last partner to receive any available cash.c. The first available $3,000 will go to Menton.d. Carney will collect a portion of any available cash before Hoehn receives money.

- Orian, Tejero, and Lacson are partners in the OTL Electric Company and share profits in ratio of 5:3:2. On June 30, 2014, they decided to liquidate the business. The statement of financial position at that date is as follows: Cash P 20,000 Liabilities P 30,000 Orian, Loan 15,000 Tejero, Loan 10,000 Non-cash Assets 135,000 Orian, Capital 80,000 Tejero, Capital 36,000 Lacson, Capital 14,000 Total Assets • P170,000 Total Equities P170,000 The non-cash assets are sold for P95,000. Rather than require payments, all partners agreed to offset the receivable from Orian against his capital credit. Required: 1. Prepare a statement of liquidation. 2. Prepare the journal entries to account for the liquidation.The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Cash $ 64,000 Liabilities $ 44,000 Noncash assets 225,000 Frick, capital (60%) 132,000 Wilson, capital (20%) 36,000 Clarke, capital (20%) 77,000 Total assets $ 289,000 Total liabilities and capital $ 289,000 Part A Prepare a predistribution plan for this partnership. Part B The following transactions occur in liquidating this business: Distributed safe payments of cash immediately to the partners. Liquidation expenses of $9,000 are estimated as a basis for this computation. Sold noncash assets with a book value of $96,000 for $64,000. Paid all liabilities. Distributed safe payments of cash again. Sold remaining noncash assets for $52,000. Paid actual liquidation expenses of $7,000 only. Distributed remaining cash to the…Slick, Tony and Sam partnership began the process of liquidation with the following account balances: Cash 16,000 Non-cash assets 434,000 Liabilities 150,000 Slick, Capital (30%) 80,000 Tony, Capital (20%) 90,000 Sam, Capital (50%) 130,000 Liquidation expenses are expected to be P12,000. After the liquidation expenses of P12,000 had been paid and the non-cash assets sold, Sam had a deficit of P8,000. Assuming all partners are personally insolvent, how much is the final settlement to Tony? P24,000 P34,800 P36,000 P37,200

- Carney, Pierce, Menton, and Hoehn are partners who share profits and losses on a 4:3:2:1 basis, respectively. They are beginning to liquidate the business. At the start of this process, capital balances are Carney, capital $ 67,000 Pierce, capital 29,100 Menton, capital 50,000 Hoehn, capital 22,100 Which of the following statements is true? Multiple Choice Carney will collect a portion of any available cash before Hoehn receives money. Carney will be the last partner to receive any available cash. The first available $4,100 will go to Hoehn. The first available $5,800 will go to Menton.Cam, Andy and Rae are partners in CAR Brokers and share losses in a 3:4:3 ratio, respectively. The balance sheet on December 31, 2023, when they decide to liquidate the business, is as follows: Assets Liabilities and Capital Cash $1,875,000 Accounts Payable $1,000,000 Noncash Assets $937,000 Cam, Loan 312,000 Cam, Capital 500,000 Andy, Capital 375,000 Rae, Capital 625,000 Total Assets $2,812,000 Total Liabilities & Equities $2,812,000 Note: A revaluation was done for non-cash assets valuing them at $1,002,000. The noncash assets were then sold for $800,000. As the accountant for the partnership, how do i prepare a Revaluation accountCam, Andy and Rae are partners in CAR Brokers and share losses in a 3:4:3 ratio, respectively. The balance sheet on December 31, 2023, when they decide to liquidate the business, is as follows: Assets Liabilities and Capital Cash $1,875,000 Accounts Payable $1,000,000 Noncash Assets $937,000 Cam, Loan 312,000 Cam, Capital 500,000 Andy, Capital 375,000 Rae, Capital 625,000 Total Assets $2,812,000 Total Liabilities & Equities $2,812,000 Note: A revaluation was done for non-cash assets valuing them at $1,002,000. The noncash assets were then sold for $800,000. As the accountant for the partnership, how do i prepare a Statement of partnership realization and liquidation?

- ABC Corporation currently has $20,000 in cash, $30,000 in noncash assets, and liabilities of $35,000. The partners, Adrian, Batch, and Crenshaw, had capital balances of $5,000, $8,000, and $2,000, respectively. The partners share a profit and loss ratio of 1:1:3. The noncash assets were sold for $20,000. Any capital deficiencies are resolved by a cash contribution by the deficient partner. Complete the liquidation chart below. Statement of Partnership Liquidation Cash Noncash Assets Liabilities Capital Adrian Batch Crenshaw Balances before realization Sale of assets and division of loss or gain Balances after realization Payment of liabilities Balances after payment of liabilities Receipt of deficiency Balances Cash distributed to partners…The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 61,000 Liabilities $ 55,000 Noncash assets 329,000 Drysdale, loan 42,500 Drysdale, capital (50%) 107,500 Koufax, capital (30%) 97,500 Marichal, capital (20%) 87,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $21,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $99,000 are sold for $72,500. How is the available cash to be divided?The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Cash $ 69,000 Liabilities $ 40,000 Noncash assets 279,000 Frick, capital (60%) 168,000 Wilson, capital (20%) 45,000 Clarke, capital (20%) 95,000 Total assets $ 348,000 Total liabilities and capital $ 348,000 Part A Prepare a predistribution plan for this partnership. Prepare a predistribution plan for this partnership. Frick, Capital Wilson, Capital Clarke, Capital Beginning balances $168,000 $45,000 $95,000 Assumed loss of Schedule 1 Step one balances Assumed loss of Schedule 2 Step two balances Assumed loss of Schedule 3 Step three balances