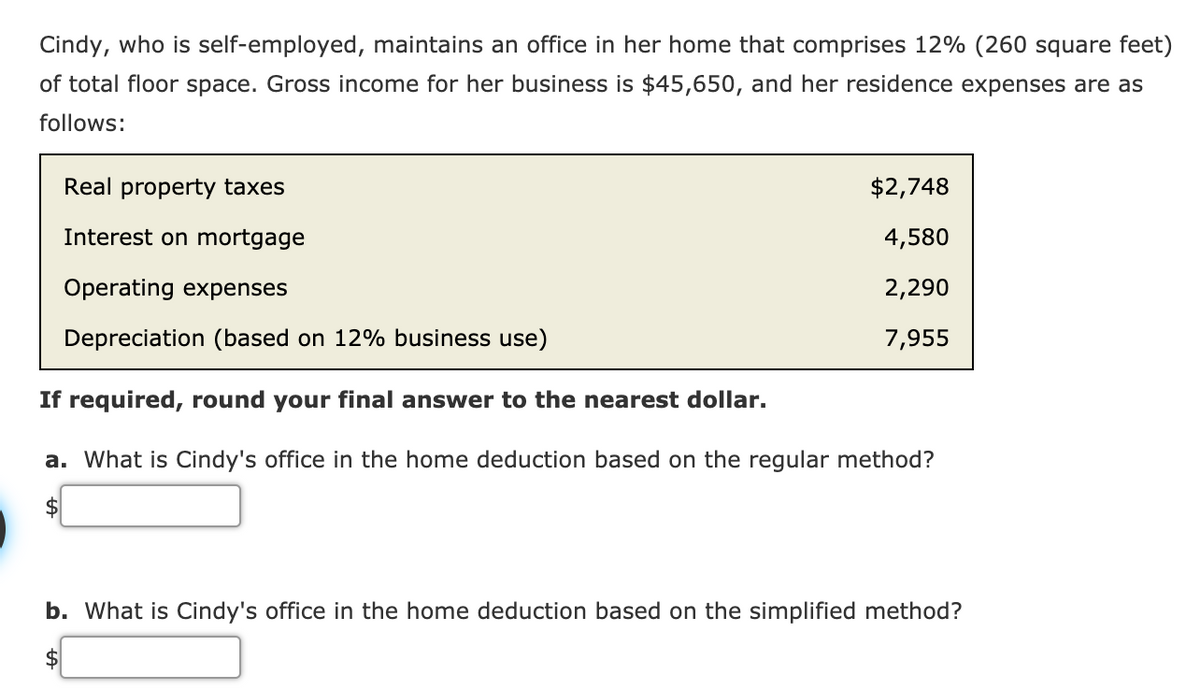

Cindy, who is self-employed, maintains an office in her home that comprises 12% (260 square feet) of total floor space. Gross income for her business is $45,650, and her residence expenses are as follows: Real property taxes $2,748 Interest on mortgage 4,580 Operating expenses 2,290 Depreciation (based on 12% business use) 7,955 If required, round your final answer to the nearest dollar. a. What is Cindy's office in the home deduction based on the regular method? $ b. What is Cindy's office in the home deduction based on the simplified method? $

Cindy, who is self-employed, maintains an office in her home that comprises 12% (260 square feet) of total floor space. Gross income for her business is $45,650, and her residence expenses are as follows: Real property taxes $2,748 Interest on mortgage 4,580 Operating expenses 2,290 Depreciation (based on 12% business use) 7,955 If required, round your final answer to the nearest dollar. a. What is Cindy's office in the home deduction based on the regular method? $ b. What is Cindy's office in the home deduction based on the simplified method? $

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 21CE

Related questions

Question

100%

Transcribed Image Text:Cindy, who is self-employed, maintains an office in her home that comprises 12% (260 square feet)

of total floor space. Gross income for her business is $45,650, and her residence expenses are as

follows:

Real property taxes

$2,748

Interest on mortgage

4,580

Operating expenses

2,290

Depreciation (based on 12% business use)

7,955

If required, round your final answer to the nearest dollar.

a. What is Cindy's office in the home deduction based on the regular method?

b. What is Cindy's office in the home deduction based on the simplified method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT