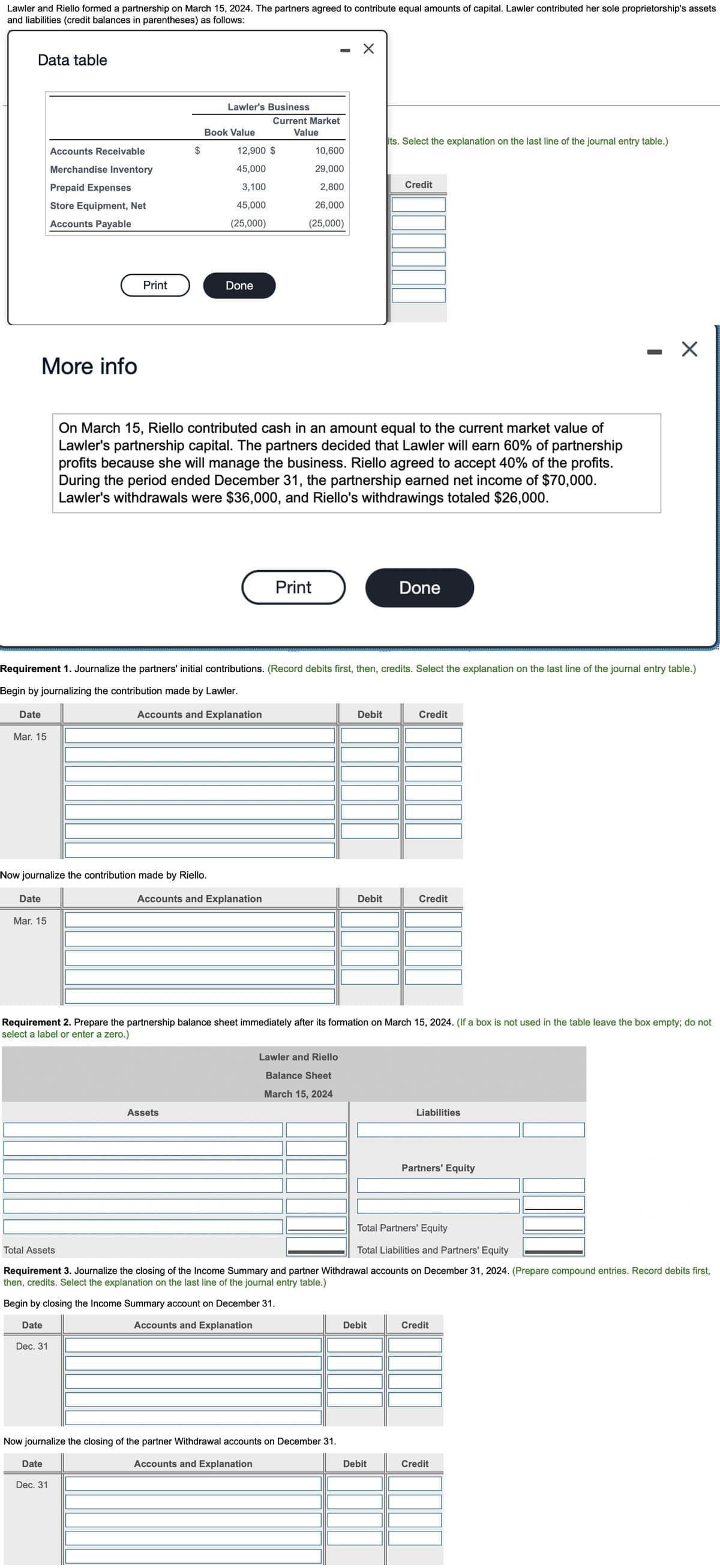

Lawler and Riello formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts of capital. Lawler contributed her sole proprietorship's assets and liabilities (credit balances in parentheses) as follows: X Data table Lawler's Business its. Select the explanation on the last line of the journal entry table.) Credit Accounts Receivable Merchandise Inventory Prepaid Expenses Store Equipment, Net Accounts Payable $ Book Value Current Market Value 10,600 29,000 2,800 26,000 (25,000) 12,900 $ 45,000 3,100 45,000 (25,000)

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps