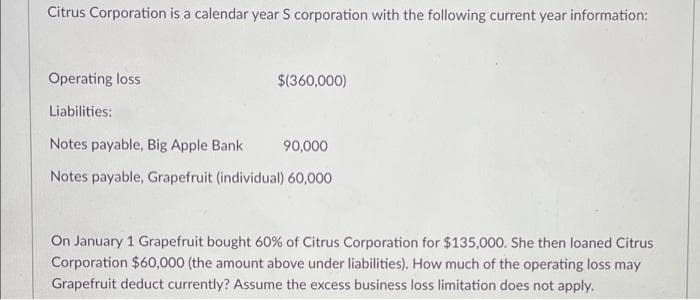

Citrus Corporation is a calendar year S corporation with the following current year information: Operating loss $(360,000) Liabilities: Notes payable, Big Apple Bank 90,000 Notes payable, Grapefruit (individual) 60,000 On January 1 Grapefruit bought 60% of Citrus Corporation for $135,000. She then loaned Citrus Corporation $60,000 (the amount above under liabilities). How much of the operating loss may Grapefruit deduct currently? Assume the excess business loss limitation does not apply.

Citrus Corporation is a calendar year S corporation with the following current year information: Operating loss $(360,000) Liabilities: Notes payable, Big Apple Bank 90,000 Notes payable, Grapefruit (individual) 60,000 On January 1 Grapefruit bought 60% of Citrus Corporation for $135,000. She then loaned Citrus Corporation $60,000 (the amount above under liabilities). How much of the operating loss may Grapefruit deduct currently? Assume the excess business loss limitation does not apply.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:Citrus Corporation is a calendar year S corporation with the following current year information:

Operating loss

$(360,000)

Liabilities:

Notes payable, Big Apple Bank

90,000

Notes payable, Grapefruit (individual) 60,000

On January 1 Grapefruit bought 60% of Citrus Corporation for $135,000. She then loaned Citrus

Corporation $60,000 (the amount above under liabilities). How much of the operating loss may

Grapefruit deduct currently? Assume the excess business loss limitation does not apply.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT