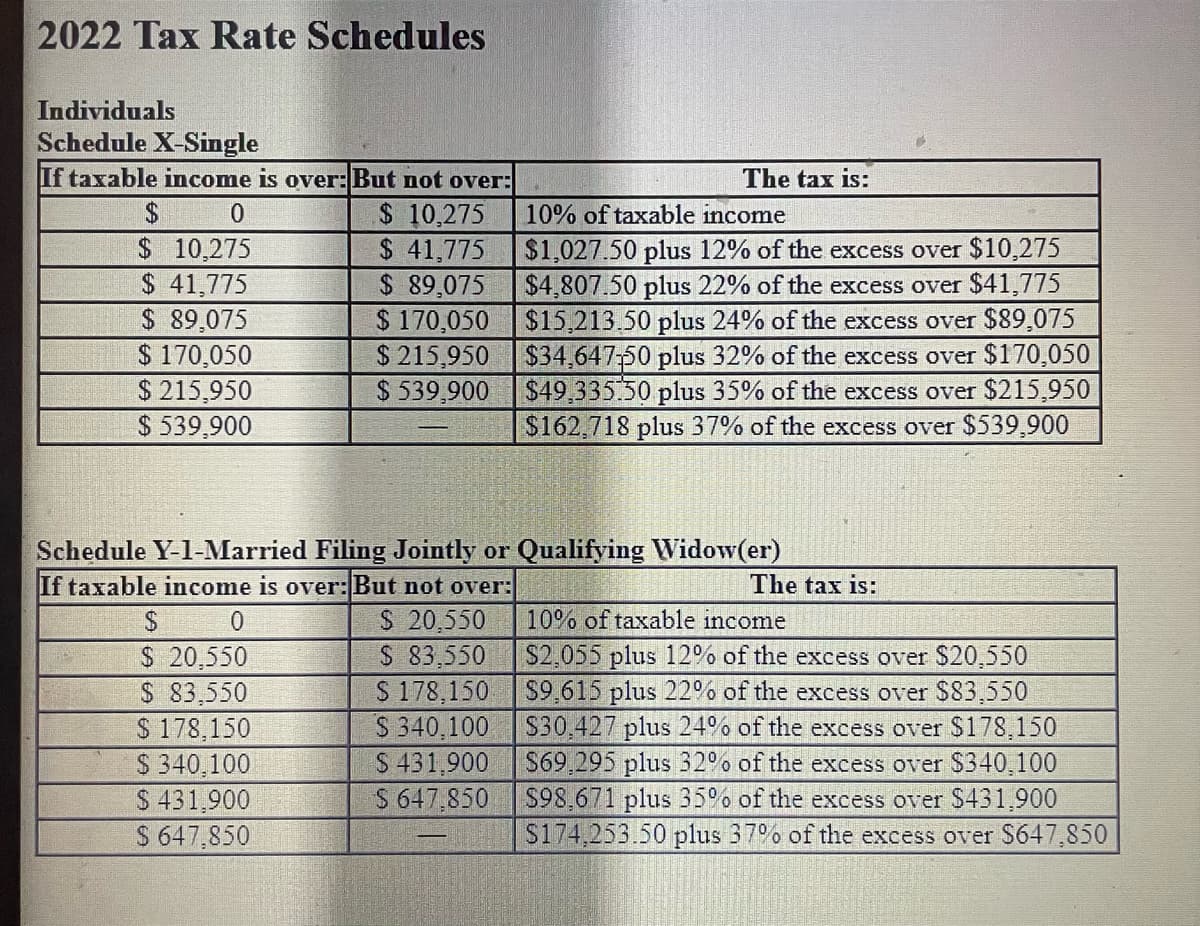

Chuck, a single taxpayer, earns $75,600 in taxable income and $10,700 in interest from an investment in City of Heflin bonds. A.how much federal tax will he owe. B. What is his average tax rate? C. What is his effective tax rate? D. What is his current marginal tax rate?

Q: Business Combination Versus Asset Acquisition As part of a project, Webflow Inc. acquire hese assets…

A: Journal entries are those entries that include the daily transactions or events stated in the books…

Q: Levy means use authority to demand and collect a payment," especially a tax. Discuss four things…

A: Levy means imposing or collecting of a tax or other payment by an authority. It refers to a charge…

Q: A proforma cost sheet of a company provides the following particulars :- Element of cost – 40% Raw…

A: INTRODUCTION Proforma cost: A proforma accounting statement predicts performance over a period that…

Q: A company's records for auditing have been destroyed. Would it be okay if the auditor asked the…

A: yes, the auditor can demand the lost documents from the third parties if the records have been lost…

Q: Briefly describe record counts, batch totals, and hash totals. What types of errors in input would…

A: Input control assures that information obtained for analysis by the computer division is correctly…

Q: ! Required information CP2-3 (Algo) Recording Transactions (in a Journal and T-Accounts); Preparing…

A: Balance Sheet :— It is one of the financial statement that shows list of final balances of assets,…

Q: Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each…

A: Employers frequently prefer to pay their employees a defined amount as a yearly or holiday bonus;…

Q: rdinary share cap

A: Stockholders are the Persons of entities whom the company issues its ownership rights in the form of…

Q: On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date,…

A: The practice of recording commercial transactions for the first time in the books of accounts is…

Q: Exercises 1. Selected data from the Tatum Company are presented below: Total assets Average assets…

A: Assets Turnover :— It is the ratio of net sales and average total assets. Profit Margin :— It is…

Q: With the use of cases and/or examples, explain FOUR (4) of the following terms as used in company…

A: INTRODUCTION A company is a legitimate organization formed by a group of people to conduct and…

Q: Bonds payable, 6% 6% Preferred stock, P100 par Common stock, P10 par. Income before income taxes was…

A: Bonds payable: 5,000,000 Preferred stock: 1,000,000 Common stock: 2,000,000 Income before income…

Q: Accounting Can you explain The Advantages of the Gold Standard?

A: Introduction: The "gold standard" is a monetary system that directly correlates the value of a…

Q: Find the adjusted trial balance, closing entries, and post-closing entries. April 1-…

A: Trial Balance A trial balance which means it is only accurate as of the date and time it was…

Q: On January 1, 2020, Pearl Company makes the two following acquisitions. 1. 2. (a) Purchases land…

A:

Q: Journalize the following transactions for Gillaspie Manufacturing. (a) Incurred direct labour costs…

A: Introduction: A journal entry is used to record a business transaction in the company's accounting…

Q: Southern Distributors, Incorporated, supplies ice cream shops with various toppings for making…

A: Estimated cost of toppings lost in fire means the amount of money spent of the production of the…

Q: Problem 3 (Adapted) Shalom corporation’s current balance sheet reports the following shareholder’s…

A: Book value per share is determined by dividing the net value of assets by the number of outstanding…

Q: Mans Company is about to purchase the net assets of Eagle Incorporated, which has the following…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: A Month in the Life of a Faculty from cash vs. accrual accounting perspective The Faculty provides…

A: Income statement: The income statement is the most important part of the financial statement. this…

Q: Pharoah Company purchases $56,000 of raw materials on account, and it incurs $67,200 of factory…

A: Raw materials are defined as the inputs that the industry uses to complete the production process.…

Q: compute the adjusted balances of the following accounts: 5. Total operating expenses 6.…

A: Hi student Since there are multiple subparts asked, we will answer only first three subparts. If you…

Q: What property tax rate should Freetown have if it has a homestead exemption of $20,000.

A: Property tax rate is the rate which has been specified and given by the government and this rate is…

Q: The Company Surteco sells 10.000 units of their wrapped moluldings for 1.5€/unit, per year. They…

A: 3/10, n30 is a trade credit given to buyers from the seller. 3/10, n30 means a buyer can get 3%…

Q: Ayres Services acquired an asset for $104 million in 2021. The asset is depreciated for financial…

A: Answer:- Depreciation meaning:- The accounting technique of spreading out the cost of a tangible…

Q: The financial condition of two companies Assets = Liabilities + $ 7,590 $ 11,000 = Allen White $…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Required: a. What earnings strategy do you think Emerson has applied over the years to maintain its…

A: Answer:- Earnings management meaning:- The practice of managing earnings is using accounting…

Q: On 1 October 2020, ABC Limited sold three machines to a customer for a total amount of R 1 900 000.…

A: As per IFRS 15, Revenue Recognition performance obligation is an promise given to customer to…

Q: Please show the Journal and Title Accounts of each event. The same with the 2nd pictu

A: Journal Entry - It is the Primary books in which transactions are recorded on double entry book…

Q: Required a. Based on this information alone, can White pay a $2,200 dividend? b-1. Reconstruct the…

A: Introduction: - Accounting equation indicates that company's total assets are equal to the sum of…

Q: A. What are total variable costs for Abilene with their current product mix? B. Calculate the number…

A: Sales mix is the ratio of more than one product that a company offers. Under CVP analysis…

Q: 8) What is

A: In this question, we have to calculate the percentage amount of the number we will divide the number…

Q: Drippin' in Heat manufactures the finest formal wear west of the Mississippi. The company produces…

A: The overhead can be applied to the production on the basis of the predetermined overhead rate of…

Q: As of January 1, Year 2, Room Designs, Incorporated had a balance of $5,200 in Cash, $2,850 in…

A: As per the honor code of Bartleby we are bound to give the answer of first three sub part only,…

Q: Based on the foregoing facts, how much total current assets should be reported on the statement of…

A: Answer - Current Assets - A current asset is an item that get easily converted into cash on an…

Q: On April 1, 2022, Wilson Corp. purchased a call option on shares of FVA stock. The contract was for…

A: As per the given information: Strike price - $130 per shareNo. of shares - 100 sharesExpiration date…

Q: Anna company presented the following account balances in the shareholders’ equity section for the…

A: Preference share is preferred as to assets when Preference shares are shares of a company's stock…

Q: On January 1, 20X1 Grin Corporation acquired a building for P10M. The entity paid P1M down and…

A: Journal entry is a process of initially recording and classifying business transactions into books…

Q: Customer life-cycle costs: Select one: a. Are the replacement costs of using a product or service.…

A: Cost Accounting system A perpetual inventory accounting system, the cost accounting system is…

Q: You are the catering manager for an upscale hotel. Last Saturday your staff catered a wedding…

A: Solution Revenue is the amount that a company generated from the normal business operations . It is…

Q: 2. Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the…

A: Transfer of property (TOP) refers to the act through which the person conveys the property in…

Q: There are no reciprocal agreements between any of the states. For the year of the move, what should…

A: Tax return is the return which has to be file by the taxpayer for the incomes which has been earned…

Q: Indicate any amounts that Mills Corp. would have included in its March 2022 quarterly financial…

A: Mills Corp. has purchased a call option of shares of XYZ stock. The strike price of the call was $…

Q: on the left with the corre patience. A water well t by sending a good the great oil reserv w million…

A: Deficit refers to the situation when the expected or earned amount is less than the needed sum value…

Q: Cost of Production and Journal Entries AccuBlade Castings Inc. casts blades for turbine engines.…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: Kingbird Miniature Golf and Driving Range Inc. was opened on March 1 by Scott Verplank. The…

A: Journal Entry :— Journal Entry is the Process of Recording the Financial and Non financial…

Q: Cost of goods manufactured during 2006 is $240, WIP inventory on December 31, 2006 is $50. WIP…

A: Manufacturing cost is the aggregate of direct materials, direct labor, and manufacturing overhead.…

Q: Prime cost consists of: O direct materials, direct labor and manufacturing overhead. direct…

A: Introduction: Prime costs are all expenses that can be directly linked to the creation of each good.…

Q: In your audit of the Gamer Inc., the client provided you the details of the Trade Accounts…

A:

Q: The following data from the just completed year are taken from the accounting records of Mason…

A: An income statement is a financial statement that shows a company's income and expenses. It also…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…

- GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From non-resident…Amount in excess of P490,000.00 taxable income is to be multiplied to_______to compute for the graduated tax due a. 30% b. 32% c. 35%

- If Your Taxable Income Is Up to $19,050 $19,050 $77,400 $77,400 $165,000 $165,000 $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 2018 Individual Tax Rates Single Individuals If Your Taxable Income Is Up to $9,525 $9,525 $38,700 $38,700 $82,500 $82,500 $157,500 $157,500 $200,000 $200,000 $500,000 Over $500,000 Standard deduction for individual: $12,000 You Pay This Amount on the Base of the Bracket $ $0 952.50 4,453.50 14,089.50 32,089.50 45,689.50 150,689.50 Married Couples Filing Joint Returns Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 $0 1,905.00 8,907.00 28,179.00 64,179.00 91,379.00 161,379.00 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 30.1 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0 Standard deduction for married…Q1. Taxable income and applicable tax rates for C.J. Company’s first four years are shown below. For each year, taxable income and pretax financial income are identical. In the table below, taxable income is before any consideration of NOL carryback and carryforward. The enacted tax rates were known at 1/1/2018. Taxable Income Enacted tax rate 2018 $200 20% 2019 ($300) 15% 2020 $340 25% 2021 $210 25% Now assume that C.J. opted to carryback its 2019 NOL and carryforward any unused NOL to future years. Complete the table below for 2018 through 2021 to show the amount of income tax payable to the IRS or the refund due from the IRS for each year. Put your answer in the table below. Show tax payable as a positive number and tax refund as a negative number. Year Tax…13. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer registered in 2020 made available the following financial information for TY2021: Balance Sheet: Asset - Php 500,000 Liability - Php 100,000 Stockholders' Equity - Php 400,000 Income Statement: Gross sales - Php 10,000,000 Cost of sales – Php 8,000,000 Operating Expenses - Php 5,000,000 How much is the income tax due under CREATE Law if the taxpayer is a domestic corporation? Group of answer choices Php 300,000 Php 600,000 Php 200,000…

- 14. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor was employed by ABC Corp. from April 1, 2020. He receives basic pay of Php 20,000 per month as compensation. During annualization of compensation in November, it was determined that he will also receive the following: Additional compensation allowance – Php 5,000 Cash gift – Php 5,000 Christmas bonus – Php 5,000 Loyalty award – Php 5,000 Performance bonus/productivity incentive – Php 10,000 How much is the 13th month pay? Group of answer…12. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 A taxpayer registered in 2010 made available the following financial information for TY2021: Balance Sheet: Asset - Php 500,000 Liability - Php 100,000 Stockholders' Equity - Php 400,000 Income Statement: Gross sales - Php 100,000,000 Cost of sales – Php 60,000,000 Operating Expenses - Php 30,000,000 How much is the income tax payable under CREATE Law if the taxpayer is a domestic corporation? Group of answer choices Php 2,500,000 Php 3,000,000 Php…18. Instructions Use the graduated tax table below if applicable: GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a businessman engaged in selling goods and services, reported gross sales of Php 1 Million and gross receipts of Php 2 Million. The company spent Php 150,000 for representation expenses. How much is the non-deductible representation expense? Group of answer choices Php 125,000 Php 105,000 Php 150,000 Php 25,000