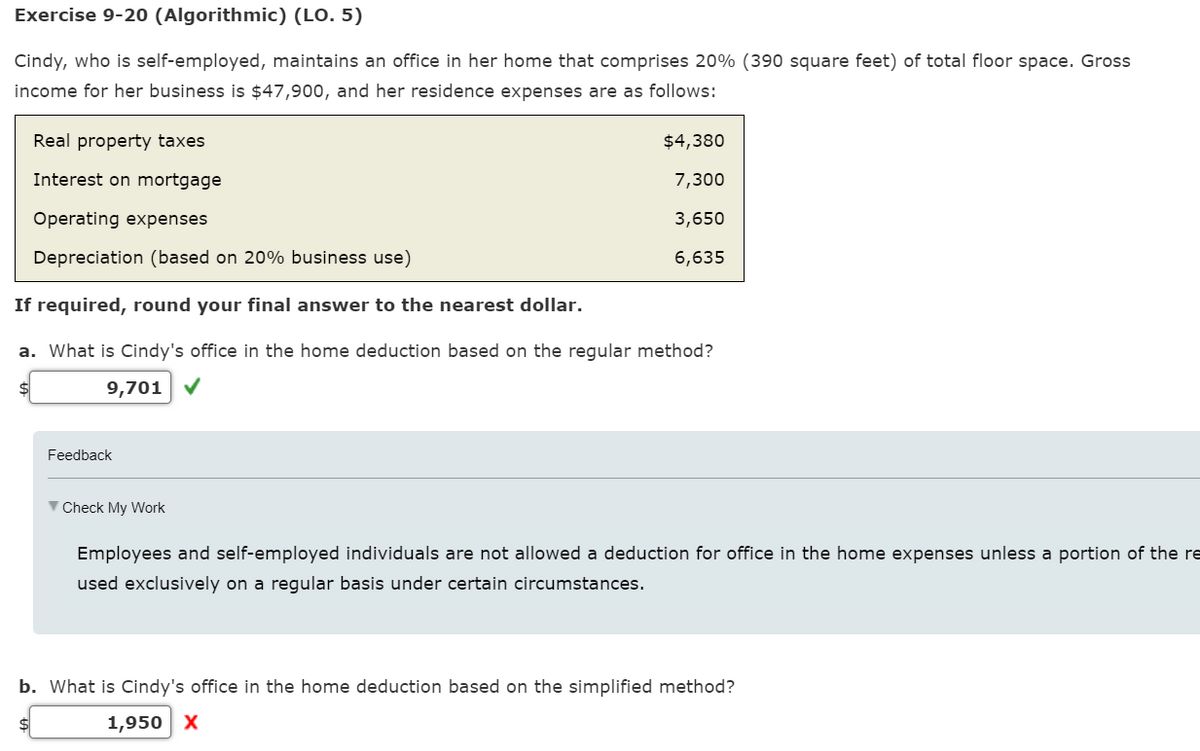

Cindy, who is self-employed, maintains an office in her home that comprises 20% (390 square feet) of total floor space. Gross income for her business is $47,900, and her residence expenses are as follows: Real property taxes $4,380 Interest on mortgage 7,300 Operating expenses 3,650 Depreciation (based on 20% business use) 6,635 If required, round your final answer to the nearest dollar. a. What is Cindy's office in the home deduction based on the regular method? 9,701 V Feedback V Check My Work Employees and self-employed individuals are not allowed a deduction for office in the home expenses unless a portion of the r used exclusively on a regular basis under certain circumstances. b. What is Cindy's office in the home deduction based on the simplified method? %$4 1,950 X

Cindy, who is self-employed, maintains an office in her home that comprises 20% (390 square feet) of total floor space. Gross income for her business is $47,900, and her residence expenses are as follows: Real property taxes $4,380 Interest on mortgage 7,300 Operating expenses 3,650 Depreciation (based on 20% business use) 6,635 If required, round your final answer to the nearest dollar. a. What is Cindy's office in the home deduction based on the regular method? 9,701 V Feedback V Check My Work Employees and self-employed individuals are not allowed a deduction for office in the home expenses unless a portion of the r used exclusively on a regular basis under certain circumstances. b. What is Cindy's office in the home deduction based on the simplified method? %$4 1,950 X

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 52P

Related questions

Question

please correct my mistake and show me where i went wrong

Transcribed Image Text:Exercise 9-20 (Algorithmic) (LO. 5)

Cindy, who is self-employed, maintains an office in her home that comprises 20% (390 square feet) of total floor space. Gross

income for her business is $47,900, and her residence expenses are as follows:

Real property taxes

$4,380

Interest on mortgage

7,300

Operating expenses

3,650

Depreciation (based on 20% business use)

6,635

If required, round your final answer to the nearest dollar.

a. What is Cindy's office in the home deduction based on the regular method?

9,701

Feedback

V Check My Work

Employees and self-employed individuals are not allowed a deduction for office in the home expenses unless a portion of the re

used exclusively on a regular basis under certain circumstances.

b. What is Cindy's office in the home deduction based on the simplified method?

$

1,950 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT